[ad_1]

There’s a Chinese language proverb that holds it’s higher to plan one’s technique of retreat than 36 other ways to win the battle.

It’s an axiom that has cropped up on Tokyo buying and selling flooring this autumn, after Japan lavished a document $62bn to struggle the yen’s collapse under a three-decade low, in as many as 4 separate interventions since September.

It’s just one entrance in its battle in opposition to world market forces. By the top of June, after months preventing to manage the yield curve, the Bank of Japan had raised its holdings of Japanese authorities bonds (JGBs) to over half a quadrillion yen ($3.6tn). Final week, to struggle the unfavorable affect of inflation, the federal government unveiled a $200bn stimulus package.

There’s mounting worry, nevertheless, that an orderly retreat could also be not possible. As a substitute the BoJ is betting all the things on one more technique aimed toward successful the battle. It’s making an enormous gamble {that a} royal flush of nationwide and worldwide outcomes will remedy its most urgent issues: sizeable wage will increase by Japanese corporations, the onset of “good” inflation, seen stability within the yen, a delicate US recession and an rate of interest pivot by the Federal Reserve.

However on the similar time, the radars of buyers all over the world are beeping noisily with indicators of a doubtlessly explosive Japan disaster.

In an October weblog publish that went viral, George Saravelos, a Deutsche Financial institution strategist, described Japan’s yield curve management coverage — curbing the quick and long-term rates of interest on Japanese authorities bonds — as “for all intents and functions, already damaged”.

The yield curve not solely demonstrated the size of coverage distortion however its doubtless limits, too, he wrote. The BoJ is reaching “near-full possession” of the three bond yields it has focused, that means “the time is quickly approaching the place these bonds will cease buying and selling of their entirety and the market will merely stop to exist”, he wrote.

However the JGB market is only one symptom of a bigger distortion, analysts and merchants say. An excessive amount of of the present Japanese coverage combine and its secondary market results appear unsustainable, says the top of 1 world fund, and ready for the end result of Japan’s wager might turn out to be insufferable.

Regardless of the interventions, Japan’s forex continues to check new lows round ¥150 in opposition to the greenback. The widening rate of interest differential between Japan and the US means few are but assured the place the yen will discover a pure flooring. With Japan the one main financial system nonetheless operating a zero-interest-rate coverage, the BoJ is wanting ever extra remoted.

“There’s a logic and a method behind what the BoJ is doing, but it surely’s a dangerous one. All the things might work out fairly nicely so long as we’re in a situation subsequent 12 months the place there’s clear proof of US inflation coming down,” says Derek Halpenny, head of analysis for world markets at Mitsubishi UFJ Monetary Group.

“The massive danger is that if that doesn’t occur. They wish to loosen up yield curve management in a world the place world bond yields are coming down. In the event that they’re not, then the longer they depart it, the extra disorderly the exit,” he provides.

Mansoor Mohi-uddin, chief economist at Financial institution of Singapore, says the closest analogy to know the potential penalties can be the Swiss Nationwide Financial institution’s abrupt elimination of the ceiling on the Swiss franc in 2015, which led to a big bounce within the forex and left European fairness markets reeling.

“However Switzerland is a small financial system in comparison with Japan,” Mohi-uddin says. A disorderly exit by the BoJ would trigger an enormous surge in 10-year Japanese authorities bond yields, inflicting “main disruptions” for bondholders, from home pension funds to central financial institution reserve managers abroad. The Nikkei would plunge, he provides, with the ripples felt throughout world inventory markets.

The expectation of inflation

To market watchers, the BoJ’s willpower to hold on with its experiment seems harmful in a world the place nations are scrambling to maintain inflation at bay.

However for Haruhiko Kuroda, that is precisely the second he had been ready for since he grew to become Financial institution of Japan governor in March 2013 vowing to do “no matter it takes” to finish the nation’s bouts of delicate but corrosive deflation.

Helped by a world surge in commodity costs brought on by the battle in Ukraine, costs of products in Japan are rising with inflation hitting 3 per cent, surpassing the BoJ’s goal of two per cent. Extra importantly, each corporations and households now count on costs to extend over the subsequent few years, after nearly twenty years of believing that costs might solely go down.

The enduring assumption that costs in Japan is not going to change is lastly crumbling, says Kentaro Koyama, Deutsche Financial institution’s chief Japan economist in Tokyo. “To make the most of this valuable alternative, financial coverage must encourage worth change, and this is the reason the BoJ’s bias towards sustaining its present financial coverage is cheap,” he says, in a hanging change of tone from his colleague Saravelos.

Based on the most recent shopper confidence survey launched by Japan’s cupboard workplace this week, 63 per cent of these polled mentioned they anticipated costs to rise 5 per cent or extra over the approaching 12 months.

