[ad_1]

Bitcoin was as soon as seen as a way to decide out of violent, legacy monetary programs. Now, it’s being co-opted by the exact same, and zealous newcomers to crypto assume that’s an excellent factor, whereas nonetheless giving lip service to peer-to-peer values. Ignoring the issues with fiat cash, they beg political pursuits and dangerous actors to control Satoshi’s digital innovation. One such actor, Joe Biden, has been within the information not too long ago complaining about not getting sufficient tax cash from struggling Individuals. To Biden and his elitist ilk, the destruction of crypto’s potentialities for financial sovereignty is a aim. Taxation is a key means to make that occur. To the crypto OGs, taxation remains to be theft, and permissionless, peer-to-peer trade remains to be the reply.

Cease the Sugar-Coating: Why Taxation Is Extortion

There’s an previous saying that goes: “you’ll be able to’t make ice cream out of sh*t.” It’s crude, perhaps, however speaks to an essential actuality in each the realm of concepts and the bodily world: one thing is what it’s, and it ain’t what it ain’t. You possibly can’t make a palace from a porta-potty, and you’ll’t make the literal stealing of taxation, inflation, and fiat currency devaluation into an excellent factor for any sane society.

Taxation is a euphemism for extortion, writ giant. Advocates of taxation (the sustained and systematic extortion by the state for one’s complete lifetime) make the identical arguments for compelled monetary servitude as slavers within the American south made for their very own model of brutal, bodily tyranny. Appeals to custom, humanitarianism, fear-mongering about financial collapse, warnings of violent chaos and anarchy are all here. “However who will choose the cotton?” has discovered its fashionable analogue in “However who will construct the roads?” Or, as this text alludes to: “Who will purchase the child sniffer his ice cream?”

A easy illustration of why taxation is theft (slightly below) will probably be a useful introduction. However first, right here is the definition of extortion:

Extortion is outlined as “the follow of acquiring one thing, particularly cash, by pressure or threats.” The fundamental drawback with the fiat system of cash and its printing and taxation is violence. As Satoshi encoded within the coinbase parameter of block zero, or the genesis block of the Bitcoin community:

The Occasions 03/Jan/2009 Chancellor on brink of second bailout for banks

Due to the state’s legalized extortion, we foot the invoice for such bailouts, whereas those on high of the pyramid scheme merely print extra money in the event that they want it, and hoard laborious belongings. Authorized definitions make some extent to notice that such violence and threats are solely dangerous if “illegal” or not issued by the IRS, however once more, that is simply one other technique to make soft-serve from excrement, for the sake of these in energy.

The US Inside Income Service (IRS) declares in no unsure style how they get hold of their cash. Here is a refresher. The so-called “voluntary” tax system within the U.S. “isn’t voluntary and is clearly set forth in sections 6011(a), 6012(a), et seq., and 6072(a) of the Inside Income Code.”

What occurs when you don’t pay is easy:

Failure to file a tax return might topic the non-compliant particular person to civil and/or felony penalties, together with fines and imprisonment.

So, pressure and threats are clearly used to acquire tax funds, even from non-violent individuals. Taxation is thus extortion, by definition.

What’s worse, if any individual makes an attempt to withstand being positioned in a cage for not eager to pay for a war abroad with their cash, not eager to reply an ominously-worded question about crypto on their tax varieties for security causes, or not feeling their cash is anybody’s enterprise however their very own, IRS brokers will try to subdue them to finish the state-sanctioned kidnapping, as much as and together with killing them. And, virtually laughably in a really darkish manner, even dying doesn’t finish one’s supposed tax liabilities.

A Easy Illustration

On to that illustration I promised. In case your neighbor knocks in your door elevating cash to construct a skate park for the neighborhood children, you’ll be able to both donate, or decline to take action. That is primary, civilized society. Nevertheless, if stated neighbor refuses to simply accept “no” for a solution, and pulls a gun on you, that is rightly seen as violence. A felony exercise.

