[ad_1]

sponsored

In January 2023, ViaBTC Capital and CoinEx collectively launched the 2022 Crypto Annual Report to supply information evaluation and insights into 9 sectors, together with Bitcoin, Ethereum, stablecoins, NFT, public chains, DeFi, SocialFi, GameFi and regulatory insurance policies. This report additionally predicts the crypto pattern in 2023.

In keeping with the report, affected by elements such because the macro surroundings and bull-to-bear transition, the entire cryptocurrency trade turned bearish in 2022. Particularly, following the Terra meltdown in Might, most cryptocurrency sectors had been hit by the bearish influence. Under is the overview of every section.

1. Bitcoin

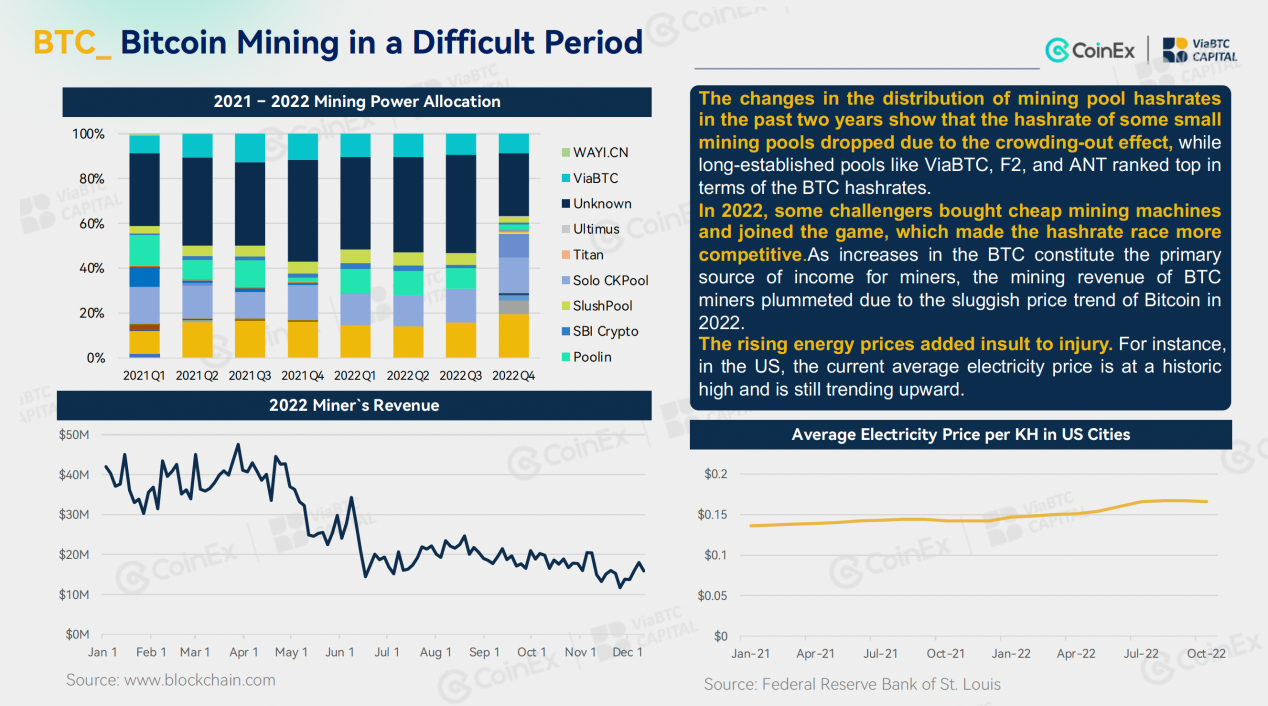

In 2022, the general efficiency of Bitcoin remained sluggish, with vital declines in value and buying and selling quantity in comparison with 2021. The value on the finish of 2022 even fell beneath the height of the final bull market. The value pattern of Bitcoin all year long is clearly influenced by the tempo of US rate of interest hikes, however because the US rate of interest hike coverage continues to advance, its influence on the value of bitcoin is regularly diminished. Concerning BTC mining, the community problem remained at a historic excessive. In the meantime, the mining income plummeted, and miners have needed to shut down their outdated fashions. Affected by a number of elements, the mining trade witnessed a robust crowding-out impact, which drove house owners of small mining farms out of the marketplace for numerous causes. On the identical time, long-established mining swimming pools and mining farms managed to take care of a sure stage of stability.

