Russia’s invasion of Ukraine a yr in the past reverberated by means of international markets. Ad infinitum to Europe’s most intense battle for the reason that second world conflict, the consequences are nonetheless being felt.

Monetary Occasions reporters have a look at what has occurred in key markets and what may occur subsequent.

Putin’s power conflict backfires

Working nearly in parallel to Russia’s invasion of Ukraine has been the power conflict President Vladimir Putin unleashed towards Europe. The squeeze on gasoline provides began earlier, in what many business commentators now consider was an try and weaken Europe’s resolve earlier than the primary pictures had been even fired.

However Moscow’s weaponisation of gasoline provides ramped up dramatically as western powers threw their assist behind Kyiv.

Russian gasoline exports, which as soon as met about 40 per cent of Europe’s demand, have been minimize by greater than three-quarters to EU nations prior to now yr, stoking an power disaster throughout the continent.

However Putin’s power conflict is not going to plan. Senior figures within the business consider that for all Russia’s undoubted sway in oil and gasoline markets, the president is now observing defeat in markets he as soon as thought he might dominate.

“Russia performed the power card and it didn’t win,” Fatih Birol, head of the International Energy Agency, informed the Monetary Occasions this week.

“It wasn’t simply meant to trigger ache in Europe for its personal sake it was designed to vary European coverage,” stated Laurent Ruseckas, government director at S&P World Commodity Insights. “If something, it made Europe extra decided to not be bullied into altering positions.”

European gasoline costs have fallen by 85 per cent from their August peak, bolstering the broader financial system, which now appears to be like prone to keep away from a deep recession.

The continent has additionally averted the worst potential outcomes comparable to outright gasoline shortages or rolling blackouts, which as soon as appeared a definite chance.

Certainly, there are indicators that Europe is now higher positioned to deal with subsequent winter too.

Comparatively delicate climate and Europe’s success in tapping various provides comparable to seaborne liquefied pure gasoline imply that storage services throughout the continent are far fuller than regular for the time of yr.

Fuel in storage stood slightly below 65 per cent of capability as of Wednesday, in response to commerce physique Fuel Infrastructure Europe, with solely a month of winter nonetheless to run. On the day of Russia’s invasion, gasoline storage stood at simply 29 per cent.

“The storage refill problem for subsequent winter is not an enormous burden,” stated Ruseckas.

Longer-term merchants together with Pierre Andurand, who has run one of many world’s most profitable power funds for greater than 15 years, assume Putin has already misplaced as he has obliterated his relationship with Russia’s predominant gasoline buyer.

Whereas Russia needs to promote extra gasoline to Asia, it might take a decade to reorient its pipelines east, with the gasfields that when equipped Europe not linked to the road it makes use of to feed China.

Andurand this month argued that China would even be able to drive a tough discount with Moscow on value, and wouldn’t need to repeat Europe’s mistake of changing into too reliant on anybody provider.

“As soon as Russia can solely promote gasoline to China, Beijing will likely be able to resolve the worth,” Andurand stated.

Europe nonetheless faces challenges. Whereas gasoline costs have plummeted from the close to $500 a barrel stage (in oil phrases) they reached in August, they continue to be two-to-three instances larger than historic norms.

Russia nonetheless provides about 10 per cent of the continent’s gasoline alongside pipelines working by means of Ukraine and Turkey. Ought to Moscow resolve to chop these provides it’s prone to push costs larger once more, though it might be cautious of alienating Turkey.

Europe may even probably face stiffer competitors for LNG provides with Asia this yr as China’s financial system reopens after the tip of zero-Covid, although there’s some preliminary proof that Beijing is extra value delicate than feared.

Merchants look to extension of grain export deal

Worldwide merchants are centered on the extension of the Black Sea grain export deal between Kyiv and Moscow that is because of expire subsequent month, amid Ukrainian accusations that Russian inspectors had been intentionally delaying the transit of grain ships within the port of Istanbul.

The settlement, brokered by Turkey and the UN final July, allowed Ukrainian grain shipments to move by means of the Black Sea, bringing costs down from their post-invasion peaks. Grain costs have since fallen to prewar ranges though they continue to be traditionally excessive.

