[ad_1]

A brand new technology of asset administration chief executives have referred to as time on a “golden decade” for his or her trade, warning that it’s changing into more and more tough to navigate the competing pressures of markets, regulators and politicians.

“The complexity of the calls for on an asset supervisor are clearly growing,” stated Ali Dibadj, chief government of Janus Henderson. “Shoppers are asking extra of all of us, regulators are asking extra from all of us, and our shoppers’ shoppers are asking extra from us.”

Katie Koch, chief government of Los Angeles-based TCW Group, stated asset managers had been “dealing with growing complexity round evolving regulation, migration of funding alternatives from public to personal markets, globalisation of the chance set and the more moderen politically charged portfolio administration setting”.

After a decade of zero charges and quantitative easing that pushed fairness markets to document highs, traders are grappling with the problem of a regime change in direction of each larger inflation and better rates of interest.

“Asset administration was once a rising tide that will raise all boats and that’s now not true,” stated Yie-Hsin Hung, chief government of State Road International Advisors.

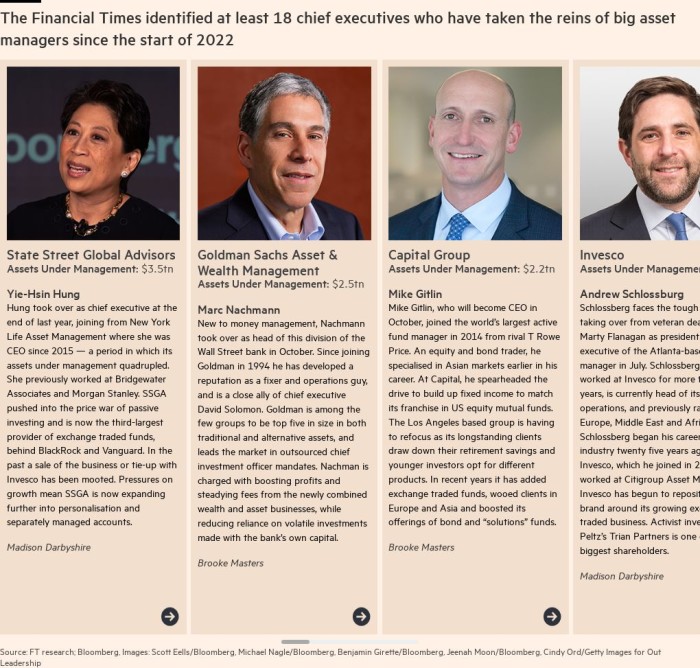

The Monetary Instances recognized a minimum of 18 chief executives who’ve taken the reins of huge asset managers for the reason that begin of 2022. This new guard is charged with stabilising their companies following the worst yr for the roughly $60tn trade for the reason that monetary disaster.

Huge falls throughout markets mixed with investor outflows and spiralling prices, compounding stress on energetic asset managers which were combating the march of passive investing.

Buyers globally pulled $530bn from funding funds (excluding short-term cash market funds) final yr, the fund trade’s worst for brand new enterprise since 2008, in line with knowledge supplier Morningstar.

Funding managers’ revenues are underpinned by the charges they cost on property underneath administration, and falling property are placing cost-to-income ratios — a key measure of funding supervisor profitability — underneath stress, particularly for much less environment friendly gamers.

“The golden decade for asset administration is over,” stated Stefan Hoops, chief government of DWS, including that traders now confronted a market setting the place “not every thing goes up and up and up” however “prices are”.

Final week BlackRock, the world’s largest asset supervisor, warned that the “conventional investing strategy” of 60 per cent shares and 40 per cent mounted earnings will serve investors poorly over the long run, calling time on a method that has been a cornerstone of many asset managers for greater than 30 years.

“The complexity of the markets proper now — not simply equities and bonds, however client behaviour, economics, geopolitics and regulation — is creating quite a lot of volatility and uncertainty,” stated Andrew Schlossberg, chief government of Invesco. “That makes making a long-term enterprise technique difficult and we predict it’s going to be with us for some time.”

Asset managers have responded to profitability pressures by attempting to diversify their companies, including higher-margin merchandise comparable to personal property or concentrating on new shopper varieties or geographic areas, typically by way of acquisitions. Their enterprise fashions have develop into more and more elaborate and tough to handle in consequence.

“The challenges of complexity are better than the challenges of scale,” stated Rob Sharps, chief government of T Rowe Value. Clients now come to T Rowe by way of a number of channels, together with direct entry on brokerage platforms, by way of advisers or to purchase particular merchandise comparable to alternate options. “Then we do this across the globe.”

He added: “It turns into an advanced enterprise particularly with the proliferation of regulation and totally different shopper preferences for automobiles, methods or constructions in finish markets.”

More and more fragmented and complicated regulation is one other space of concern, notably across the fast-growing sector of investing on the idea of setting, social and governance components. Asset managers try to steadiness the calls for of a extremely interconnected funding trade in opposition to retreats from globalisation and the more and more politicised nature of ESG within the US.

“Regulation is changing into far more difficult,” stated Matthew Beesley, chief government of Jupiter. “Regulatory pressures have elevated in each area. We’re additionally seeing regulatory divergences rising inside Europe following the UK’s exit from the EU.”

For instance, European regulators took a lead on defining requirements for ESG investing, with the Sustainable Finance Disclosure Regulation, which goals to enhance transparency and prevent greenwashing. However the UK is consulting by itself model of guidelines, which may take a special strategy to the EU within the aftermath of Brexit, and the US Securities and Change Fee is getting ready guidelines round ESG disclosures.

Karin van Baardwijk, chief government of Dutch asset supervisor Robeco, stated that with the rising demand and related provide of ESG merchandise, “the danger of greenwashing is changing into extra prevalent. This may injury the credibility of our trade as an entire . . . and can finally result in extra regulation.”

Within the US, asset managers together with BlackRock and Vanguard are discovering themselves a lightning rod for each side of the political spectrum. Republican politicians are attacking them over the usage of ESG metrics, contending that they’re hostile to fossil gasoline investments, whereas Democrats have criticised them for failing to do extra to battle local weather change.

In the meantime, asset managers are locked in a struggle for expertise, notably in areas comparable to personal property, know-how and sustainable investing, and attempting to maintain investing of their companies to remain forward of the competitors.

“The stress on price, inflation of wages, and the struggle on expertise is absolutely right here to remain,” stated Naïm Abou-Jaoudé, chief government of NY Life Funding Administration.

“And the pressures we’ve on regulation, compliance and all the necessities imply the enterprise is changing into extra demanding . . . all of that is costing lots by way of funding to be actually environment friendly as an organisation.”

The chief executives all agreed that traders in the present day face a future fairly totally different from these of their predecessors in latest many years.

To navigate this extra advanced setting asset managers will “must work more durable and be much more revolutionary . . . working throughout conventional silos,” in line with Marc Nachmann, international head of asset and wealth administration at Goldman Sachs.

“Extra in depth relationships and assets — globally distributed and amplified by higher know-how — shall be more and more wanted for concept technology, deal sourcing, portfolio development, and worth creation,” he stated. “These aren’t small investments to make.”

[ad_2]

Source link