2. Ethereum

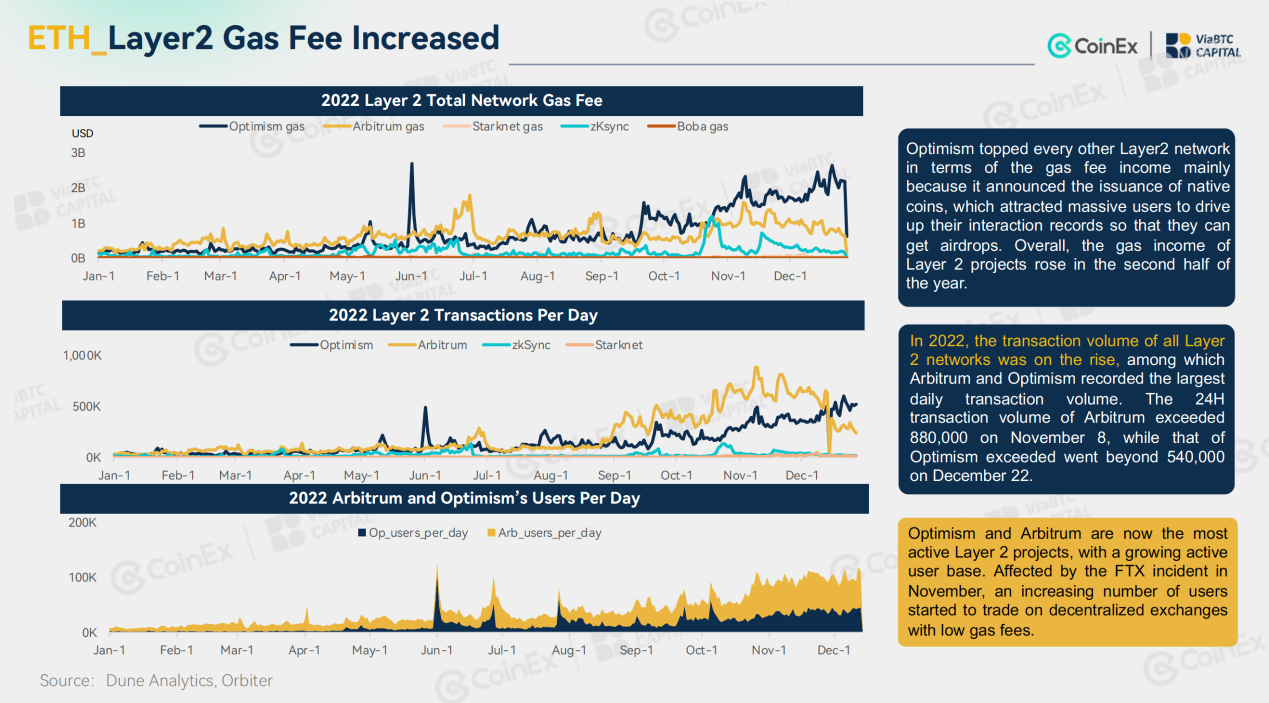

The first statistics of Ethereum trended downward in 2022. Along with the secondary market value and transaction quantity, the on-chain information, together with TVL, transaction price, lively deal with and burning quantity additionally took a plunge. Regardless of that, the community did obtain loads of progress in 2022. On September 15, Ethereum accomplished the historic transition from PoW to PoS. The Merge considerably reduce the community’s power consumption and day by day output, thereby lowering the dumping strain from secondary markets. In the meantime, Layer 2 tasks comparable to Arbitrum, Optimism, zkSync, and Starknet launched their mainnet both in entire or partly. Though their day by day transaction quantity was far lower than Ethereum mainnet, the tasks exceeded Ethereum by way of the variety of addresses. Furthermore, their fuel price was usually 1/40 of that charged by Ethereum. On the identical time, the community additionally noticed an exponential enhance in fuel charges throughout 2022.

