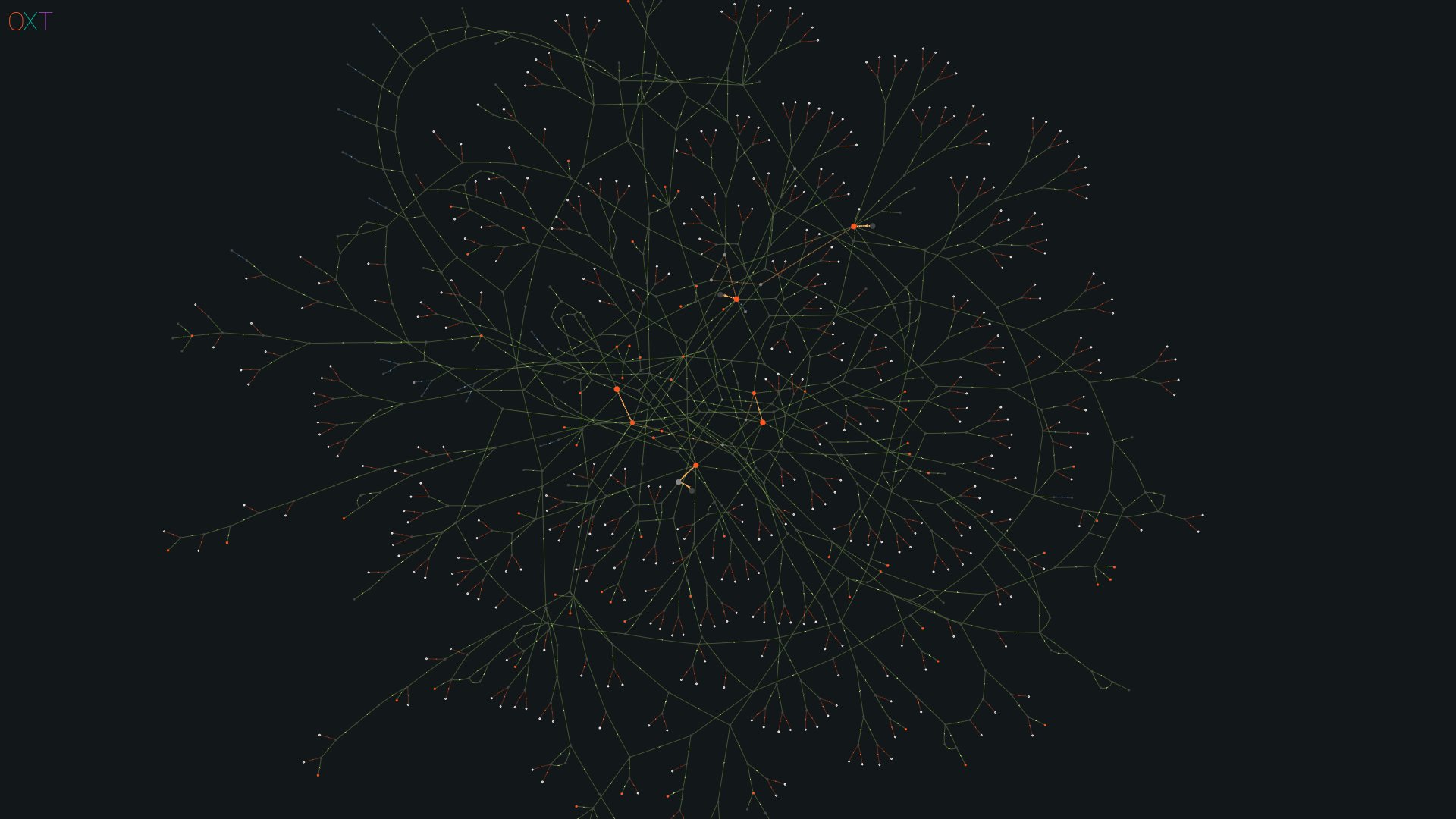

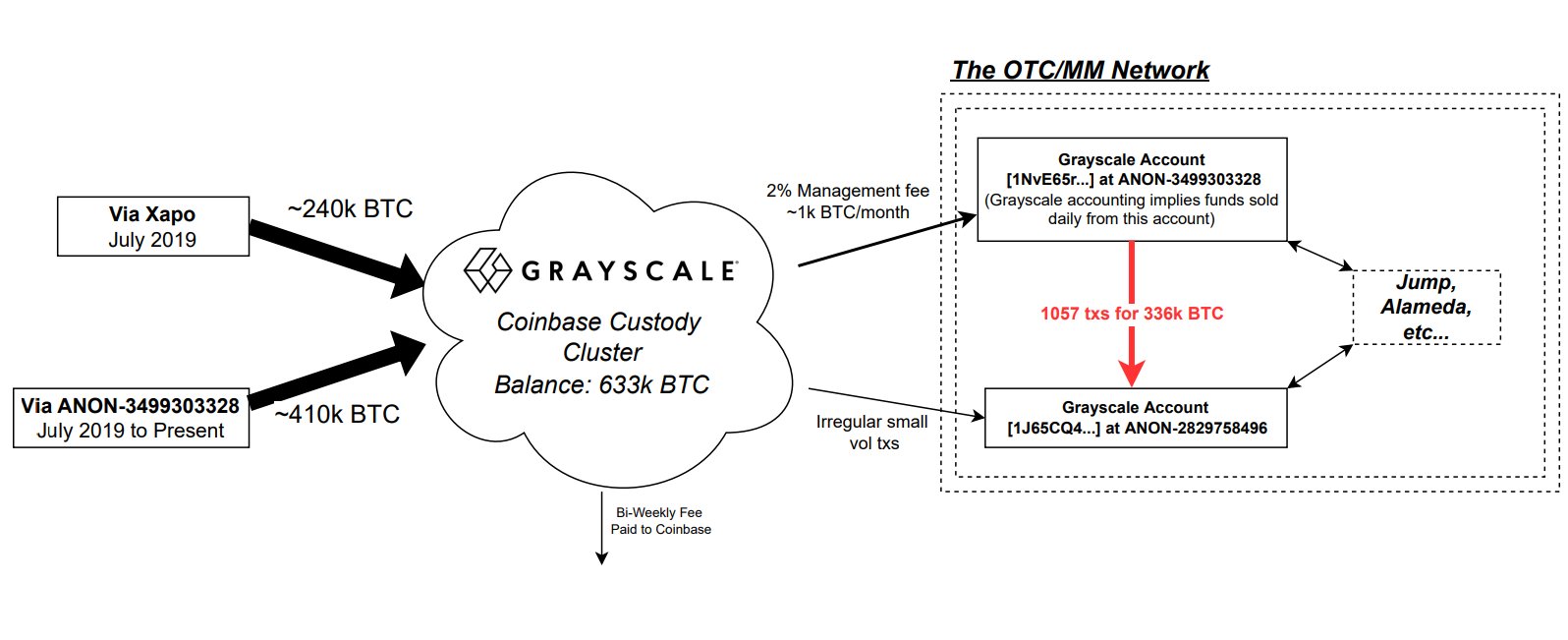

After Grayscale Investments shared data in regards to the firm’s product holdings, folks questioned why the agency wouldn’t share the general public addresses related to the crypto belongings it holds. Nevertheless, on Nov. 23, OXT researcher Ergo printed a Twitter thread that includes onchain forensics that verify Coinbase Custody holds a stability of 633K bitcoin that seemingly belongs to the Grayscale Bitcoin Belief (GBTC).

OXT Researcher Verifies Grayscale’s Bitcoin Holdings

5 days in the past, Bitcoin.com Information reported on Grayscale disclosing data tied to the protection and safety of the corporate’s digital belongings. Grayscale’s statements had been meant to guarantee the general public that the corporate’s cryptocurrencies are “secure and safe” after the FTX collapse.

The digital asset fund supervisor detailed that all the firm’s digital belongings are saved with Coinbase Custody Belief Firm. On the Grayscale web site, the agency says Coinbase Custody is a certified custodian beneath New York banking legal guidelines and the funds are stored in “chilly storage.”

The one factor Grayscale didn’t disclose is the corporate’s digital asset addresses and it did point out why it selected to not share the wallets. Grayscale defined that it has by no means publicly disclosed onchain addresses to most people “on account of safety considerations.” The declare was criticized and mocked, however Grayscale stated that it understood the non-disclosure could be “a disappointment to some.”

Regardless of Grayscale’s non-disclosure, the OXT researcher (oxt.me) Ergo defined that it began a community-led effort to create transparency round GBTC holdings. “We’ve got taken steps to ID seemingly GBTC addresses and balances based mostly on public data and blockchain forensics,” Ergo said on Nov. 20.

