[ad_1]

Visa, the monetary providers company headquartered in San Francisco, California, revealed a weblog put up that talks about leveraging ethereum and the layer two (L2) scaling answer Starknet so folks with self-custodial wallets will pay their payments. The weblog put up notes that whereas Ethereum doesnt assist account abstraction or delegable accounts, the monetary providers firm carried out a delegable accounts answer on Starknet, the L2 blockchain community.

Visa Develops Account Abstraction Utilizing the L2 Ethereum Scaling Resolution Starknet, Funds Firm Envisions a Future With Programmable Cash

On Dec. 19, 2022, Visa’s Crypto Thought Management weblog revealed a post written by Andrew Beams, Catherine Gu, Srini Raghuraman, Mohsen Minaei, and Ranjit Kumaresan. Visa’s topic temporary is about “auto funds for self-custodial wallets,” and Visa exhibits that it’s attainable to leverage Ethereum to execute auto-payments from a self-custodial pockets answer. Nonetheless, the idea makes use of account abstraction, a characteristic that Ethereum core builders are at present debating.

“Account abstraction (AA) is a proposal that makes an attempt to mix consumer accounts and sensible contracts into only one Ethereum account sort by making consumer accounts operate like sensible contracts,” the Visa weblog put up particulars.

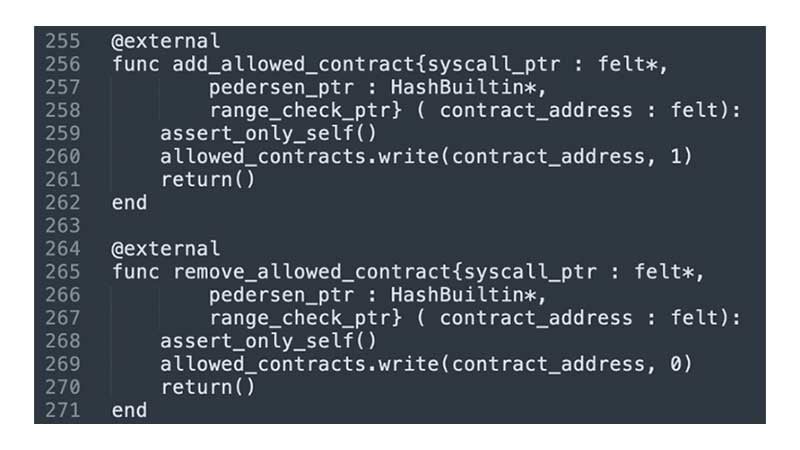

With a purpose to bypass the problem that AA is at present not possible utilizing Ethereum’s layer one (L1), Visa crypto researchers have summarized how they’ll accomplish auto funds for self-custodial wallets with AA by way of the L2 scaling answer Starknet. “With Starknet’s account mannequin, we had been capable of implement our delegable accounts answer thus enabling auto funds for self-custodial wallets,” Visa defined. The corporate’s weblog put up provides:

We see auto funds as a core performance that present blockchain infrastructure lacks.

The Visa weblog put up on the topic initially stems from a analysis paper that was revealed in Aug. 2022. The information follows Visa filing trademark applications on the finish of Oct. 2022 and the logos lined a broad vary of crypto merchandise together with a pockets. Being one of many world’s largest fee networks, Visa mentioned the agency desires to assist “earn cash and funds programmable.”

Along with Visa, the second-largest payment-processing company worldwide and Visa’s competitor, Mastercard, can be working to make cryptocurrency options extra accessible. Throughout the first week of Nov. 2022, Mastercard said: “We’re welcoming a brand new cohort of startups to ease entry to digital property, construct communities for creators and empower folks to innovate for the long run by Web3 applied sciences.”

Visa’s statements are akin to the identical concepts and the auto-payments from a self-custodial pockets answer might present a myriad of ideas. “We shared a novel answer that leverages the idea of account abstraction to offer self-custodial wallets with automated recurring funds functionality,” Visa’s weblog put up concludes. “Utilizing the strategy we now have launched, different real-world purposes past recurring funds may very well be dropped at the blockchain.”

What do you concentrate on Visa’s auto funds for self-custodial wallets idea utilizing Starknet? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial photograph credit score: Tony Inventory / Shutterstock.com

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link