[ad_1]

It’s a vogue of late to match the UK with Italy. As a result of yields on their authorities bonds are at related ranges, commentators have been eager to say that Britain has grew to become as profligate because the southern pizza, pasta and mafia financial system.

Tory MPs are in disarray, and Liz Truss has turn into the human equal of Larry the cat, dwelling in Downing Avenue however wielding no energy. Issues are turning ever extra Britalian: https://t.co/Wf26N0kFPv pic.twitter.com/c1KoKtsMfu

— The Economist (@TheEconomist) October 20, 2022

However fiscal profligacy is extra a actuality for the UK than it has been for Italy during the last twenty years.

UK gilt costs dived on the outgoing prime minister’s announcement of huge unfunded tax cuts. Drastic U-turns on almost all the guarantees, a return to austerity and a record-quick defenestration have stabilised markets however left reputations shredded.

In the meantime, Italy is ready for its subsequent finance minister following the election victory final month of Giorgia Meloni’s arch-conservative coalition. Whoever will get the job can be taking management of a authorities main funds excluding debt curiosity funds that has been in surplus for almost twenty years.

This isn’t the case for the UK, which has recorded a deficit for many of that interval. In actual fact, with out curiosity funds on authorities debt, Italy has been operating a funds surplus much like that of Germany. It has confirmed rather more frugality than the UK, and of the typical of probably the most industrialised international locations.

At present’s UK fiscal similarities would in all probability be nearer with Italy’s fiscal selections within the Nineteen Eighties, when speedy will increase in authorities spending weren’t matched by corresponding rises in revenues, leading to a surge in authorities debt.

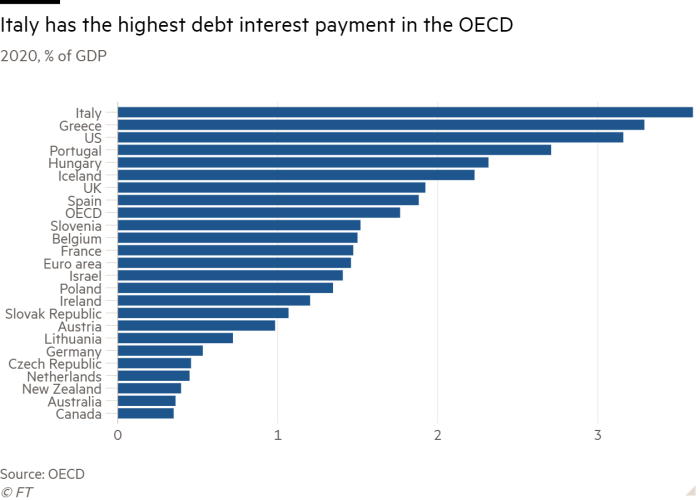

The gathered authorities debt nonetheless weighs on Italy’s fiscal and financial outlook through the very best funds within the OECD. Coupled with the necessity for structural reform, Italy’s financial system has largely stagnated for the final twenty years. That is what’s dangerous about Italy for buyers, not current fiscal profligacy.

Not satisfied? Right here’s Bert Colijn, senior economist at ING:

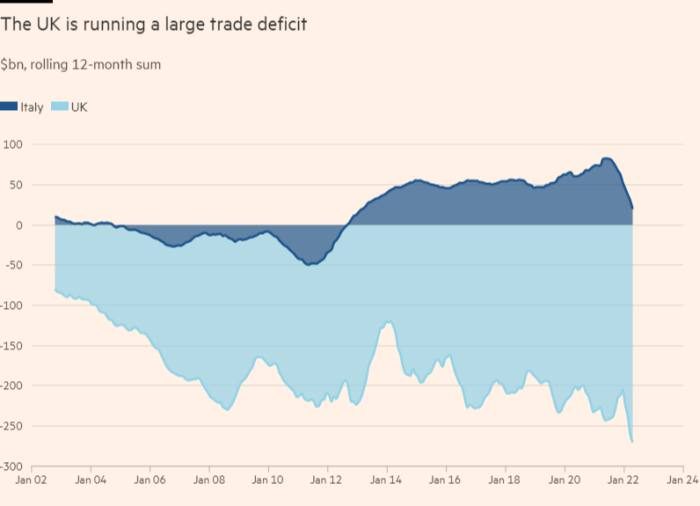

The considerations in monetary markets concerning the UK stem from a really accommodative fiscal stance, regardless of funds deficits already being excessive and a commerce deficit on the again of that,” he mentioned. “This stands in sharp distinction with Italy, which suffers from excessive legacy debt from the Nineteen Eighties and 90s, whereas they’ve really delivered main fiscal surpluses for a lot of the previous twenty years.

Because of this “Italy has a structural drawback of low financial progress and excessive debt, whereas the UKs considerations appears primarily associated to the very expansionary funds proposals,” mentioned Colijn.

Nicola Nobile, economist at Oxford Economics, agrees. Italy’s drawback is “primarily a legacy of the earlier gathered debt in addition to an issue stemming from lacklustre progress.”

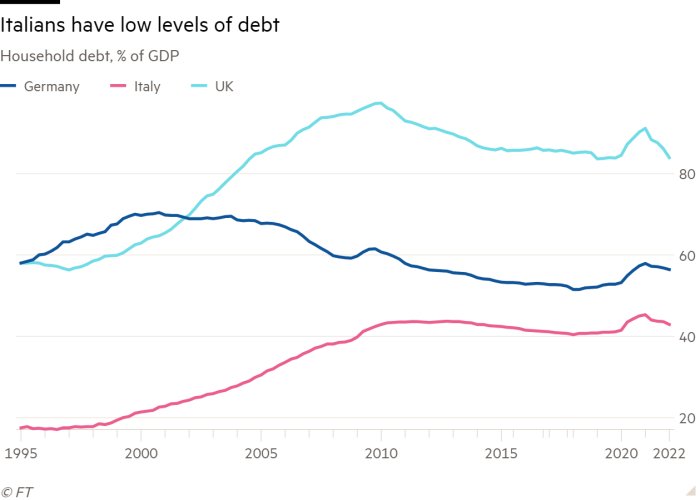

Even Italians households don’t dwell past their means. Italy’s households have one of many lowest debt-to-GDP ratios amongst all superior economies, effectively under that of the UK and even decrease that of Germans.

Just like the UK, Italy’s financial system is battling weak home demand. However its companies are profitable exporters operating a items exports surplus for the final many years. The UK is operating one of many largest present account deficits amongst superior economies including uncertainties for buyers.

In abstract, reasonably too many commentators have preso lucciole per lanterne.

[ad_2]

Source link