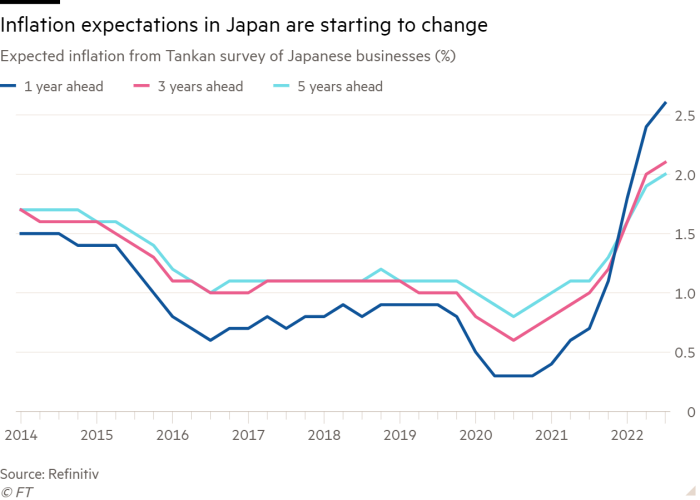

The BoJ’s Tankan, a intently watched survey on enterprise sentiment, additionally confirmed that in September, Japanese corporations anticipated an inflation fee of two per cent inside 5 years, the best degree because it started polling such expectations in 2014.

Creating the presumption of inflation is crucial in Japan, a rustic that has struggled to dislodge the expectations set by 15 years of on-and-off deflation between 1998 and 2013. This mindset has additionally posed the most important hurdle for rising costs to be mirrored in worker earnings.

The concern for the BoJ shouldn’t be a wage spiral that would lead to a extra extended interval of excessive inflation, as it’s within the US and Europe, however the reverse: the dearth of sturdy wage development that will defend the economy from falling again right into a deflationary spiral.

A weaker yen may additionally assist kindle wage development. Despite the fact that advantages have waned as corporations have shifted manufacturing overseas, a softer forex nonetheless will increase company income made abroad when they’re repatriated and the hope is that sturdy earnings will make it simpler for companies to boost wages.

“To do away with the deflationary mindset, they have been ready to see a weaker forex. What they wished badly was for this inflation fee of three per cent to be translated into greater wages. That is an important factor in Japan,” says a former senior BoJ official.

Wage development wanted

The ace within the gap for the BoJ, say analysts, is probably not a possible pivot by the Fed, however the “shunto” wage negotiations within the spring.

These annual talks between unions and employers have for a few years delivered a build-up of hope adopted by a collective slouch of disappointment amongst staff throughout the nation.

In an indication of fixing occasions, the Japanese Commerce Union Confederation (Rengo) is in search of a 5 per cent year-on-year improve in wages — 3 per cent when it comes to base pay — throughout the spring negotiations, the best since 1995.

If such a critical wage hike is in prospect, it might additionally coincide with the change in BoJ governorship when Kuroda’s time period expires in April.

If a pattern for a gentle wage rise will be confirmed, which may give the subsequent BoJ governor confidence to think about reining within the quantitative and qualitative financial easing (QQE) programme.

Kuroda has argued that any tightening can be untimely with Japan’s core inflation anticipated to fall under its 2 per cent goal by subsequent 12 months, however the BoJ’s present forecast doesn’t take note of potential wage hikes by corporations in spring.

“Robust wage development is seen as the final word ‘amulet’ in opposition to Japan slipping again into disinflation,” argues David Bowers, co-founder of Absolute Technique Analysis. “If [the talks] succeed, then it could be that the Financial institution of Japan — underneath Kuroda’s successor — can begin to pivot away from its QQE narrative, with implications for the yen and for bond yields not simply in Japan however all over the world.”

Nonetheless, economists are divided on how a lot corporations can be keen to extend staff’ pay after resisting for thus lengthy. Whereas some are cautiously elevating the value of their merchandise, others are nonetheless afraid shoppers will balk at greater costs, making a chicken-and-egg drawback for company Japan.

“If corporations generate income and lift wages, demand would possibly decide up. However which comes first? Firms can’t elevate wages if they aren’t making a living, whereas shoppers can’t purchase items at greater costs if their wages usually are not going up, ” says Masahiro Okafuji, chief government of Itochu, considered one of Japan’s massive 5 buying and selling homes.

“We will’t simply criticise the BoJ since corporations will endure as nicely if a mistaken choice is made,” he provides.

Time to purchase Japan?

The 28 per cent descent of the yen in opposition to the greenback thus far this 12 months has reignited the broader query of how investable Japanese markets are.

Ten years in the past, the financial and regulatory reforms that passed off underneath “Abenomics” pushed Tokyo-listed equities, as measured by the Topix index, right into a multiyear rally and a close to 100 per cent rise in worth. However extra not too long ago, Japanese equities should some extent turn out to be one other extremely seen symptom of the place BoJ coverage has far outstripped its unique plan.

