[ad_1]

The financial challenges going through the eurozone will not be the identical as these going through the US. On stability, nonetheless, they’re much more troublesome.

The eurozone financial system shouldn’t be affected by overheating of home demand to the identical extent because the US. This could make the duty of financial coverage simpler for the European Central Financial institution than for the Federal Reserve. However the provide shock buffeting the eurozone is much greater, with an enormous rise within the worth of vitality, particularly fuel, after Russia’s invasion of Ukraine. That shock is each inflationary and contractionary: inflationary, in that it has raised the value stage sharply; and contractionary, in that it has lowered actual incomes for households and the phrases of commerce for international locations.

Crucially, the eurozone is extra fragile than the US. Its nationwide economies are numerous and cross-border insurance coverage mechanisms comparatively undeveloped. Above all, politics stay nationwide. In consequence, fragmentation is at all times a danger. However, the eurozone does have benefits in dealing with the Covid and vitality shocks in contrast with the monetary crises of a decade in the past. Current shocks have affected members in fairly comparable methods, whereas the worldwide monetary disaster break up the eurozone between domineering collectors and humiliated debtors. This time is certainly completely different.

So, what may the long run maintain? And what, above all, must be carried out?

Begin with financial coverage. Within the 12 months to August 2022, headline shopper worth inflation was 9.1 per cent within the eurozone and eight.3 per cent within the US. However core inflation (with out vitality and meals costs) was solely 4.3 per cent within the eurozone in opposition to 6.3 per cent within the US. Thus, 4.8 proportion factors of eurozone inflation had been as a consequence of will increase in vitality and meals costs, in opposition to 2 proportion factors within the US. Knowledge on labour market information equally point out substantially less overheating than within the US.

This explains why the ECB has tightened later and fewer than the Fed — a 1.25 proportion level rise within the intervention fee, from minus 0.5 per cent, within the former, in opposition to a 3 proportion level rise, from 0.25 per cent within the latter. However, the ECB was proper to start out normalising monetary policy, too, partly as a result of coverage had been so aggressive and partly as a result of it wanted to forestall the value results of the shocks from being embedded in expectations. Its actions had been additionally not untimely: the IMF’s Global Financial Stability Report reveals that the inflation expectations of many market individuals have already shifted upwards to about 4 per cent.

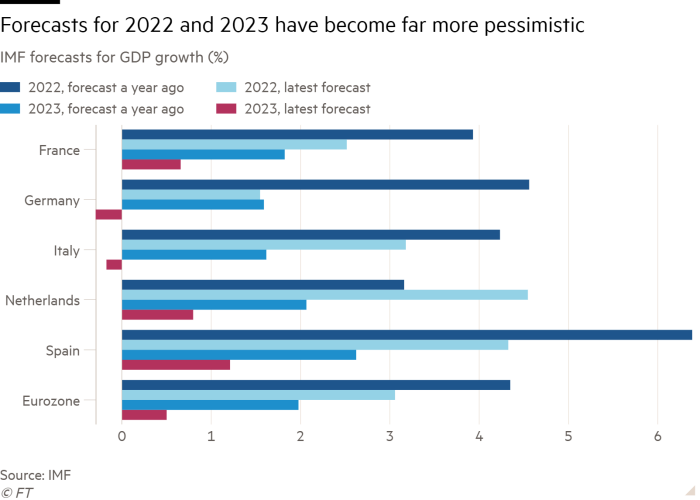

However, the ECB must be cautious about how rapidly and the way far it strikes. One cause for that is that the vitality shock goes to impart a strong recessionary impulse to the financial system. Certainly, recessions are extremely possible within the eurozone. One more reason for warning is the complexity of the transmission mechanisms, as specified by a recent speech by Philip Lane, ECB chief economist. A specific fear is the uncertainty in regards to the lags. It’s fairly doable that headline inflation will probably be falling quick fairly quickly, as a result of fuel costs have been falling. In that case, the principle influence of right this moment’s financial tightening could happen lengthy after inflation expectations have already adjusted downwards. Certainly, it’s doable that “regular” financial coverage for the eurozone stays very unfastened, because it was pre-Covid.

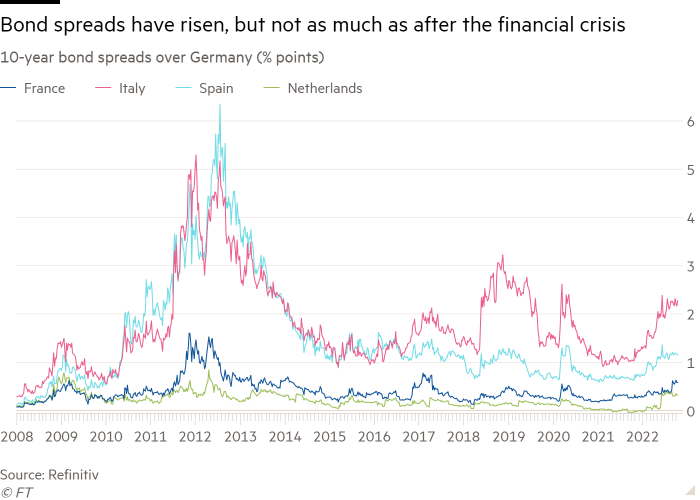

A specific concern is the rising spreads on authorities bonds, which might then be transmitted to debtors in essentially the most susceptible economies. To this point, these spreads are far smaller than through the eurozone disaster. Furthermore, the ECB has a number of instruments — by itself or in co-operation with different establishments, notably the European Stability Mechanism — to take care of fragmentation. These embody asset reinvestment, a brand new “transmission protection instrument” and, if all else fails, the “outright monetary transactions” developed in 2012, after Mario Draghi’s “whatever it takes” speech. Implementing these programmes will, nonetheless, create conceptual, sensible and political difficulties, particularly over the excellence between illiquidity and insolvency. In the end, although, it’s easy: all through these crises, the eurozone has to deal with all members as in the event that they had been in a lot the identical form despite the fact that they aren’t.

Will this work? The perfect reply is that it has to. The survival of the EU and so the eurozone, its financial core, is within the overriding nationwide and collective curiosity of its members. They confront a brutal enemy of their most basic rules within the east and an unpredictable US within the west. The EU should not solely survive, however thrive, if Europe itself is to take action. As has been proven repeatedly since Covid hit, the member international locations perceive this, particularly a very powerful ones. Nevertheless ramshackle and incomplete the constructions of the EU and eurozone could also be, members should maintain everyone collectively via thick and skinny. Proper now it’s going to be the latter.

This implies excess of making certain that the financial regime works for everyone. It additionally means shaping a typical vitality coverage, notably one which accelerates the shift to renewables; serving to member states cushion their residents in opposition to the worst of the vitality shock, agreeing a typical coverage in the direction of Vladimir Putin’s Russia along side Nato, shaping a commerce and financial coverage that manages relations with China, and even transferring in the direction of extra steady relations with the UK.

The compromises wanted to deal with the vitality shock and Ukraine battle will probably be painful. However they have to be made. With out the EU, the member international locations could be misplaced. They know this and can, I’m certain, act upon that information. Out of those crises should emerge a stronger EU, as a result of there isn’t a different.

[ad_2]

Source link