[ad_1]

Central bankers are to shift in direction of a extra gradual financial tightening, economists predict, as current “jumbo” price strikes present indicators of taming inflation and officers acknowledge the rising risk of recession.

After central banks’ final conferences and a cooling in US inflation to 7.7 per cent in October from 8.2 per cent in September, markets are pricing in a higher likelihood of 50bp slightly than 75bp rises within the subsequent bulletins by the Fed, ECB, BoE, Swiss Nationwide Financial institution and Financial institution of Canada, and smaller price rises persevering with into subsequent yr.

The US Federal Reserve, European Central Financial institution and Financial institution of England have given a “clear sign” that “we’re coming in direction of a interval of slower tightening, mirroring what we’ve seen from Australia, Canada and Norway”, stated James Pomeroy, economist at HSBC.

Financial policymakers consider the aggressive rounds of tightening had been having an impact on shopper costs, stated Jennifer McKeown, chief international economist at Capital Economics. “We anticipate central banks to sluggish the tempo of rises attributable to a mixture of weakening economies, easing home worth pressures and the truth that rates of interest are above or reaching equilibrium ranges [where activity is neither restricted nor boosted],” she stated.

Capital Economics expects that many of the subsequent strikes throughout greater than 20 central banks it tracks to be price rises of fifty or 25bp.

Hawks on the planet’s central banks gained the battle of concepts over the autumn, saying rate of interest rises of a magnitude final seen a long time in the past. Collectively, 20 main central banks have elevated charges by a complete of practically 11 proportion factors since August, exhibiting the current route of journey in financial coverage. The Financial institution of Japan is an outlier because it has not raised charges since 2007 and isn’t forecast to extend them any time quickly, whereas Russia and Turkey have reduce charges.

The Fed, ECB, BoE and BoC alone elevated charges by a complete of 5.5 proportion factors over that interval, with all of them delivering at the very least one 75bp enhance. The Fed had not raised charges by 75bp since 1994 however has delivered four consecutive rises of that size since June, with the primary federal funds price now 3.75-4 per cent.

The ECB’s 75bp rises in September and October, taking the deposit price to 1.5 per cent, had been the largest tightening strikes in its 24-year historical past, whereas the BoE’s related enhance in November was its largest in additional than 4 a long time, leaving the speed at 3 per cent.

With coverage charges now a lot nearer to their equilibrium or “impartial” stage and financial exercise weakening, “the case for scaling again coverage tightening . . . has strengthened”, stated Ben Could, international economist on the consultancy Oxford Economics.

There are a lot of indicators of weakening output. S&P World’s buying supervisor indices indicated a deepening downturn for the US, UK and eurozone in October. The worldwide index of recent orders dropped to the bottom stage since spring 2020, on the top of the pandemic.

Consumer and enterprise confidence ranges are close to document lows in lots of nations as excessive inflation and a surge in borrowing prices after the spherical of huge price rises hit family and company spending.

Economists are revising down their progress forecasts for 2023 for the wealthiest nations and anticipate output to say no in Germany, Italy and the UK.

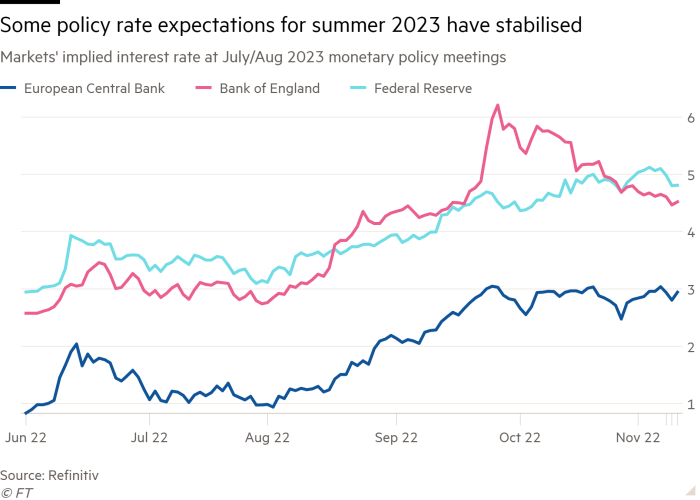

Market expectations for subsequent summer time have additionally eased. Primarily based on by-product merchandise akin to rate of interest swaps, expectations for the ECB deposit price subsequent summer time had soared to three per cent in September from lower than 1 per cent in early August, however they haven’t been raised since then.

Within the UK, larger charges had been priced in after aggressive tax cuts had been introduced in September’s “mini” Finances. However with these cancelled as a part of the brand new authorities’s extra modest fiscal plans, expectations for subsequent summer time have largely returned to their mid-September ranges of 4.6 per cent.

Susannah Streeter, senior funding analyst at asset supervisor Hargreaves Lansdown, stated it was “smart” to anticipate smaller will increase within the UK, “particularly with a recession forecast which might final two years and convey deflationary pressures”.

Within the US, market expectations for subsequent summer time proceed to rise after Jay Powell, the Fed chair, warned that charges would peak at the next stage than anticipated.

Nevertheless, even the Fed could also be adjusting coverage because the current price rises start to cut back financial exercise. “The extra aggressive strikes seem like coming to an finish, with a gentler technique anticipated within the months to come back,” stated Streeter.

[ad_2]

Source link