[ad_1]

Bloomberg Intelligence senior commodity strategist Mike McGlone has defined {that a} supercycle could also be taking place in bitcoin, noting that the cryptocurrency is thrashing gold by virtually 10 occasions to this point this yr. The strategist added that if previous traits maintain, bitcoin’s volatility is extra more likely to get better in comparison with commodities when the crypto “heads towards new highs.”

Bitcoin’s Supercycle

Mike McGlone, a senior commodity strategist for Bloomberg Intelligence (BI), the analysis arm of Bloomberg, defined on Twitter Tuesday {that a} supercycle could also be taking place in bitcoin. He tweeted:

Searching for a brilliant cycle? Bitcoin outperforms commodities with declining threat — Bitcoin beating gold, the top-performing old-guard commodity in 2023 to March 20, by virtually 10x could also be indicative of a brilliant cycle taking place within the crypto.

The strategist defined {that a} profit bitcoin (BTC) has over most commodities is its “nascent stage of low and rising adoption vs. diminishing provide.”

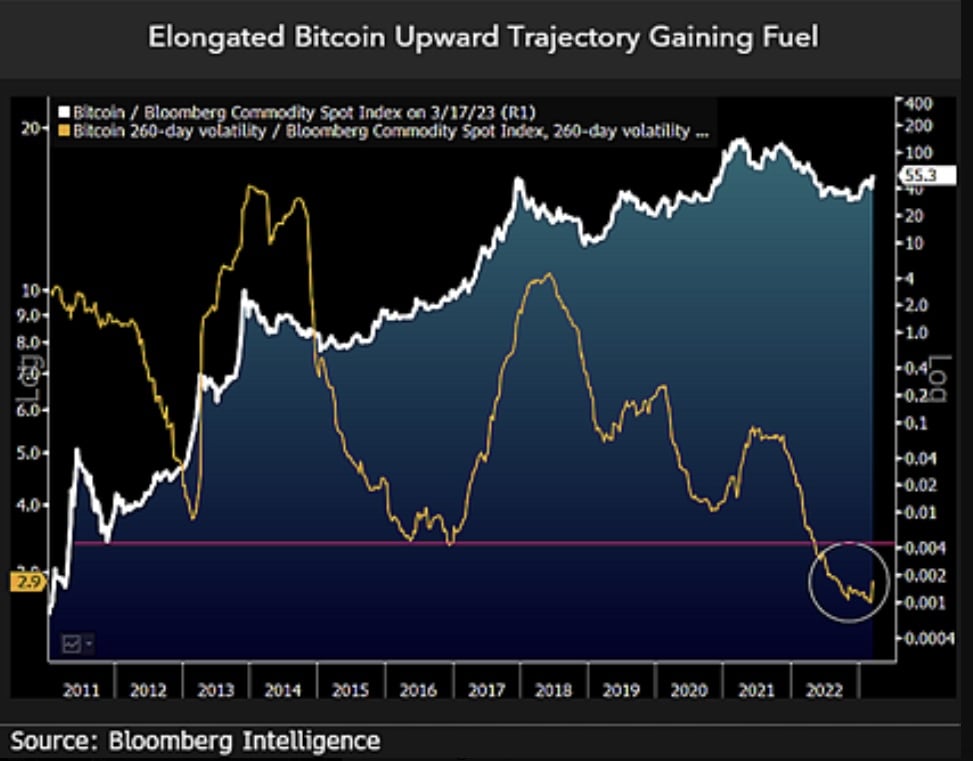

Referencing the chart titled “Elongated Bitcoin Upward Trajectory Gaining Gasoline,” proven above, McGlone famous that the elongated upward trajectory of BTC’s worth in comparison with the Bloomberg Commodity Spot Index is “typical in contrast with most property.” Nevertheless, he identified, “What’s distinctive relative to commodities is the 260-day volatility of bitcoin bottoming from a brand new low,” including:

If previous traits maintain, the crypto’s volatility is extra more likely to get better vs. commodities when bitcoin heads towards new highs.

The Bloomberg Intelligence strategist defined final week why he expects BTC to proceed to outperform gold and the inventory market. “Dealing with the Federal Reserve, inflation, and struggle, 2022 could also be primed for risk-asset reversion and mark one other milestone in bitcoin’s maturation,” he tweeted Friday. “It’s unlikely for bitcoin to cease outperforming gold, inventory market amid bumps within the street because the Fed makes an attempt one other rate-hike cycle,” McGlone opined.

In a unique tweet posted Saturday, he commented on how latest failures of main banks, together with Silicon Valley Financial institution and Signature Financial institution, affected bitcoin. The strategist detailed:

Banking points might outline bitcoin, crypto {dollars} — Bitcoin could also be progressing to commerce extra like U.S. Treasury lengthy bonds and gold as banks come below stress on the again of the bond-price collapse. Bitcoin sustaining above $25,000 is a transparent signal of divergent energy.

Do you assume a supercycle is going on in bitcoin? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link