[ad_1]

Will Japan abandon its ultra-loose financial insurance policies now that Kazuo Ueda has changed Haruhiko Kuroda as governor of the Financial institution of Japan? The reply, it appears, is “no”. The brand new governor, a well known and revered educational economist, stressed that the 2 pillars of Japan’s present financial coverage — damaging rates of interest and yield curve management — remained applicable. Was he additionally proper to stay to those insurance policies? On stability, my reply is “sure”. This isn’t as a result of that is with out threat, as Robin Harding argued final week. However as a result of the alternate options are dangerous, too.

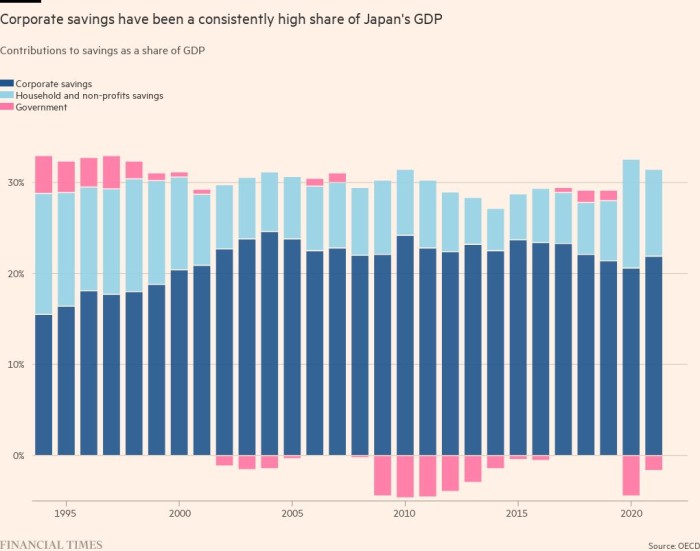

Even when one ignores the BoJ’s asset purchases (or “quantitative easing”) and more moderen coverage of yield-curve management, the hanging truth stays that its short-term intervention price has been 0.5 per cent, or decrease, since 1995. What number of economists would have guessed {that a} nation might run such an accommodative financial coverage for nearly three many years and but stay apprehensive about weak demand and low inflation?

That is clearly a deep-seated structural phenomenon. So what has induced it? The reply is persistent extra financial savings. Japan is just not the one massive market financial system with a powerful manufacturing sector and structural extra financial savings. The opposite is Germany. However Germany has had a solution Japan doesn’t have: the euro.

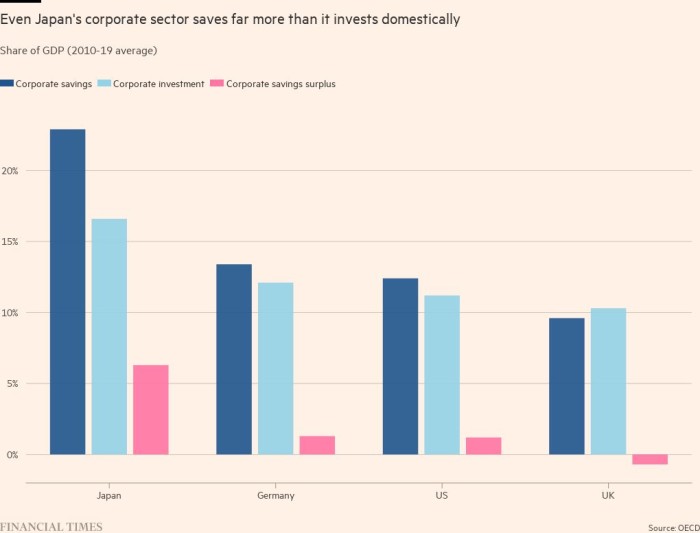

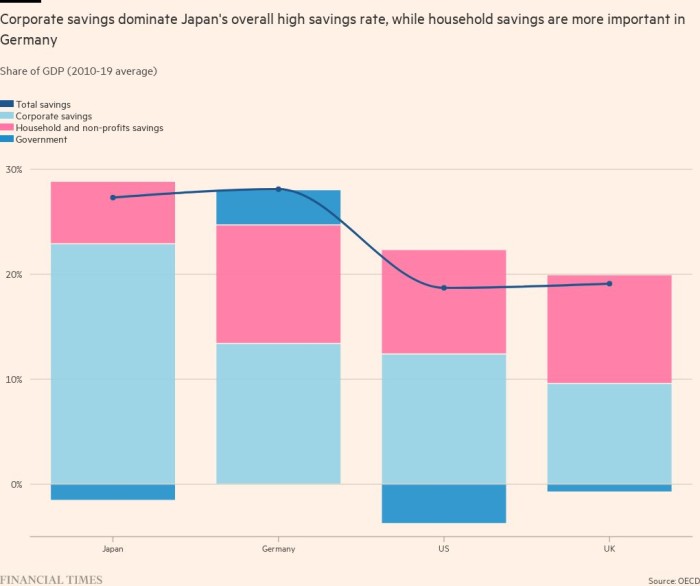

Japan’s personal sector gross financial savings averaged a rare 29 per cent of GDP between 2010 and 2019 (earlier than the shocks of Covid and the Ukraine conflict). This was properly above Germany’s 25 per cent and much above the 22 per cent of the US and the absurdly low 15 per cent of the UK. Japan’s personal sector additionally invested a (fairly in all probability) extreme 21 per cent of GDP. But this nonetheless left surplus financial savings of 8 per cent of GDP. Germany’s personal financial savings surplus averaged 6 per cent of GDP, that of the US 5 per cent and the UK’s near zero.

