Over the past seven days, bitcoin’s worth has remained above the $16K area following the aftermath of FTX’s collapse. Since then, a lot of ‘sleeping bitcoins’ that sat idle for 5 to 9 years have been transferring over the past 4 days. Bitcoins that had been price far much less again then are being transferred for the primary time in years.

$20M Value of Previous Bitcoins Transfer After Sitting Dormant for Years

Bitcoin’s (BTC) worth has remained regular over the past seven days, ranging between $16,150 to $16,995 per unit, and a short leap over the $17K zone. Over the past 4 days, whereas BTC costs are a lot decrease than they had been at the beginning of November, a whole bunch of previous bitcoins have been on the transfer.

For example, two homeowners spent 348 bitcoin on Nov. 29, 2022, and the stash was as soon as price $348,000. We will’t actually inform whether or not or not the transferred cash had been offered, however they had been spent from addresses created virtually six years in the past. Heuristics additionally point out that out of the 348 bitcoin that sat dormant since March 2017, 299 of that BTC doubtless belonged to the identical proprietor.

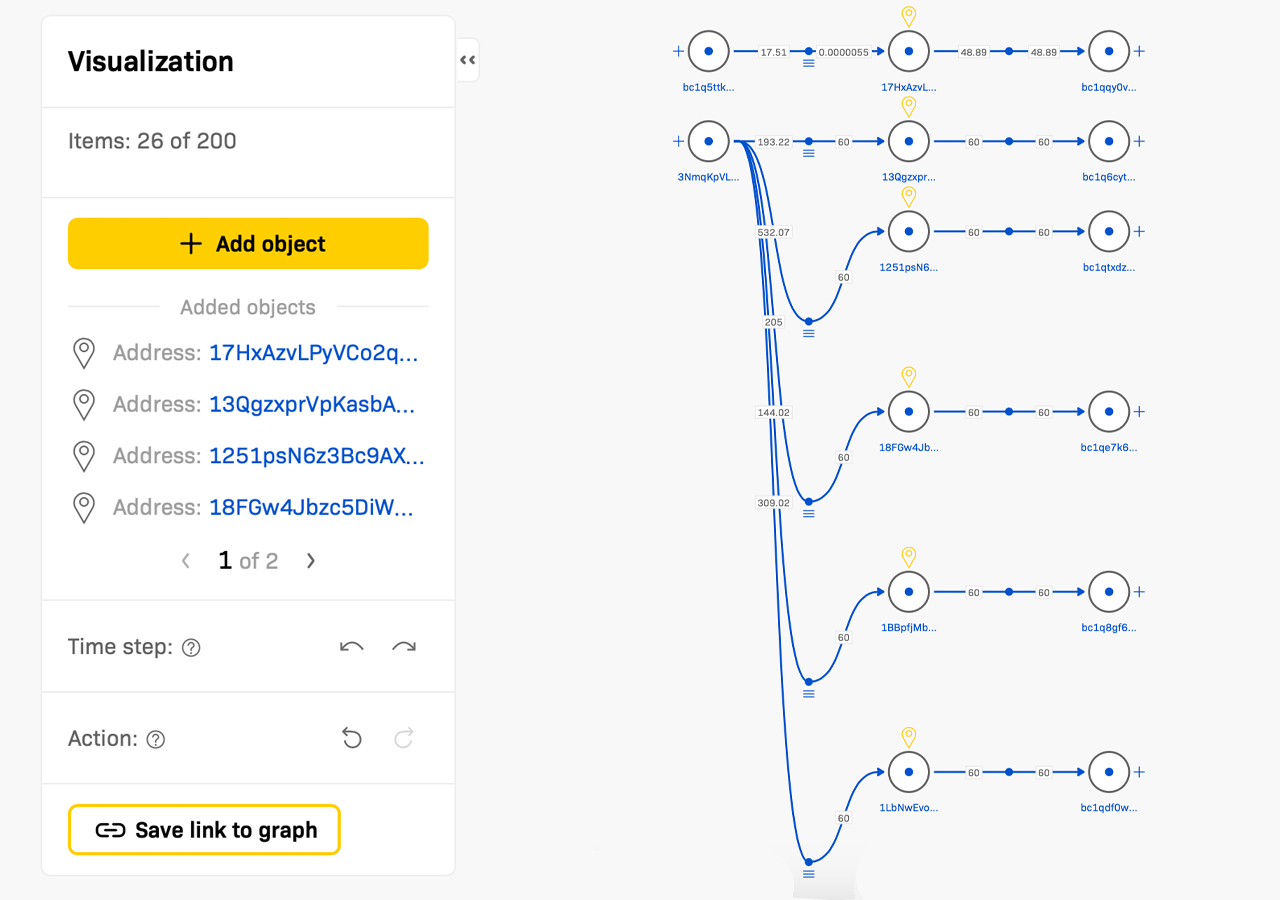

The 348 BTC is price roughly 5.8 million nominal U.S. {dollars} utilizing present BTC change charges. One proprietor managed “17HxA,” an tackle created on March 29, 2017, and it spent 48.88 BTC at block top 765,168. Coincidently, 5 extra transactions, from addresses created on the finish of March 2017, spent 59.99 BTC in every transaction at block heights 765,169, 765,184, 765,185, 765,187, and 765,190.

On the identical day, blockchain parsers from btcparser.com caught a 173.61 BTC spend from an idle tackle created on June 14, 2017, and one other 100 BTC spend from an address created on April 12, 2014. The 100 bitcoin sat in an tackle idle for near 9 years, and on the time, every BTC was price lower than $500 per unit.

Following these previous spends, a transaction from an tackle first seen shut to 10 years in the past, on April 26, 2013, beat all of the spends transacted on Nov. 29, 2022. The transaction occurred on Dec. 2, 2022, and the pockets “1EaAv” spent 600 so-called ‘sleeping bitcoins.’ The 600 BTC was price round $84,000 on April 26, 2013, and as we speak the cash that had been spent at block top 765,644, are price roughly $10.14 million utilizing present BTC change charges.

Information reveals that out of all of the bitcoins spent since Nov. 29, which slept for roughly 5 to 9 years, all of them mixed had been price lower than $800K in worth on the time the unique addresses had been created. Utilizing change charges as we speak, the 1,221.45 BTC that stemmed from ‘sleeping bitcoin’ addresses equates to round $20 million. Previous holders are transferring bitcoins that sat dormant for 5 to 9 years, whereas present bitcoin costs are on the lowest values in two years.

What do you concentrate on the so-called ‘sleeping bitcoin’ addresses which have spent roughly $20 million in bitcoin throughout the previous couple of days? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss induced or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.