[ad_1]

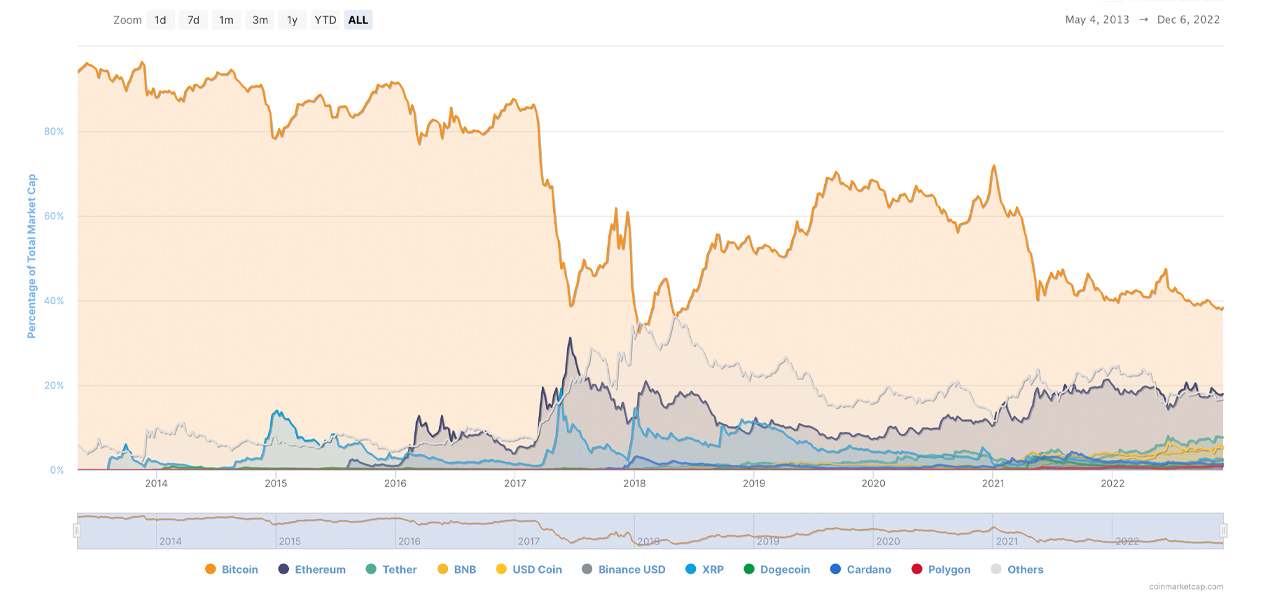

During the last 100 days or roughly three months, bitcoin’s market dominance amongst 21,958 completely different crypto belongings price roughly $850 billion has been underneath 40%. Bitcoin dominance has been underneath 40% since Aug. 27, 2022, with a short occasion of rising above the 40% vary 52 days in the past, on Oct. 15.

Bitcoin’s Market Superiority Misplaced 41% in 35 Months

Bitcoin’s market capitalization has been above the $325 billion area since Nov. 29, 2022. On the time of writing, bitcoin’s (BTC) general market valuation is round $328 billion, which represents round 38.3% of the crypto economic system’s total $856,947,917,107 market cap.

