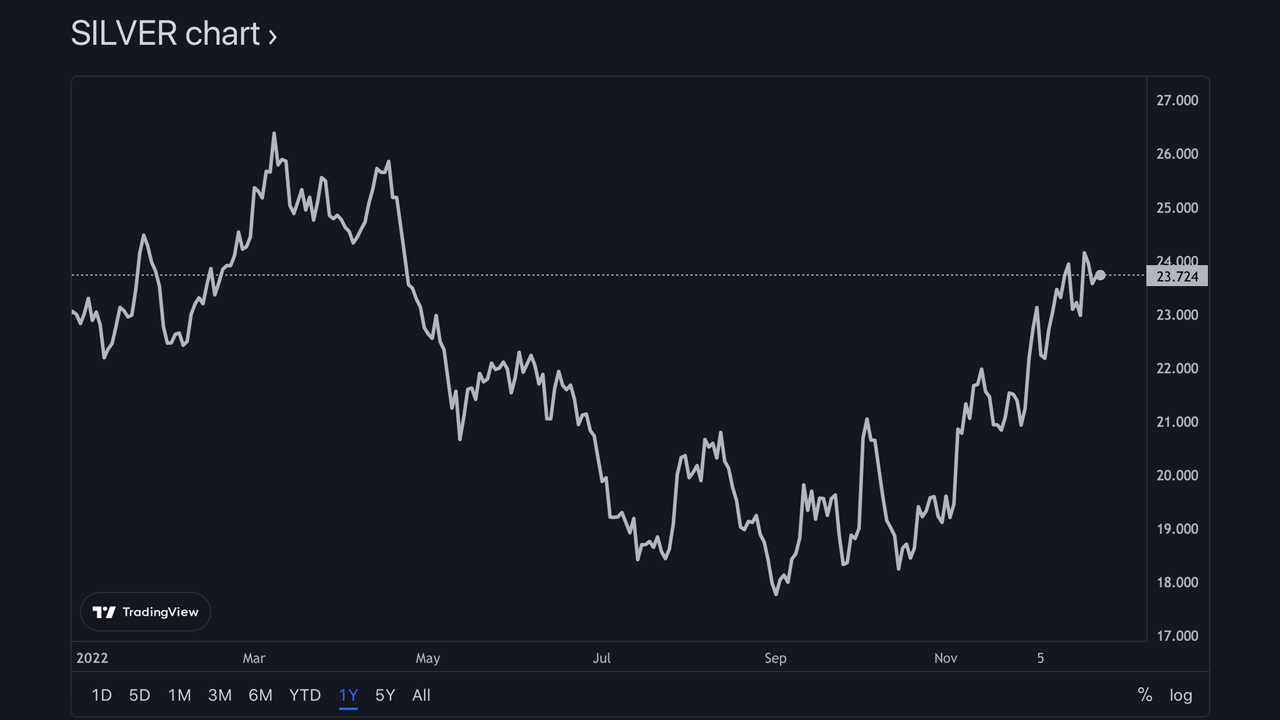

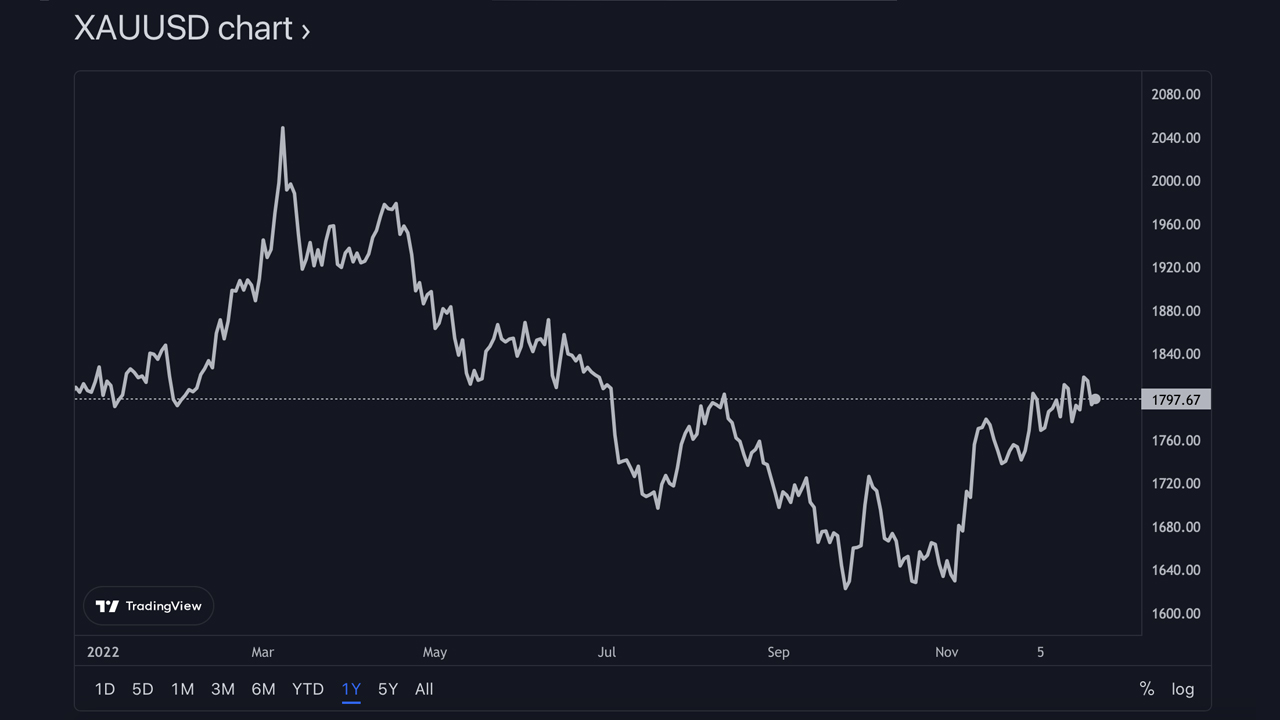

Gold costs are ending the 12 months a hair under the values recorded 12 months in the past. Statistics on Dec. 26, 2021, present the U.S. greenback worth per ounce of gold was $1,810 per unit, and as we speak gold is $1,797 per ounce. Silver, then again, managed to extend a hair in worth since final 12 months, as costs climbed from $23.04 per unit to the present USD worth of round $23.72 on Dec. 26, 2022.

Gold Dropped a Hair Through the Final 12 months, Whereas Silver Rose a Contact — Treasured Steel Belongings Managed to Maintain Worth All 12 months Lengthy Regardless of the Macroeconomic Calamity and Power Disaster

Whereas valuable metals like gold and silver fluctuated in U.S. greenback worth over the last 12 months, gold and silver year-to-date worth statistics present costs are just about the identical as final 12 months. Gold is down a contact over the last 12 months because it was buying and selling for $1,810 per ounce and as we speak it’s buying and selling 0.71% decrease at $1,797 per ounce. Silver was $23.04 per ounce and as we speak it’s 2.95% increased in worth at $23.72 an oz.

2022 was an fascinating 12 months for gold as the dear metallic reached a lifetime worth excessive on March 8, 2022, as one ounce of gold reached $2,070 per unit. Whereas silver tapped a excessive on the identical day, the metallic nonetheless has a protracted approach to go earlier than catching as much as the $40 an oz vary reached in 2011. Silver got here awfully near surpassing the $27 per unit vary on March 8, 2022.

Each valuable metals did so much higher than the highest two cryptocurrencies bitcoin (BTC) and ethereum (ETH). Metrics present BTC is down 66% since this time final 12 months, and ETH has misplaced a contact greater than 70% since final 12 months. Like cryptocurrency followers, valuable metals advocates assume 2023 will see a bullish revival when it comes to silver and gold rising in worth. Kitco Information contributor Phillip Streible shared his predictions for the 2 valuable metals on Dec. 23.