3. Stablecoins

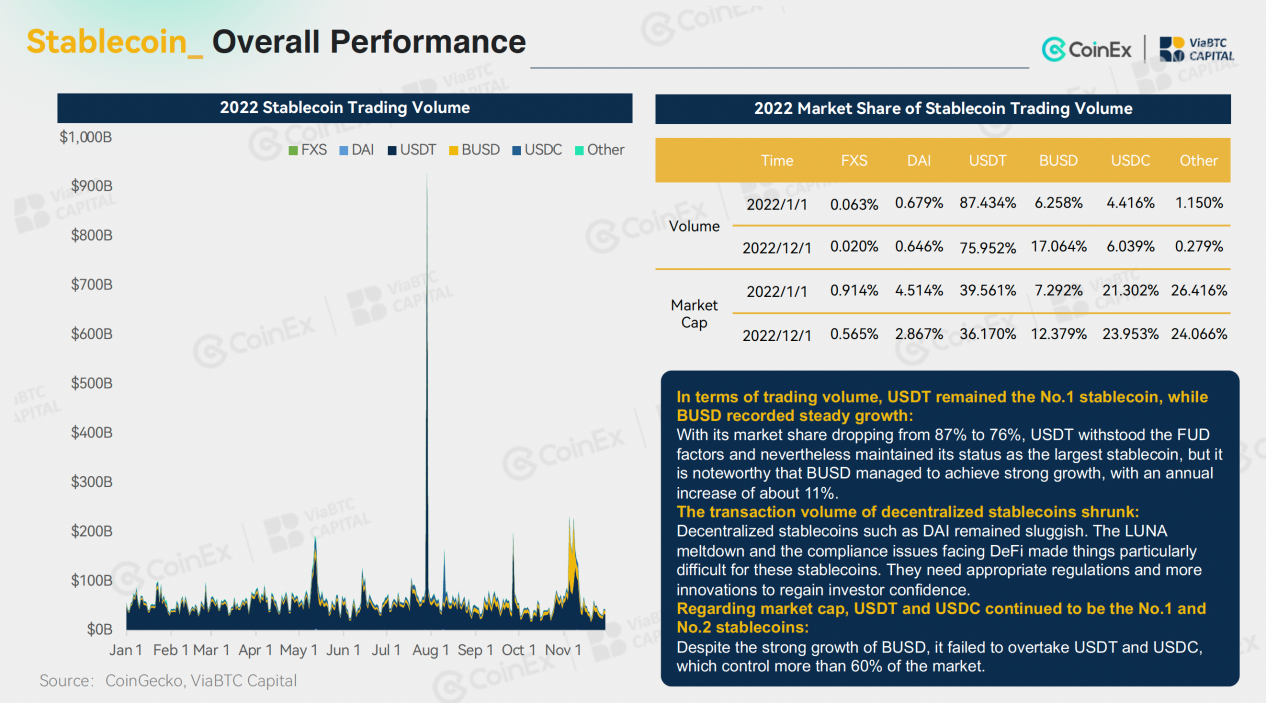

The stablecoin market as a complete was secure in 2022. Particularly, all year long, the provision of stablecoins fell from $157 billion to $148 billion, a 6% drop. On this regard, the autumn was not substantial. With respect to centralized stablecoins, USDT maintained its dominance, whereas BUSD is rising quickly on Binance’s again. In contrast, algorithmic stablecoins had been hit onerous by the autumn of LUNA, which shattered the religion in decentralized stablecoins and decreased buying and selling volumes. Consequently, there was a transparent drop within the variety of new decentralized stablecoins.