Ukraine had been a number one participant within the meals commodity markets previous to the conflict, accounting for about 10 per cent of the worldwide wheat export market, just below half of the sunflower oil market and 16 per cent of the corn market.

Final November, the deal was prolonged regardless of Putin’s threats to terminate it, and there’s heightened uncertainty over how Moscow will act on the negotiation desk.

“If [the deal] is renewed — that’s nice information, but when it’s not performed, then instantly you’re going to have a problem there with provides,” warned John Baffes, senior agricultural economist on the World Financial institution. “These points are going to have an effect on principally nations in north Africa and the Center East.”

Excessive inflation ensures rates of interest stay elevated

Inflation was already elevated in February 2022, as costs had been pressured larger by snarls in provide chains and the big fiscal stimulus unleashed to mood the worst results of the Covid-19 pandemic.

However these forces had been understood by central banks as transitory. The sanctions positioned on Russia at first of the conflict drove up the costs of oil, gasoline and coal — amongst different commodities — including to inflation and rendering it extra persistent.

At the same time as provide chains had been unblocked and pandemic money was spent, inflation continued to rise.

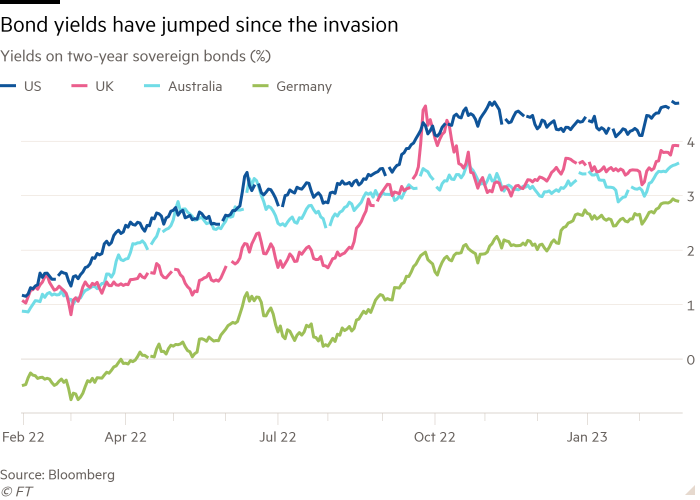

The persistence of that inflation has compelled central banks to boost rates of interest larger and better, lifting yields on sovereign debt. Two-year sovereign bond yields, which transfer with rates of interest, have risen greater than 2 proportion factors in Germany, the UK, the US and Australia, amongst others, within the final yr alone.

As the associated fee to borrow has risen for sovereign nations, so it has for firms, pushing company bond yields larger and inventory costs decrease.

There’s little likelihood they are going to fall quickly. Though inflation globally has begun to gradual, the tempo stays far above goal for a lot of central banks, which have vowed to proceed their combat.

Rouble set to depreciate after recovering from post-invasion low

One yr on from Russia’s invasion of Ukraine and the rouble’s worth towards the greenback is near the place it was at first of the battle — though there have been loads of twists alongside the best way.

The Russian forex halved in worth to a report low of 150 to the greenback within the month after Putin ordered troops into Ukraine, regardless of Russia’s central financial institution greater than doubling rates of interest to twenty per cent in late February in an try and calm the nation’s more and more strained monetary system.

European and US sanctions — designed to chop Russia out of the worldwide funds system and freeze the a whole bunch of billions of {dollars} of reserves amassed by the Financial institution of Russia — swiftly adopted. In late March, an emboldened US president Joe Biden declared that the rouble had been “nearly instantly diminished to rubble” consequently.

Then got here the rebound. Moscow’s imposition of capital controls meant the rouble had recovered nearly all of its losses by the beginning of April. The forex was additionally helped by the continued move of oil and gasoline exports.

It has progressively weakened since July, nevertheless, when it touched 51 towards the greenback, a stage final seen in 2015. At the moment it trades at 75.

With Russia’s capital account all however closed for main arduous currencies, “the trade charge doesn’t carry out its forward-looking function primarily based on expectations, it solely displays day after day commerce flows, most of which is power commerce,” stated Commerzbank analyst Tatha Ghose.

Ghose anticipated the rouble to proceed to depreciate towards the dollar in 2023, dragged decrease as western sanctions on Russian oil weigh on the nation’s present account.