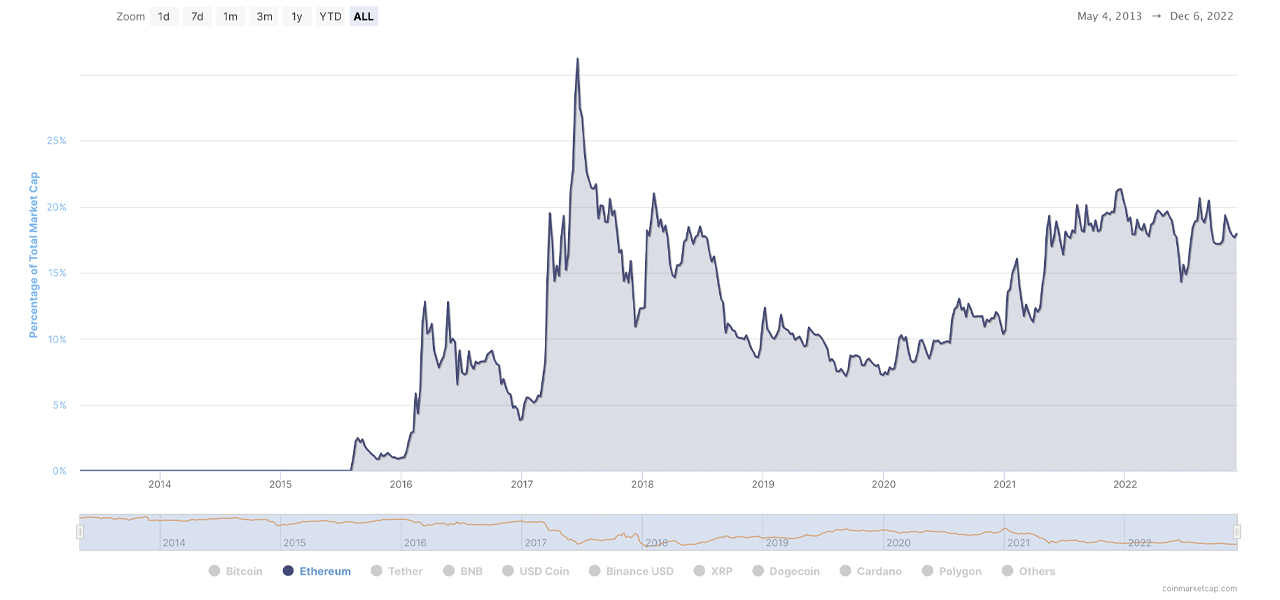

The second main crypto asset, ethereum (ETH), then again, has a market cap right now of round $155.38 billion or 18.1% of the mixture $856 billion. Within the early days, BTC’s market supremacy was above the 90% area from when it first gained worth in 2010, all the best way up till the second week of Nov. 2014.

Crypto market dominance, among the many 1000’s of digital asset market capitalizations, refers back to the relative dimension of the coin’s capitalization in comparison with the general market capitalization of all the crypto economic system. After mid-Nov. 2014, BTC’s market dominance slid under the 90% area however remained above the 80% vary all the best way till the primary week of March 2017.

Basically, throughout these early days, BTC’s market superiority was 90% for 61 months and after Nov. 2014, it was above 80% for 33 months. Nonetheless, there have been a short few cases in Jan. 2015, March 2016, Might 2016, and Sept. 2016, that noticed BTC’s market dominance drop under the 80% area.

Bitcoin dominance has been decrease than 80% for 68 months thus far, and it’s been struggling to carry the 40% vary in more moderen occasions. On Might 15, 2021, and up till Aug. 27, 2022, BTC’s market supremacy when it comes to capitalization had been above the 40% vary which was round 15 months.

Ethereum, Tether, and Dogecoin Market Dominance Ranges Rise

Right this moment, it’s been greater than a strong three months of BTC dominance under the 40% vary and dominance has not been this low since Might 2018. From a logarithmic perspective, ethereum’s (ETH) market dominance, amongst all the opposite digital belongings, has proven a big rise since Jan. 2020.