Even when that neighbor returns with 5 different individuals from the neighborhood making the identical risk, the extortion would nonetheless not be justified. And in the event that they return with all the neighborhood or the entire city? Or everybody in an space of, say, 54,000 sq. miles? The logical reality stays that this instance of threatening violence — and in the end lethal violence — to accumulate funds, is rightly seen by logically constant and moral people as felony, even whether it is for one thing seen as optimistic, like a park for youths.

So after we take New York State, for instance, with its land mass of simply over 54,000 sq. miles like in our illustration above, why is it out of the blue, magically okay for an additional group of mere human beings (now referred to as “the federal government” and “the IRS”) to challenge that very same actual risk, demanding donations at gunpoint?

Donations, thoughts you, to pay not only for parks and roads, however for wars which unceasingly murder innocent people, so-called public providers that are horribly mismanaged (like police safety, which is usually not provided after payment and is not even legally required to be provided), and buildings and nations we can not enter if we don’t take an injection of a largely untested mRNA spike protein cocktail. These are so-called providers and items one can not decide out of, even when one doesn’t use them.

Even seen from a strictly financial lens, this centralized extortion mannequin is a recipe for catastrophe. There isn’t any price discovery, with market indicators of provide and demand disrupted. No competitors is allowed, even when the providers are failing. The only, central societal “node” referred to as the state determines what funds are wanted arbitrarily, who they might go to, and what could also be achieved with them.

