[ad_1]

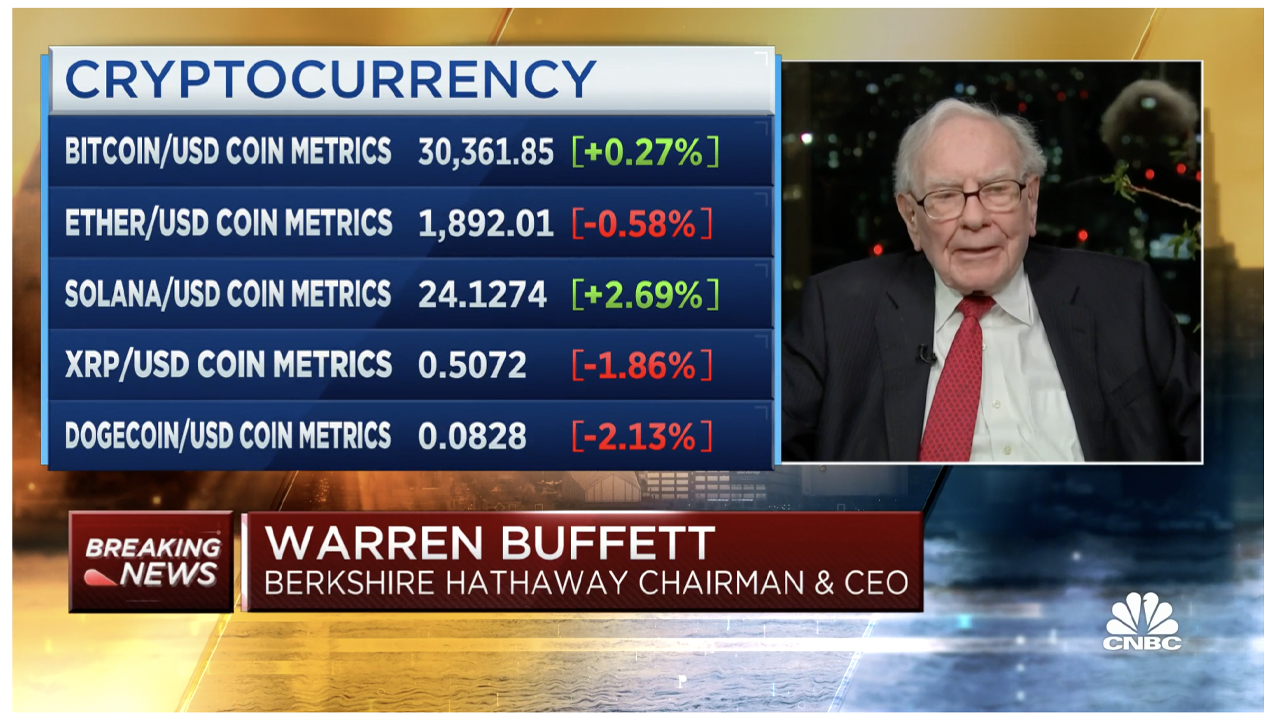

Finance mogul Warren Buffett, one of the vital profitable traders in historical past, mentioned bitcoin throughout an interview on CNBC’s Squawk Field on April 12. As he has carried out in earlier interviews, the enterprise magnate likened bitcoin to a playing scheme and chain letters he acquired as a toddler.

Buffett Shares His Two Cents on Bitcoin, Warns Towards Making a Dwelling ‘Attempting to Guess Towards the Home’

It’s well-known that Warren Buffett doesn’t like bitcoin, and he as soon as said that he wouldn’t purchase all of the bitcoin (BTC) on the earth for $25. Buffett can be identified for saying that bitcoin is “in all probability rat poison squared,” and through an April 12 interview on CNBC’s Squawk Field, he reiterated his distaste for the main cryptocurrency. Through the interview, he summarized bitcoin as a “playing token,” and he insisted that the world has seen an “explosion of playing.”

The Oracle of Omaha advised CNBC broadcasters that he likes to wager on soccer video games as a result of it “makes it extra fascinating.” Nevertheless, he additionally warned that he doesn’t assume he needs “to make a dwelling attempting to wager in opposition to the home.” Buffett hinted that stimulus checks might have additionally elevated the playing drive. “You had hundreds of thousands of people that have been receiving checks and cash, sitting at dwelling and discovering out that they may have a roulette wheel of their home,” the investor mentioned. When requested particularly in regards to the main crypto asset bitcoin (BTC), Buffett said:

Bitcoin is a playing token, and it doesn’t have any intrinsic worth — however that doesn’t cease individuals from desirous to play the roulette wheel.

Within the midst of Buffett’s playing rhetoric, he additionally made a comparability to chain letters. Chain letters are messages that have been generally despatched via snail mail, encouraging the recipient to ahead the message to a sure variety of individuals, promising that they’d obtain some kind of profit in return. “I didn’t like chain letters once I was a child,” Buffett defined to the CNBC present hosts. “I assumed, ‘Why on the earth would I ship alongside a sequence letter — once I might begin my very own?’”

Whereas the chairman and CEO of Berkshire Hathaway clearly doesn’t like bitcoin, he’s identified for his aptitude for investing. Berkshire Hathaway owns a number of well-known companies, resembling Geico, Fruit of the Loom, Duracell, BNSF Railway, See’s Candies, Clayton Properties, Pampered Chef, and Dairy Queen. In line with the latest data from companiesmarketcap.com, Berkshire Hathaway (BRK-B) is listed because the eighth-largest market capitalization when it comes to property on the earth. Bitcoin (BTC), alternatively, is the tenth-largest market valuation worldwide in accordance with the identical web site.

What do you consider Warren Buffett’s stance on bitcoin and playing? Do you agree or disagree along with his perspective? Share your ideas within the feedback under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, CNBC,

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link