Leveraging an article from Coindesk, heuristics, and publicly recognized bitcoin addresses related to the custodian Xapo, that day, Ergo “attributed 432 addresses holding 317,705 BTC to seemingly GBTC custody exercise.”

The researcher found at the very least 50% of the GBTC holdings and added: “further work is important to ID the remaining addresses.” By 2:49 p.m. (ET) on Nov. 23, Ergo stated the extra work was completed in a Twitter thread known as: “The Grayscale G(BTC) Cash Half 2” Ergo tweeted:

On this evaluation, we use further [onchain] forensics to CONFIRM the approximate 633K BTC stability held by G(BTC) at Coinbase Custody.

Ergo’s abstract notes that after discovering the primary 50% of bitcoins related to Grayscale’s BTC, the staff needed to ‘scan the blockchain’ for added addresses becoming the profile of these present in Half 1.

Ergo additional leaves unbiased analysts with data on the heuristics used and the bitcoin addresses compiled for the search. “Clearly no heuristic or set of heuristics are good, and this evaluation definitely contains false positives and negatives,” Ergo remarked. “However our result’s virtually equivalent to the G(BTC) self-reported holdings.”

Within the Twitter thread, Ergo says that it doesn’t know why Grayscale determined to not share the corporate’s BTC addresses. Ergo stated the staff initially thought Coinbase Custody could have a non-disclosure coverage. However after studying some data printed by Coinbase, Ergo said “it appears clear that Coinbase Custody is prepared to reveal addresses.”

A number of individuals complimented Ergo’s Twitter thread and evaluation of the GBTC cash. Moreover, the information follows Coinbase CEO Brian Armstrong explaining that as of Sept. 30, Coinbase holds 2 million bitcoin.

What do you concentrate on Ergo’s onchain evaluation of GBTC’s bitcoin horde? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Ergo BTC, Grayscale brand,

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.