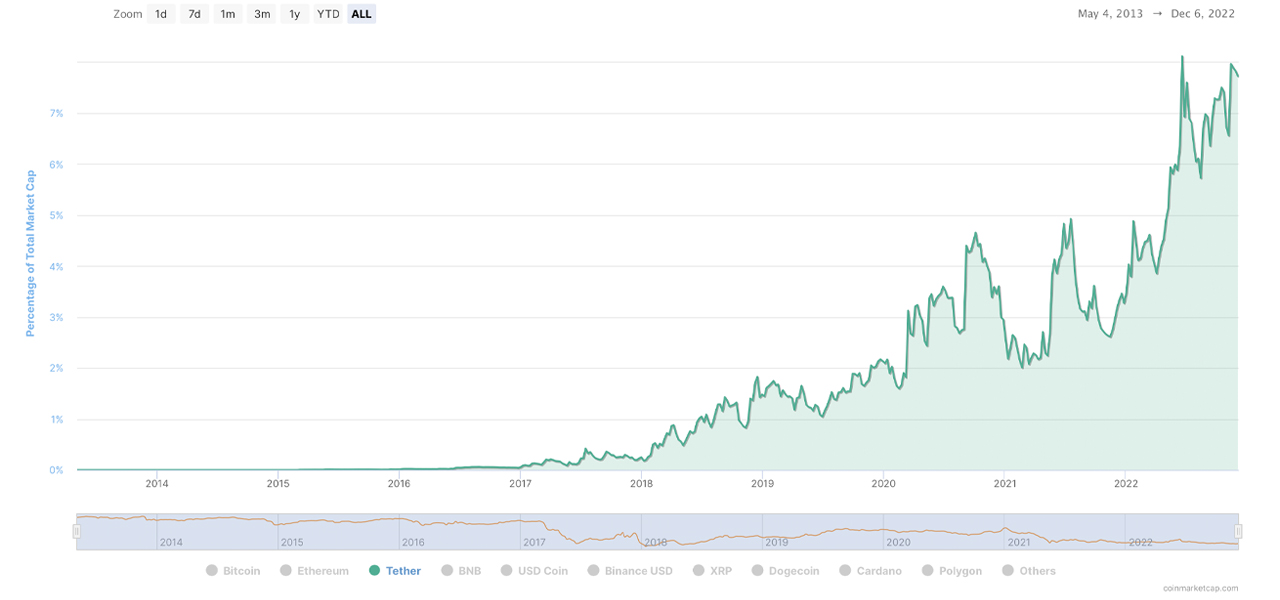

ETH dominance elevated 130.86% since Jan. 2020, whereas BTC dominance step by step slid 41.96% in that time-frame. From January 2020 till right now or roughly 35 months, tether’s (USDT) market dominance jumped 285%, compared to the mixture worth of greater than 20,000 listed crypto belongings.

BNB noticed its market dominance develop by 440% over the past 35 months and usd coin’s (USDC) dominance jumped by 2,500%. Like bitcoin (BTC), xrp’s (XRP) market supremacy has dropped over the past 35 months, sliding 47% since January 2020.

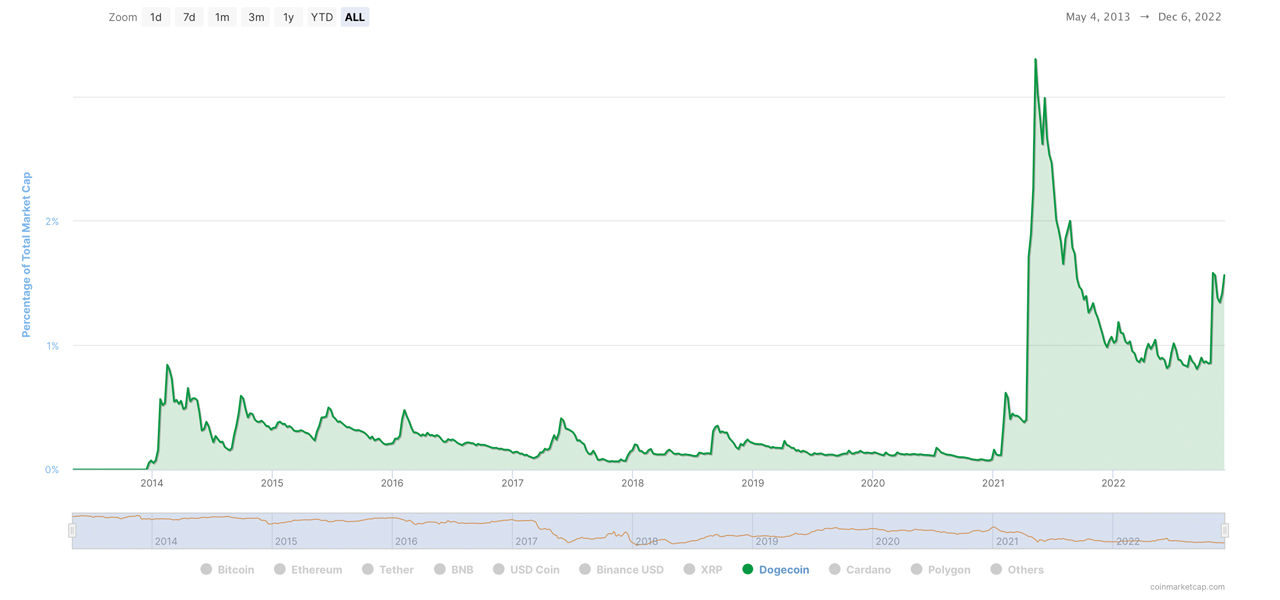

Out of the highest ten digital belongings when it comes to market valuations, BTC’s and XRP’s dominance ranges have seen the worst declines. The meme token dogecoin’s (DOGE) dominance degree, then again, jumped 1,100% greater throughout the previous 35 months.

There’s an excessive amount of individuals who don’t put a lot worth into market capitalization and dominance information in the case of digital currencies. As an illustration, a bitcoin maximalist would say that BTC’s market cap is all that issues, and others might say {that a} meme coin like DOGE shouldn’t be in comparison with blockchains that weren’t meant to be a joke.

Nonetheless, many crypto supporters do imagine market dominance ranges provide significant information. Bitcoin and ethereum, for example, may be seen in opposition to their opponents as having excessive market superiority ranges, which might have a big affect available on the market. As a rule, when BTC’s and ETH’s costs go up or down, various crypto belongings observe the dominant crypto’s market patterns.

What do you concentrate on bitcoin’s dominance ranges among the many 1000’s of market capitalizations? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link