[ad_1]

On Saturday, the liquid staking protocol Lido tweeted in regards to the largest day by day stake influx up to now as 150,000 ethereum was staked. Experiences point out that the ethereum, price greater than $240 million, belongs to Justin Solar, founding father of Tron.

Liquid Staking Protocol Lido Data 150,000 Ether Influx

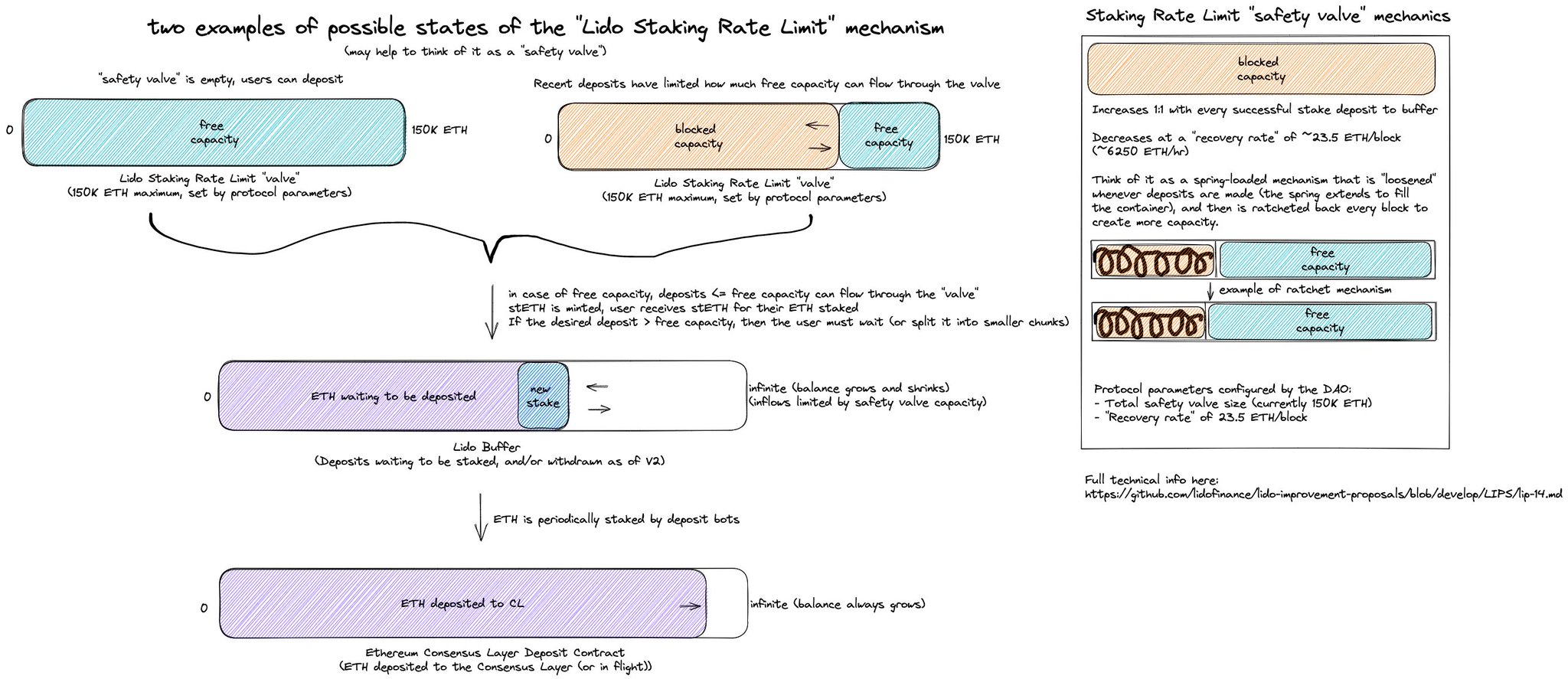

Lido, the liquid staking platform with the best quantity of ethereum (ETH) worth locked, famous that it acquired the biggest day by day stake influx up to now, with 150,000 ether price $240 million. “Lido protocol has registered its largest day by day stake influx thus far with over 150,000 ETH staked,” Lido said. “Upon reaching this quantity, a curious (however necessary) protocol security characteristic known as Staking Price Restrict was activated.”

Lido acknowledged that the Staking Price Restrict is a dynamic mechanism that manages massive influx spikes by lowering the prospect of diluting worth with out explicitly pausing stake deposits. Within the final 24 hours, Lido’s whole worth locked (TVL) skilled a 2.09% spike, in response to statistics. During the last month, Lido’s TVL elevated by 9.02% to $8.93 billion.

Tron Founder Reportedly Deposited the Ether

Of the full $8.93 billion, $8.7 billion is in staked ether (STETH), making it the twelfth largest crypto asset by way of market capitalization. In accordance with Hildobby, a researcher and information analyst at Dragonfly Capital, the 150,000 ETH deposit into Lido was reportedly made by Justin Solar of Tron.

“Right this moment [Justin Sun] staked 150K [ether] by way of [Lido Finance] (~0.9% of all staked ETH). That is now the best week by staked quantity in nearly a yr,” Hildobby said. “That is now the biggest day by day stake influx for Lido, it additionally activated Lido’s charge restrict characteristic for the primary time,” the researcher added.

In January 2023, Lido announced plans to create a withdrawal characteristic for ethereum deposits forward of Ethereum’s Shanghai hard fork, anticipated to happen in March. “The method needs to be asynchronous, as a result of asynchronous nature of Ethereum withdrawals,” defined the Lido builders on the time.

What are your ideas on Lido’s largest day by day influx of ether? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link