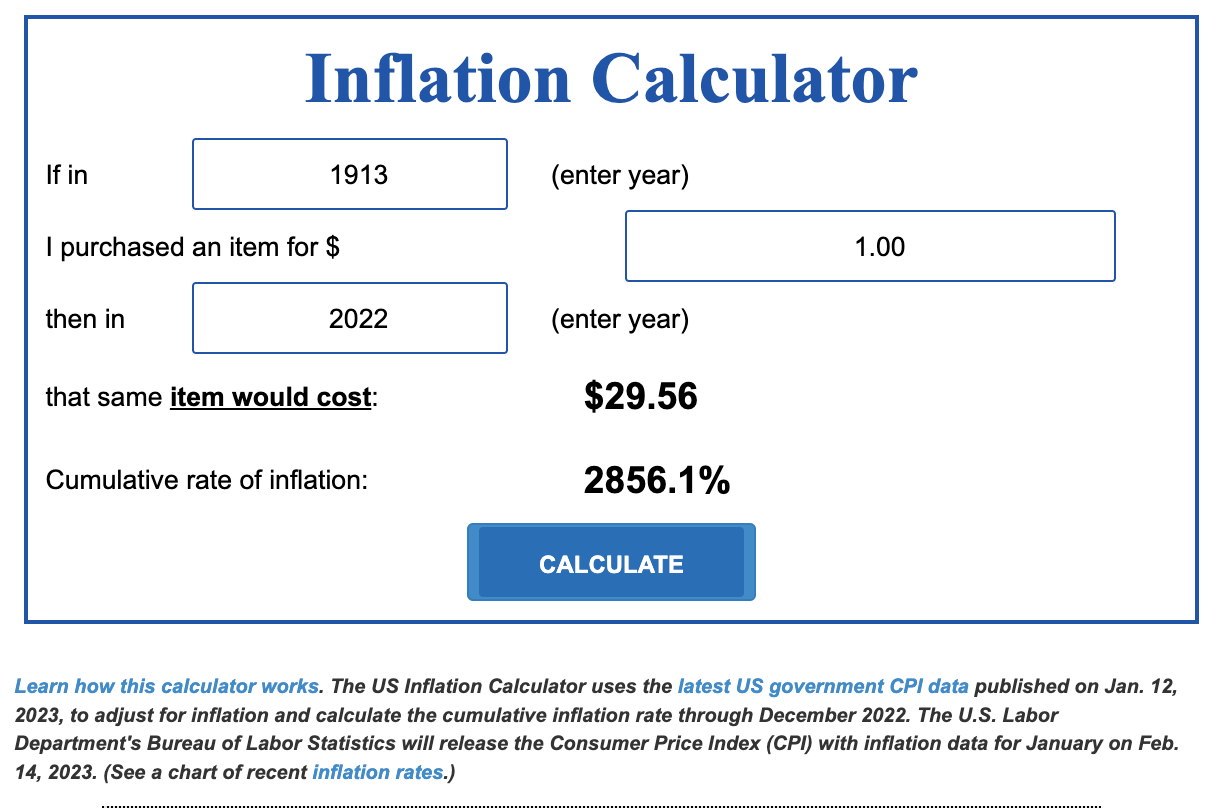

On high of this, the fiat currencies taxed are themselves perpetually depreciating and recklessly destroyed by quantitative easing and inflation, leading to exponential lack of worth to the holder who’s compelled to make use of them on the exclusion of extra sound options. The arrival of bitcoin noticed a lightweight on the finish of the tunnel right here: a limit on printing money, the top of funding wars and pilfering with inflation and taxation.

Leaving economics, seen ethically, taxation is a psychopathic proposition: violation of the non-violent to realize non-violence. Individuals all through historical past have been usually prepared to pay for their very own wants, and even to offer what assist they’ll to their quick communities the place attainable, with out the necessity for violence being leveraged, not to mention systematic violence. To argue that folks don’t do that could be to detonate the place that authorities (themselves simply individuals) might or would do it. It might even be an odd admission of a self-destructive impulse.

Abandoning Political Parasites for P2P: Authentic (Gangsta) Concepts By no means Die

I have to get to the ice cream warhawk. Whereas the brand new crypto zealots preserve speaking on Twitter in regards to the “monetary freedom” of merely HODLing BTC and weirdly asking for extra legal guidelines and guidelines, roughly 87,000 new IRS workers could possibly be employed in america over the subsequent decade to make sure on a regular basis individuals in America cough up their pennies on time. The Treasury Division document the 87,000 ballpark quantity comes from is attention-grabbing, because it delves into crypto as nicely, noting:

One other concern is that an data reporting regime will shift taxpayers towards a better use of money … Nonetheless one other vital concern is digital currencies … Cryptocurrency already poses a major detection drawback by facilitating criminal activity broadly together with tax evasion.

Bitcoin.com Information not too long ago reported that the Biden administration is talking out towards proposed laws that may lower funding for the tax company. A press release from Biden’s camp famous the funding at stake “permits the IRS to crack down on giant firms and high-income people who cheat on their taxes.”

However who the struggling IRS truly targets and all the time has cracked down on, on each side of the BS bi-partisan aisle, tells the actual story. The article goes on to notice:

American crypto advocates have been plagued with anxiousness over the appearance of a brand new tax reporting requirement that can necessitate digital forex exchanges, Venmo, Money App, Paypal, Airbnb, and eBay sending 1099-Okay varieties to their customers. The IRS, with its unyielding gaze, has set its sights on funds of $600 or extra for items and providers obtained by a third-party fee community.

The “unique gangsters” of crypto, these OGs who noticed instantly that bitcoin might present a manner for any human, no matter political standing, revenue, or cultural background, to transact worth freely above and past this restrictive statist quo, might appear to have thinned out a bit. However we’re nonetheless right here.

Bitcoin is highly effective due to the concept behind it. And any system that facilitates free trade without the need for third parties can open the door to empowering decentralized communities and impartial (and interdependent) “social nodes” of people centered on order and peace — not chaos, pilfer, and demise.

The extra people can lastly see past the euphemisms — and they’re going to, ultimately — to the paradigm-busting reality that people don’t have to be managed by archaic, violent programs of governance and taxation, the earlier the shift to a better way. This idea can’t be killed, regardless of the tool to assist it work could also be. Fortunately, it’s already out of the bag. So let the previous child sniffers (and different actually ungoverned parasites on the high of the worldwide Ponzi) work for his or her cash, like each sincere individual has to.

There’s a threat to permissionless, peaceable dwelling, however the threat of passively watching free market trade die — and permitting incalculable evil to envelop the lives of future generations — is arguably a lot better. Any little permissionless motion helps. Any little phrase about freedom and non-compliance to a good friend or stranger. Even sending a pair obfuscated BCH sats to somebody in the present day for a cheeky ice cream cone.

To be taught extra about free trade, self-ownership, and voluntaryism, see here, here, and here.

What are your ideas on this story? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Prachaya Roekdeethaweesab / Shutterstock.com

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link