4. Public chains

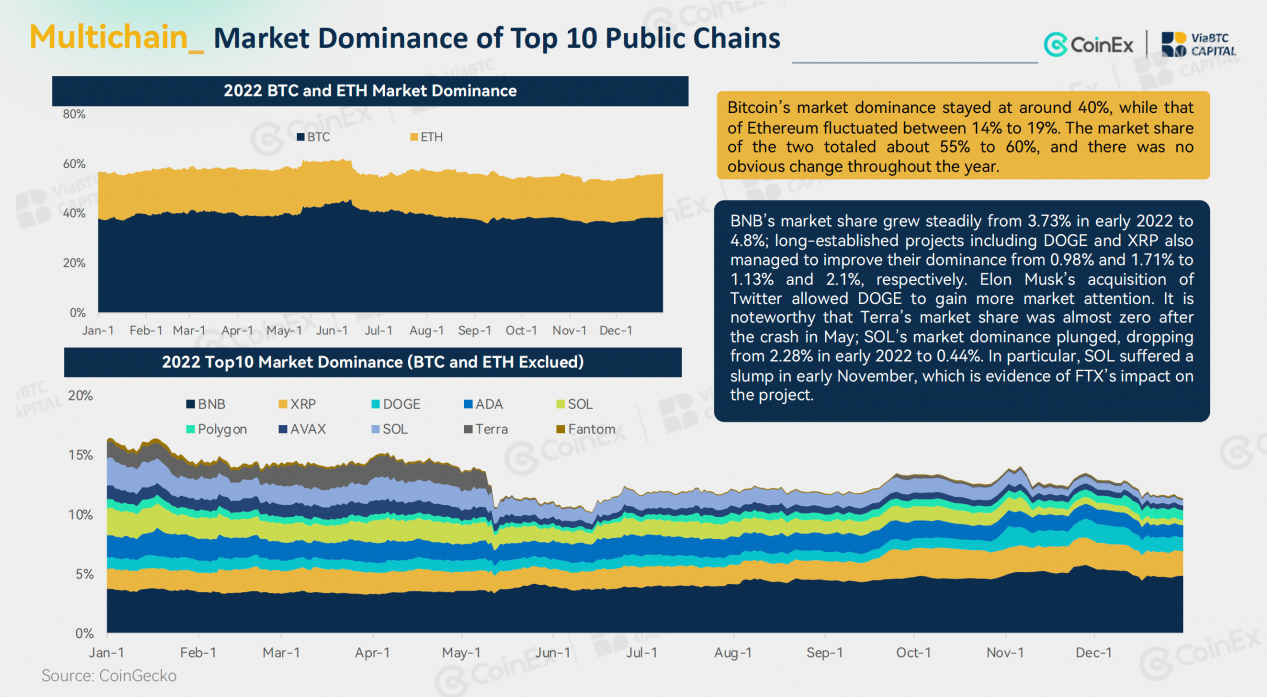

Regardless of the tough market situations in 2022, public chains remained a aggressive sector. As a result of overflow of demand attributable to the congestion of the Ethereum community, the brand new public chain with low charges maintained a vivid efficiency earlier than Might. Nonetheless, as numerous dangerous information brewed and fermented, a sequence of bankrupt occurred one after one other. Many public chains had been enormously impacted, and the decline was even worse than that of Ethereum. In Might, Terra collapsed in just a few days, making it the primary well-known public chain to fall. Moreover, the Terra meltdown was additionally a sign that the market turned totally bearish. In November, hit by the autumn of FTX and Alameda Analysis, Solana’s token value and TVL took one other plunge, and the tasks inside its ecosystem had been additionally damage. Different new chains comparable to Fantom and Avalanche had been additionally struggling. On the identical time, quite a lot of new public chains, together with Layer 2 tasks like Arbitrum and Optimism and Meta-related chains comparable to Aptos and Sui, made their debut in 2022.