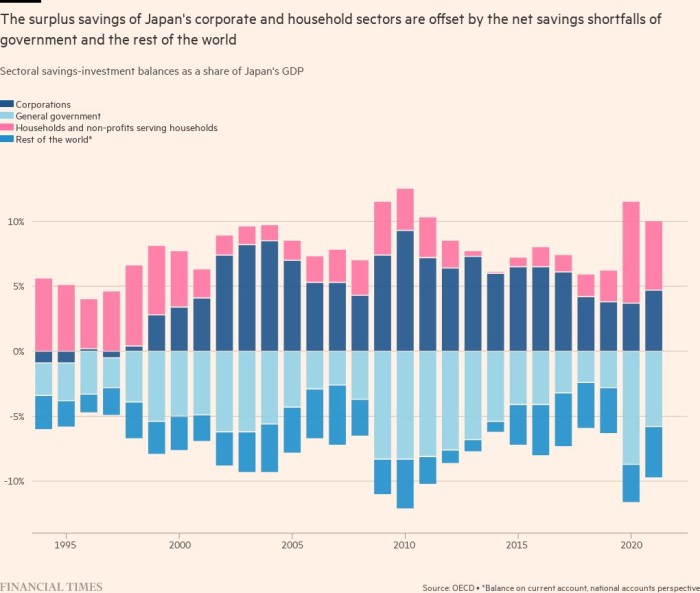

Within the financial system as an entire, financial savings should equal funding as soon as one contains the federal government and foreigners. The query is how that stability is achieved and crucially, as Keynes taught us, at what ranges of financial exercise. With a sufficiently big recession, income (and so company financial savings) would presumably collapse. But it surely must be an infinite collapse. In yearly from 2000 to 2020, together with recessions, Japan’s company retained income exceeded 20 per cent of GDP. Equally, with a sufficiently big recession, family financial savings would collapse. But when such a recession had been to happen, funding would collapse, too. The end result could be a dire despair.

No sane policymakers would attempt to remove extra financial savings by way of a hunch. As an alternative, they’d select insurance policies geared toward both absorbing the financial savings in productive investments or decreasing the nation’s propensity to save lots of.

A wise mind-set about what Japanese policymakers have been doing for the reason that finish of the excessive funding section of Japan’s postwar catch-up financial system within the early Nineteen Nineties is that this: they’re attempting to maintain mixture demand within the context of the large surplus financial savings of the personal sector. That is one other approach of claiming that they’re attempting to flee from deflation, which might, within the absence of their efforts, in all probability have been far deeper than it was.

Extremely-low rates of interest are, for instance, supposed to lift personal funding and scale back personal financial savings. However in follow, the personal financial savings surplus, particularly the company surplus, has remained large. Unfastened financial coverage has facilitated essential absorption (and offsetting) of surplus personal financial savings by way of the surplus of presidency funding over financial savings. These deficits averaged 5 per cent of GDP from 2010 to 2019. Lastly, a median of three per cent of GDP went into web acquisition of international property by way of Japan’s present account surpluses.

Had been there different methods of managing the structural surplus financial savings drawback from which Japan has been struggling for a decade (and, not coincidentally, China has been struggling more and more, too)? Sure, there have been three alternative routes.

One is Germany’s: its web acquisition of international property averaged 7 per cent of GDP from 2010 to 2019. This allowed each personal and public sectors to run saving surpluses, whereas balancing mixture provide and demand at moderately excessive ranges. There are two the explanation why this method would have been arduous for Japan to repeat. One is that the commerce surpluses would have run head on into US mercantilism. The opposite is that there would have been fierce upward stress on the yen alternate price, compounding the deflationary forces on Japan. Certainly, if the euro had not existed, foreign money crises within the alternate price mechanism would absolutely have pressured large revaluations of the D-Mark, pitching the German financial system into deflation and ultra-easy financial coverage, regardless of the Bundesbank wished.

The second different is structural insurance policies geared toward reducing the terribly excessive share of retained company earnings (or company financial savings) within the financial system. That is primarily a distributional problem: wages are too low and income too excessive. The only method to repair that is to lift the speed of tax on company income, whereas permitting full expensing of funding. Different methods might be discovered, akin to distributing income to staff. However the purpose could be clear: to shift extra income into consumption.

The third different could be to go away the structural issues untouched, tighten financial and financial insurance policies and go away the Japanese to select up the items. That is “liquidationism”. It’s turning into trendy these days. It’s also irresponsible nonsense. As long as Japan continues to run large extra personal sector financial savings, coverage has to search out methods of both decreasing or offsetting them. Japan’s financial system continues to be trapped. It additionally has no straightforward approach out.

[ad_2]

Source link