[ad_1]

The power disaster triggered by Russia’s invasion of Ukraine, together with excessive inflation and rising rates of interest, sparked issues of an financial downturn within the eurozone this winter. However Toni Ruiz, chief govt of Spanish vogue retailer Mango, stated gross sales have been proving the pessimists flawed.

“After months, years of Covid, folks wished fairly, elegant outfits,” Ruiz informed the Monetary Instances. “Folks have been uninterested in primary garments. So what we’ve seen is a gigantic take-off.”

Throughout the area, sentiment has rebounded. Low unemployment, larger fiscal assist from governments, a drop in power costs from their peak in August and a gentle autumn that has helped hold fuel storage services, stuffed over the summer time, near capability have all improved the outlook.

António Simões, head of Europe enterprise at Spain’s largest lender Santander, informed a convention this week: “I’m involved like everybody else, however extra with a view of the glass half-full.”

Even in Germany, the place producers have been hit exhausting by hovering power prices brought on by diminished provides from Russia, there are indicators of a cautiously extra upbeat temper amongst companies.

“Manufacturing in most industrial and providers sectors has held up very nicely regardless of the power worth shock,” stated Klaus Deutsch, head of analysis, financial and industrial coverage at Germany’s BDI enterprise affiliation. “There’s an enormous backlog of orders so there may be nonetheless some work to do even when demand falls.”

The BDI informed the Monetary Instances it had been “too gloomy” and was probably in January to boost its forecast from September for the German economic system to develop 0.9 per cent this yr. The Ifo Institute’s index of German enterprise confidence bounced from 84.5 in October to 86.3 in November, whereas the Munich-based think-tank additionally discovered three-quarters of firms that use fuel in manufacturing had diminished their consumption with out chopping output.

Most economists nonetheless count on the eurozone to slip into a gentle recession — outlined as two consecutive quarters of falling output — and central bankers are warning they should increase borrowing prices once more in December.

But, after resilient third-quarter growth of 0.2 per cent within the 19-country bloc, there are indicators many might have overestimated the drag on shopper spending and industrial output from excessive inflation and underestimated the enhance from lifting Covid-19 restrictions.

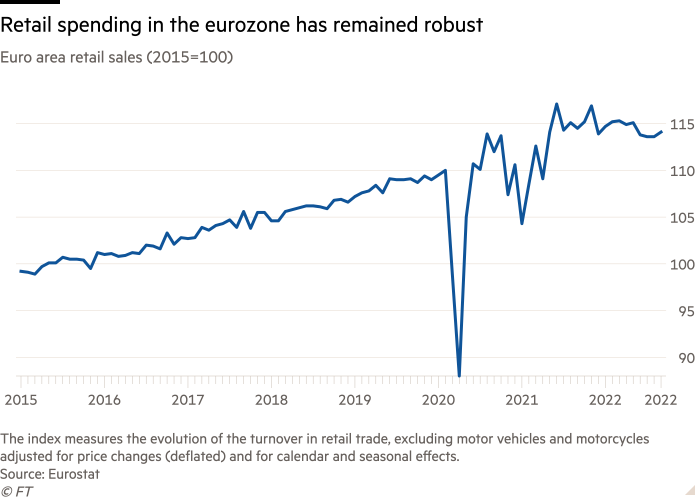

Retail spending rose 0.4 per cent within the eurozone and wider EU between August and September, whereas industrial manufacturing was up 0.9 per cent in the identical interval, taking each measures additional above pre-pandemic ranges.

The EU’s month-to-month survey of firms and households, published on Tuesday, confirmed financial sentiment had risen greater than anticipated to a three-month excessive. Client confidence throughout the EU rose as folks turned extra prepared to make huge purchases, whereas providers firms anticipated larger demand and industrial teams grew extra upbeat on manufacturing expectations.

Members of Germany’s Dax index of blue-chip firms are on monitor to pay report dividends subsequent spring, in response to analysis revealed by enterprise newspaper Handelsblatt on Tuesday.

The eurozone’s industrial powerhouse has not emerged from Russia’s invasion of Ukraine unscathed. Output has fallen in energy-intensive sectors which might be notably uncovered to larger fuel and energy costs, similar to chemical substances, paper and glass. However these sectors solely account for 4 per cent of Germany’s financial output and lots of firms have been in a position to offset the blow with larger costs.

Eurozone inflation, which hit a report excessive of 10.6 per cent within the yr to October, is ready to stay a bane for companies and shoppers.

Though Mango’s uncooked materials prices had fallen not too long ago, Ruiz stated he anticipated inflation to stay an issue for the style chain for 2 or three extra years, noting it was experiencing sharp rises in workers, lease and electrical energy prices at its 1,700 shops throughout Europe.

An govt at one massive German group warned households nonetheless had not seen the complete affect of the surge in power prices. He famous that it might take till March 2023 for merchandise that have been produced in September, when power prices have been nonetheless near report highs, to be purchased by prospects.

However even on inflation there was some excellent news. Spain and Germany reported decrease figures on Tuesday, indicating shopper worth development might have peaked within the eurozone after rising for 16 straight months.

In France, worries about power costs, exacerbated throughout a gas crunch in October when refinery staff went on strike, have lifted barely. Enterprise leaders turned extra upbeat concerning the outlook for the primary time since July, in response to a survey of greater than 600 firm chiefs revealed this week by CCI France, the nation’s chamber of commerce federation.

Wholesome order books within the development sector and throughout different industries, coupled with easing bottlenecks in some provide chains for elements and dropping uncooked materials prices for inputs similar to metal, had fuelled the turnround, CCI France discovered.

Italy’s industrial commerce affiliation Confindustria stated output had held up nicely in manufacturing and providers, though the development sector had floor to a halt. However a few of the affiliation’s gloom had merely been postponed till subsequent yr. A slowdown induced by “larger rates of interest and decrease liquidity attributable to larger utility payments” was probably for 2023.

Others agreed that subsequent winter was set to be robust. “We’re seeing indications of gradual enchancment,” stated Rolf Hellermann, head of finance at German writer Bertelsmann. “[But] fuel provide in Germany and the build-up of storage would possibly show to be tougher [next year] than in 2022, given a lot decrease inflows from Russia.”

Extra reporting by Patricia Nilsson, Sarah White and Silvia Sciorilli Borrelli

[ad_2]

Source link