5. NFT

Final 12 months, the NFT sector declined after its preliminary growth. In April, the market cap of the NFT reached $4.15 billion, a historic excessive; In Might, pushed by the growth of Otherside, a metaverse NFT assortment developed by Yuga Labs, the buying and selling quantity of the sector hit a report excessive of $3.668 billion. However quickly afterward, because the NFT market turned sluggish, the buying and selling quantity declined. In the meantime, the value of blue-chip NFTs, in addition to the ETH value, plummeted, which each negatively affected the market. Alternatively, the variety of NFT holders stored rising and reached a historic excessive in December.

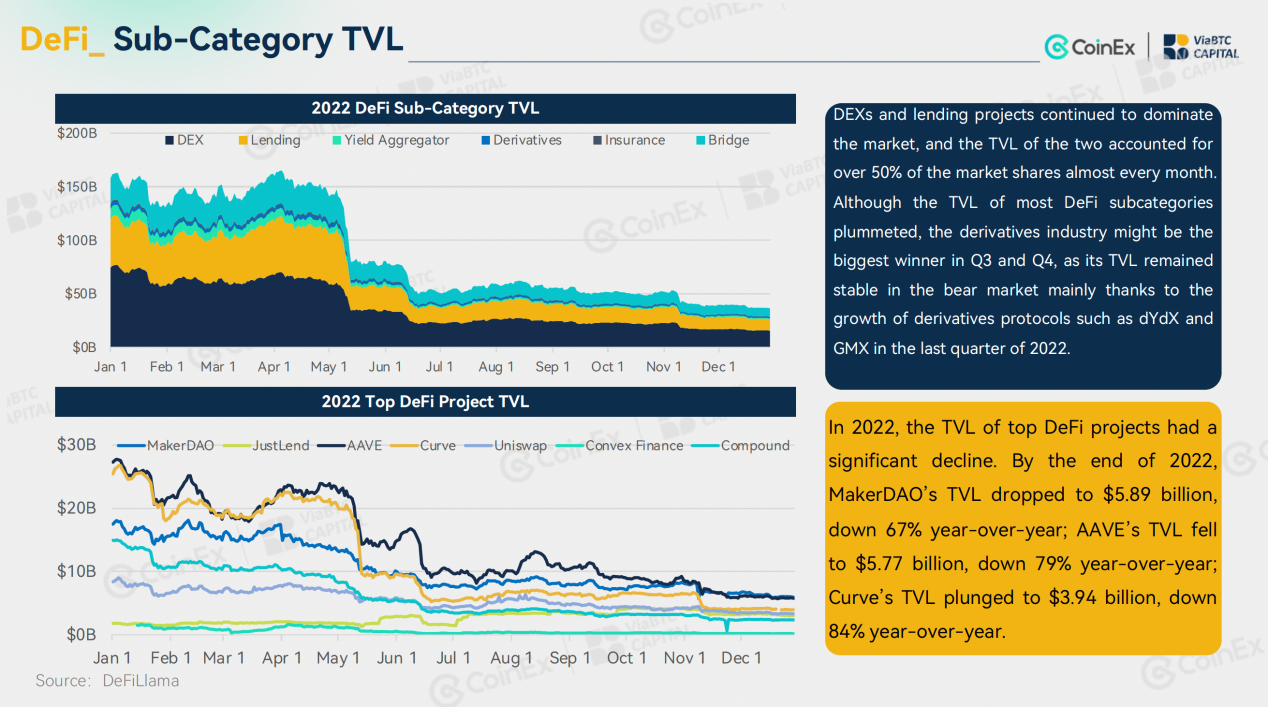

6. DeFi

DeFi’s TVL additionally trended downward in 2022. Particularly, throughout the LUNA/UST meltdown in Might, mainstream cash witnessed essentially the most spectacular crash within the historical past of cryptocurrencies, which was adopted by a TVL collapse. Moreover, over the 12 months, DeFi additionally suffered frequent hacks, which raised safety considerations for DeFi. By way of innovation, though the primary two quarters of 2022 noticed trending hypes about DeFi 2.0 on occasion, together with the hunch of OHM and the (3, 3) meme, DeFi 2.0 was nearly confirmed to be a very false narrative, and the market shifted its consideration again to DeFi 1.0 infrastructure tasks comparable to Uniswap, Aave, and MakerDAO. Regardless of the bearish situations, mainstream DeFi tasks together with AAVE and Compound managed to take care of regular operations and attracted many new customers from sure CeFi tasks (e.g. Celsius and FTX).

