[ad_1]

The World Financial Discussion board in Davos has been the assembly place and cheerleader for international capitalism. However, some would argue, this trigger is useless. Russian oligarchs are absent. Though some Chinese language enterprise leaders are there, their wings are clipped at dwelling and overseas. The worldwide monetary disaster, Covid, resurgent nationalism, deteriorating relations between the US and China, and struggle in Ukraine have reworked the worldwide enterprise setting for the more serious.

Finally, capitalism is international, as a result of alternatives are international. Past nationwide borders lie markets to serve and sources to take advantage of. As we speak’s multinational firms and cross-border flows of products, providers, information, finance, individuals, knowledge and concepts are merchandise of those alternatives. But, whether or not they’re exploited, and by whom, can be decided by the dangers and the constraints.

What has modified are perceptions of threat. Not so way back, each companies and politicians noticed solely the upside. Now in addition they see the draw back. Enterprise sees threat in prolonged provide chains and vulnerability to disruption. Politicians see the dangers of prolonged provide chains, too. But in addition they see threats from hostile powers, lack of their nations’ technological superiority and threats to the livelihoods of vital home constituencies.

Perceptions have, in sum, shifted in the direction of “canine eats canine” from “canine trusts canine”. How far has this shift gone in follow? “Not thus far” is the reply.

A report on Global flows printed final November by the McKinsey International Institute offers wanted illumination. A sign conclusion is that international flows are actually being led by intangibles, providers, and human expertise.

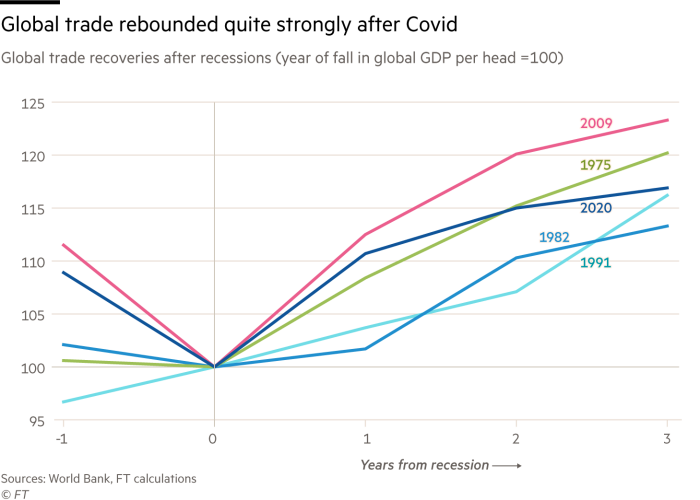

Thus, commerce in items has stabilised relative to world output because the international monetary disaster, after an unlimited rise over the a long time earlier than it. Flows of providers, worldwide college students, and mental property grew about twice as quick as commerce in items in 2010-19. Knowledge flows grew at practically 50 per cent yearly. Crucially, most flows have proved sturdy throughout current disruptions: flows of products recovered fairly strongly after the pandemic (see charts).

Reliance on merchandise produced in only a few locations is widespread. Such focus is, notes McKinsey, a “two-sided” coin. It permits substantial effectivity positive aspects however creates dependency and dangers of great disruption.

Europe’s reliance on Russian fuel has proved a paradigmatic case of a harmful dependency. Lithium, uncommon earths, and graphite are extracted from three or fewer nations and largely refined in China. Probably the most refined laptop chips come from Taiwan.

Total, argues a newer McKinsey report, each area depends on commerce with others for greater than 25 per cent of at the very least one vital sort of fine. For 40 per cent of worldwide commerce, the importing financial system depends on simply three, or fewer, nations for the availability of a given useful resource or item for consumption.

Furthermore, no proof exists of systematic diversification by the most important economies previously 5 years. Lastly, multinationals proceed to account for about two-thirds of worldwide exports.

So, globalisation is changing, rather than dying — and rumours of worldwide capitalism’s demise are exaggerated. Russia is partly out of the image however stays an enormous vitality exporter. The US has maintained the Trump tariffs and imposed an embargo on exports of sure chips to China; it is set on rendering World Trade Organization guidelines ineffective. China insists on being handled as a “creating nation”. Attitudes and practices are shifting in opposition to some features of openness. Will this transformation?

Previous expertise demonstrates the destruction that may be executed by wars and financial disasters. Globalised capitalism virtually disappeared between 1914 and 1945. If one assumes away comparable follies, financial alternative will certainly proceed to information what occurs.

Sure, there will likely be a level of decoupling of commerce and funding between China and the west, notably in strategically delicate applied sciences. Nevertheless, decoupling seems unlikely and silly — not simply economically, however politically.

Once more, some diversification of provide is wise for nations and firms. However, past a sure level, it turns into extraordinarily pricey. Reliance on a number of suppliers at dwelling or in close by nations may itself show dangerous. Additionally it is unimaginable to stockpile sufficient to fulfill each conceivable emergency. In most circumstance, a versatile international financial system goes to be a much better safeguard.

Commerce can not sensibly be restricted to 1’s personal area or to 1’s “associates”. For the US and Europe, the previous would imply not solely foregoing buying and selling alternatives with the strategically and economically essential Asian area, however abandoning it to China. Forcing Asian nations to decide on between China and the west can be equally counterproductive. Once more, who’re our “associates”? Friendships change. Not so way back, Vietnam was an enemy.

FT at Davos

Tune in to the Davos Day by day Present, hosted by Andrew Hill at 12:00 GMT 17-19 January. Register here at no cost and for FT Dwell occasions from the World Financial Discussion board

The largest questions are whether or not a mutually passable modus vivendi will be reached with China and the way far the protectionist thrust of politics will be contained within the US.

Unquestionably, substantial reform of how international capitalism works is required. Among the many greatest points is tackling the defects of worldwide finance. Recognition is required, too, of the upheaval that will likely be caused by the dynamic new types of digital globalisation, notably our wild web.

Capitalism could also be turning into considerably much less international. However an internationally open capitalism stays the muse of future prosperity. It must be reformed. It should not be deserted, because it was within the early twentieth century.

[ad_2]

Source link