This text is an on-site model of our Commerce Secrets and techniques publication. Join here to get the publication despatched straight to your inbox each Monday

Welcome to Commerce Secrets and techniques. So far as I can inform, the big Macron-Biden love-in final week boiled all the way down to Biden saying “Congress had no concept what they have been doing with these electrical car subsidies, sorry about that, we’ll punch some holes within the regulation” and Macron saying “Très gentil, however we’d higher begin splurging on our personal inexperienced handouts simply in case”. Then lots of smiles, something about baguettes, and the EV subsidies race is off, if the Europeans can afford it. It’s set to be Airbus-Boeing, however with out the litigation. They might do worse, to be truthful, however they could also do a lot better.

In the meantime, the transatlantic Trade and Technology Council meets in Washington in the present day, nevertheless it isn’t the principle discussion board to deal with the EV concern, confirming the TTC’s rising status as a spot for talking about the non-contentious stuff. EU inside markets commissioner Thierry Breton, who was significantly put out at not becoming a member of the primary TTC in Pittsburgh in September 2021, isn’t bothering to attend this one.

Right now we take a look at two different features of EV subsidies: the roles of the opposite huge aggrieved international locations, Japan and Korea, and the inconvenient details about who really makes the autos. (China.) Charted waters seems to be on the elements affecting meals inflation.

Get in contact. E-mail me at alan.beattie@ft.com

Tokyo and Seoul strive placing on the brakes

Individuals (together with me, apologies) usually give the impression that the one antagonist within the US automobile subsidies row is the EU. However what of the opposite two most important complainants, Japan and Korea? Neither nation is completely happy, however they appear to be following considerably contrasting techniques.

Japan’s signalled its concern however is taking issues slowly and isn’t going to hurry into World Commerce Group litigation — a warning usually shared by the EU regardless of the occasional burst of feisty rhetoric from Brussels. A Japanese official says: “At this cut-off date we have to specific our views and hopefully have interaction in bilateral dialogue.” Like Brussels, Tokyo is concentrating on influencing the implementation of the Inflation Discount Act. Specifically, it will like extra time for US-based Japanese factories (Toyota has a plant in West Virginia, Senator Joe Manchin’s state, and a battery manufacturing unit in North Carolina) to increase and amend their provide chains sufficient to have the ability to profit from the tax credit score.

Korea has been making way more confrontational noises, explicitly mentioning a WTO case, most probably as a result of its extra febrile home political state of affairs calls for an aggressive response. It’s obtained the identical timing concern as Japan: the Korean carmaker Hyundai’s investments in the US are a way off beginning to churn out EVs, making it unlikely that they may adapt by the point the IRA tax credit score is carried out. Raphael Warnock, the Georgia senator whose state homes Hyundai, has introduced a bill to delay the credit score till international carmakers have had time to regulate. With out one thing like that, we’d properly see a litigation ingredient being thrown into the IRA affray from Seoul. Received’t that be enjoyable?

Don’t neglect who really makes EVs

It’s really barely surreal that we’re all specializing in the Europe-US argy-bargy over EVs, final 12 months’s enjoyably bonkers Norway-phobic Will Ferrell Super Bowl advertisement for GM’s EVs being the definitive instance of the style.

The true power in electric vehicle manufacture is China, which aggressively constructed up its home market and manufacturing capability early on. By no means thoughts a number of local-content sweeties thrown into the IRA which may make not a lot distinction anyway, Beijing has used significantly aggressive funding and commerce incentives to get international firms to arrange there, together with expertise switch. Overseas firms appear to have made the calculation that they’re going to have their expertise copied or stolen anyway, so greatest commerce it for some Chinese language market share.

As these putting charts from the think-tank Merics present, conventional European inside combustion (IC) automobile exports to China, one of many causes the German company institution clung to the Wandel durch Handel phantasm for thus lengthy, are giving approach to EV imports coming the opposite method. Half the Chinese language exports to the EU are Tesla and the remaining additionally overwhelmingly non-Chinese language manufacturers, together with BMW and Renault.

Ought to European governments have used extra Chinese language-type intervention techniques? Maybe, however higher to do it by growing consumption incentives early on to increase the home market than fiddling round with commerce restrictions. It’s one other huge failure of the German political-industrial complicated that they clung to IC engines within the European market reasonably than seeing the technological transformation shifting underneath their ft.

In addition to this text, I write a Commerce Secrets and techniques column for FT.com each Thursday. Click on right here to learn the newest, and go to ft.com/trade-secrets to see all my columns and former newsletters too.

Charted waters

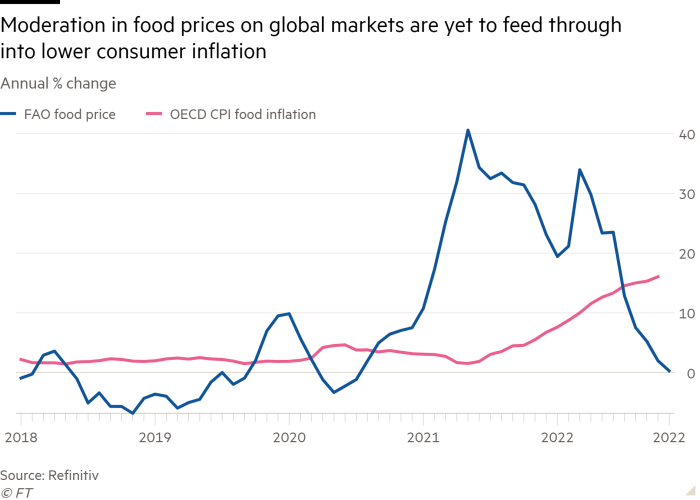

Right here is a few excellent news: wholesale meals costs have stabilised over current months. So does this imply some reduction for households from excessive inflation in fundamentals components resembling rice, milk and bread? Sadly not, because the chart beneath exhibits.

The issue, in response to this very good analysis by Monetary Occasions colleagues, had been two of the 4 horsemen of the apocalypse: warfare (in Ukraine) and famine (from poor harvests blamed on local weather change).

We are actually within the third 12 months of the La Niña weather phenomenon — the reason for extreme droughts within the US, Argentina and Europe — have hit farmers, curbing their capability to extend output. Add to this the Ukraine battle, which has raised the price of vitality for meals manufacturing, and value rises usually are not anticipated to wane for some time but. (Jonathan Moules)

Commerce hyperlinks

Chinese language commerce knowledge released this Wednesday will give us some clues concerning the state of the world economic system.

Individuals casting round for precise makes use of for blockchain expertise have usually alighted on digitising commerce paperwork, and significantly a platform developed collectively by IBM and the transport large Maersk. Sadly it didn’t get the shoppers it wanted and has been canned.

The German Bundestag final week formally ratified the EU-Canada trade deal, Ceta, which appeared all very contentious and necessary when it was signed and provisionally went into power six years in the past. Now it seems a reasonably quaint dialogue from a bygone age.

An extended-running US investigation discovered China was circumventing tariffs on photo voltaic panels by routing them through international locations in south-east Asia, a discovering that got here as a shock to actually nobody.

Commerce Secrets and techniques is edited by Jonathan Moules