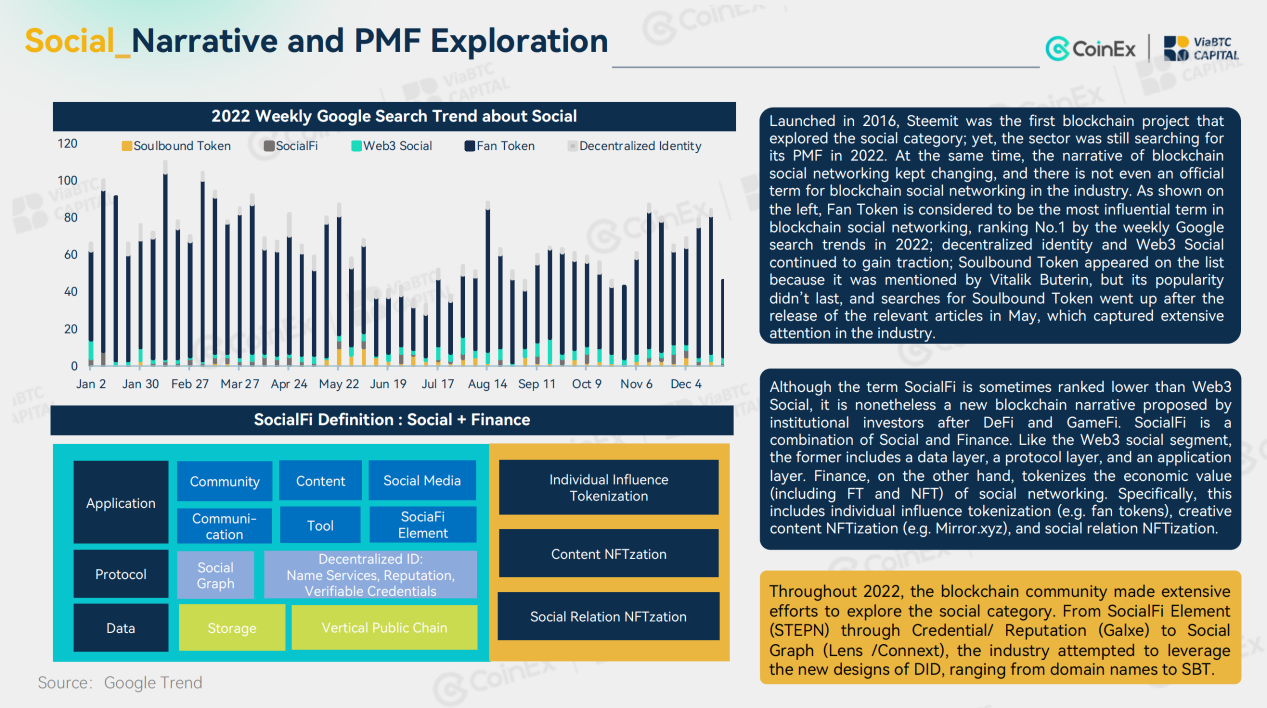

7. SocialFi

In 2022, the blockchain trade continued to discover new potentialities for SocialFi. Over the 12 months, we noticed the looks of iconic phrases like Fan Token, Soulbound Token (SBT), Web3 Social, and Decentralized Id (DID), however the PMF (Product- Market Match) was by no means recognized. Regardless of that, the SocialFi nonetheless managed to current us with quite a lot of star tasks, together with Web3 life-style app STEPN that includes SocialFi components, credential community Galxe, BNB Chain area identify service SPACE ID, social graph Lens Protocol, and Web3 gamified social studying platform Hooked Protocol. Other than that, the 2022 Qatar World Cup additionally helped Fan Tokens entice in depth market consideration. Consequently, as a substitute of plummeting because of the bearish influence, the Fan Tokens additionally carried out barely higher in 2022 than in 2021.