Within the two-and-a-half years that adopted the arrival of Shinzo Abe as prime minister in 2012 and the appointment of Kuroda as BoJ governor, overseas buyers purchased a internet ¥25tn of Japanese shares.

Within the years between 2015 and at the moment, they’ve reversed that utterly, promoting ¥25.6tn. Over the previous 10 years, the BoJ has been a internet purchaser of ¥36tn, by way of its ETF-purchasing programme.

The circumstances might sound ripe for one more rally. Japanese corporations look comparatively steady and, due to the yen, very low-cost. In concept, a sturdy inflow of overseas stock-buying would shore up the yen and create the form of pure upward strain that will save the Japanese authorities from digging ever deeper into the nationwide retailer of US Treasuries to artificially assist the forex.

In actuality, the yen is locked in a unstable buying and selling sample dictated by huge outflows by Japanese corporations and asset managers. Whereas that’s inflicting instability, overseas buyers should decline to “purchase Japan”.

Bruce Kirk, head fairness strategist at Goldman Sachs in Tokyo, says forex stability is crucial for funding committees to have a look at Japan once more. “There’s numerous curiosity from overseas buyers in Japan, however what’s holding them again is that they really feel they don’t but understand how a lot additional the yen might fall and whether or not the 150 degree is the reply or whether or not it might fall additional in direction of 175 or 200.”

The Japanese authorities could also be muddying the state of affairs, say analysts, in how they’re responding to the latest volatility of the yen. Repeated references by Japan’s finance minister Shunichi Suzuki and different officers to market speculators closely overstate the function of hedge funds and different leveraged buyers.

Shusuke Yamada, chief Japan foreign exchange and fairness strategist at Financial institution of America, says that it was “actual cash” driving the yen’s fall this 12 months: company Japan and home Japanese asset managers responding to the speed differential, Japan’s commerce deficit and overseas direct funding deficit.

In contrast to the interval instantly earlier than the 2008 world monetary disaster, the place speculators at residence and overseas would borrow yen and promote it to purchase higher-yielding belongings in what was often called the “carry commerce”, there may be much less pleasure round such investments now, says Yamada.

All of the central financial institution can do now’s wait out the storm, he provides. “The BoJ is making an attempt to purchase time, hoping that the US charges peak out and smoothing the strikes the place they will,” he provides. “How it will play out in the end relies on the US facet.”

The exit ramp

Few economists count on Kuroda to vary course earlier than his time period expires subsequent 12 months. However when Japan ultimately (and, some say, inevitably) does, it will likely be fraught with danger.

Specialists agree any trace of normalisation from the BoJ would require intricate communication with markets to keep away from the chance of misinterpretation. “The BoJ might want to give you a fundamental plan beforehand in order that the market can count on what shall be coming,” the previous BoJ official says.

Kuroda mentioned as a lot at a information convention final week. Although “we’re not pondering of a fee hike or an exit anytime quickly . . . when the two per cent [inflation] goal turns into reachable, the coverage board might want to focus on the exit technique and it will likely be vital to correctly talk with the market,” he mentioned.

Masamichi Adachi, chief economist at UBS in Tokyo, says the BoJ is more likely to make a public evaluation of the consequences of its financial coverage throughout 2023 to sign an adjustment is looming. It did one thing comparable earlier than bringing in yield curve management, he says.

A primary step is likely to be to revise the BoJ’s ahead steering and widen the 0.25 per cent goal on 10-year JGBs, Adachi provides. “We might name this course of a starting of coverage normalisation for bettering bond market perform, permitting a easy begin with out tough strain from markets.”

On Wednesday, Kuroda dropped his greatest trace but {that a} pivot level is likely to be approaching. “If the achievement of our 2 per cent inflation goal that’s accompanied by wage hikes comes into sight, a evaluation of the financial coverage will in fact turn out to be needed,” he instructed parliament.

However any tweak that’s perceived to be too quick or past expectations might trigger speedy repercussions throughout markets.

When yields within the UK spiked within the wake of September’s “mini” Price range, the Financial institution of England needed to step in to assist pension schemes dealing with sudden, surprising liquidity points. If the Japanese central financial institution have been pressured into an analogous motion with bondholders, the size of intervention would have to be far, far bigger — with a lot greater danger of worldwide contagion.

Little surprise then that throughout the BoJ and the Japanese authorities, the disaster within the UK gilts market has turn out to be a cautionary story. “It’s turn out to be a lesson for markets in addition to policymakers that Japan should not turn out to be just like the UK when it comes to the turmoil that it triggered,” says Mari Iwashita, chief market economist at Daiwa Securities.

A disorderly exit shouldn’t be but on the playing cards. However Kuroda shall be watching the flop fastidiously, hoping he reaches the top of his time period with the strongest hand attainable.

[ad_2]

Source link