“By year-end [2023], inflation ought to decline to 3-3.5%, resulting in gold costs averaging $1,950/oz with extensions up over $2,000 at totally different durations,” Streible mentioned. “We must always see the two’s vs. 10’s yield curve flatten whereas Silver might simply see ‘inexperienced shoots’ up into the mid-high $ ’30s, settling again to $28 by year-end.”

Like cryptocurrencies and fairness markets, gold and silver have been affected by the macroeconomic storm and occasions like Covid-19, the Ukraine/Russia battle, and the results of increasing the world’s cash provide like no different time in historical past. The U.S. Federal Reserve has elevated the federal funds charge six occasions to date so as to fight America’s highest inflation charges in over 40 years.

The gold bug and economist Peter Schiff believes gold and silver will do properly in 2023 as properly however he’s not as optimistic in regards to the inflation charge as Streible. Speaking with Kitco Information anchor David Lin, Schiff mentioned there’s an opportunity it might drop however he expects the U.S. inflation charge to leap above 10%.

“We’re not getting anyplace close to 2 p.c [inflation],” Schiff remarked. “Perhaps we’ll go under 7 p.c earlier than we go above 10 p.c, however I feel we’re going to take out the highs from 2022 earlier than the top of 2023 on a year-over-year foundation,” the economist added.

What do you consider gold’s and silver’s market performances in 2022? What do you consider Phillip Streible’s and Peter Schiff’s opinions about inflation and valuable metallic costs? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.