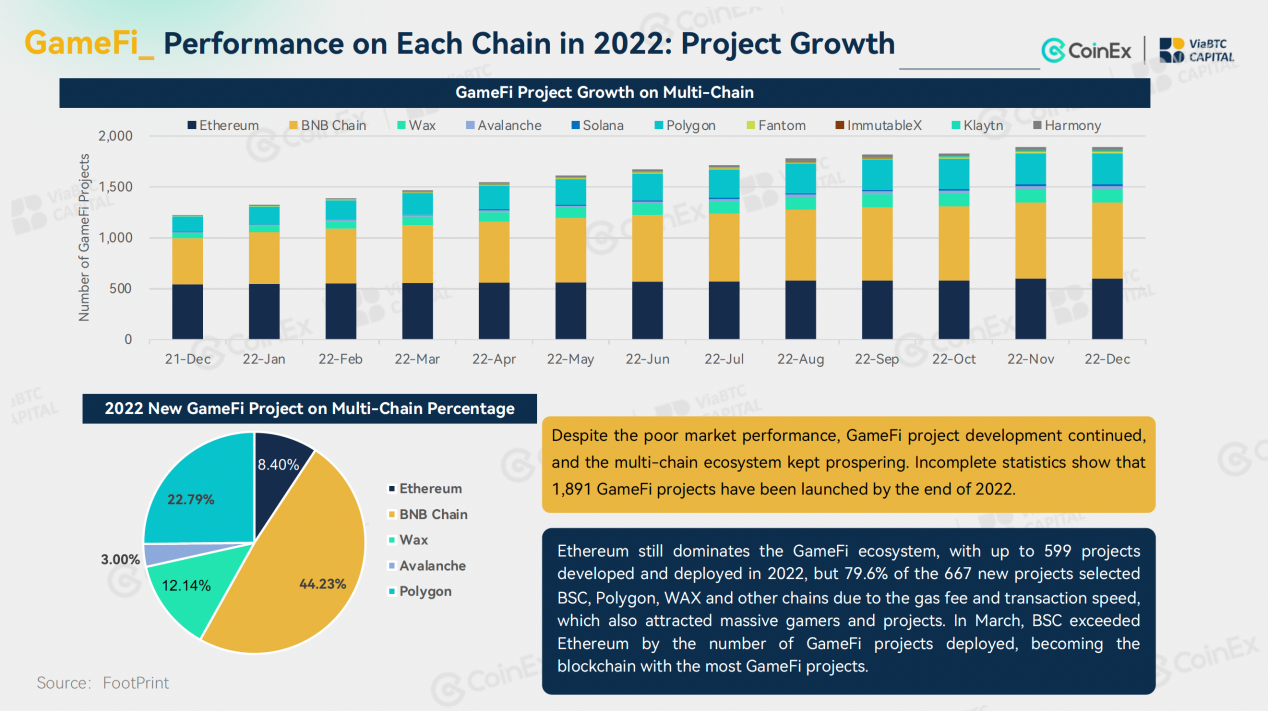

8. GameFi

2022 was additionally the start of the GameFi bear. There was no vital innovation in P2E blockchain sport mannequin. As the expansion of customers and buying and selling volumes dwindled, institutional traders regarded away from the P2E mannequin. Within the first half of the 12 months, the Transfer-2-Earn mannequin created by STEPN captured the highlight with its modern twin tokenomics and advertising method, bringing new dynamics to GameFi. Final 12 months, blockchain tasks raised the most important funds in April, with blockchain investments totalling $6.62 billion. Nonetheless, the market didn’t reply to different mission groups specializing in the truth plus token mannequin. Because the multi-chain ecosystem gained rising reputation, Ethereum maintained its dominance within the GameFi ecosystem, however the development fee of tasks on Ethereum did not match that of BNB Chain and Polygon. As well as, most chains relied closely on their prime tasks, and there have been nonetheless loads of low-quality GameFi tasks with a small consumer base, subpar interactions and low buying and selling volumes.

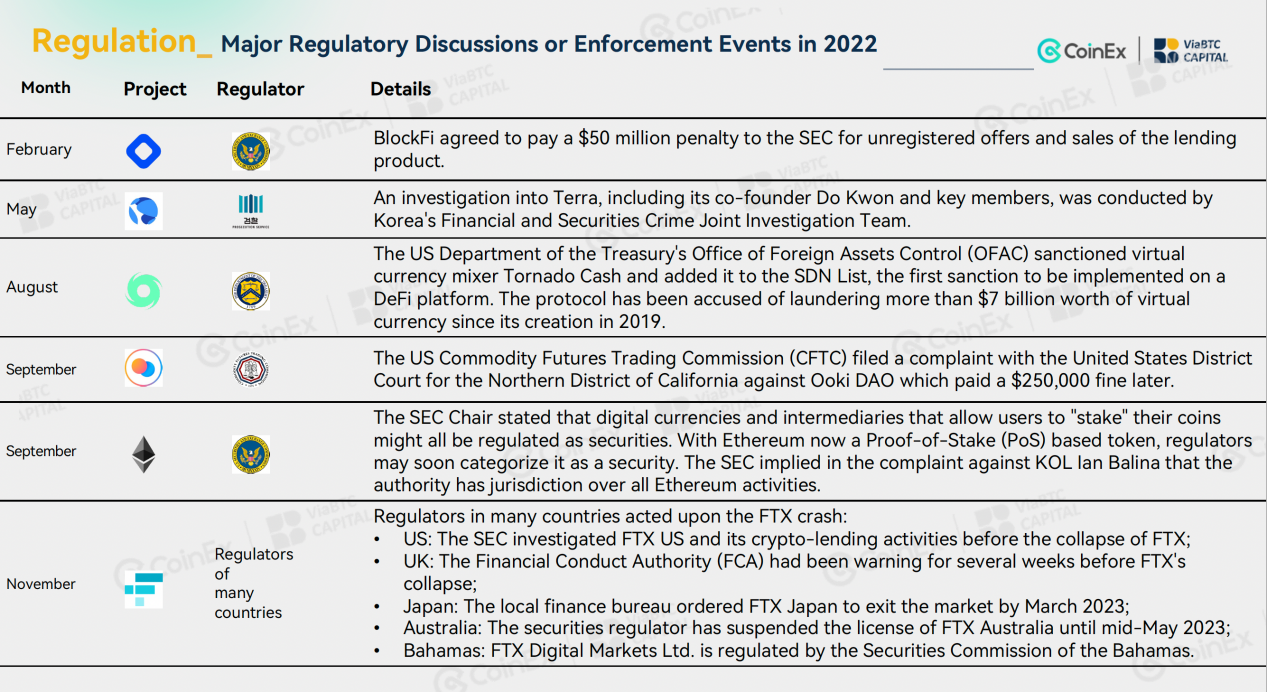

9. Regulatory insurance policies

Typically talking, for the cryptocurrency trade, 2022 was filled with ups and downs, however laws are headed in the suitable path. Over the previous 12 months, regulators within the developed world achieved loads of progress. The USA launched a regulatory framework for cryptocurrencies; the European Union initially authorized the MiCA Act and the TFR Act; the UK and South Korea made progress within the institution of the related organizations; Russia and Hong Kong promoted the dialogue and implementation of insurance policies for cryptocurrency mining and digital asset securities. The turbulence that occurred within the cryptocurrency trade in 2022 was partially the results of the sharp drop in funds and partially the results of regulatory loopholes and crackdowns. Final 12 months, the chapter of Terra and FTX, two prime cryptocurrency tasks, prompted nationwide regulators and legislation enforcement companies to additional improve their cryptocurrency oversight and investigations.

For extra particulars, please go to the ViaBTC Capital web site by way of the hyperlink:

For extra particulars, please go to the ViaBTC Capital web site by way of the hyperlink:

This can be a sponsored put up. Discover ways to attain our viewers here. Learn disclaimer beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link