[ad_1]

Traders are underestimating how excessive eurozone borrowing prices will rise, the top of Belgium’s central financial institution has warned, insisting he’ll solely conform to halt rate of interest rises as soon as wage progress begins to fall.

Pierre Wunsch, who sits on the European Central Financial institution’s rate-setting governing council, informed the Monetary Occasions: “We’re ready for wage progress and core inflation to go down, together with headline inflation, earlier than we will arrive on the level the place we will pause.”

His concentrate on wage progress raises the bar on the situations that should be fulfilled earlier than the ECB will cease elevating charges. The central financial institution has already raised its deposit charge at an unprecedented tempo from minus 0.5 per cent final July to three per cent in March.

“I’d not be shocked if we needed to go to 4 per cent in some unspecified time in the future,” stated Wunsch, indicating that borrowing prices might rise additional than anticipated by traders, who’re betting on an increase within the ECB’s deposit charge to barely above 3.75 per cent. Traders count on the ECB to maintain elevating charges additional than the US Federal Reserve and Bank of England, that are each anticipated to extend coverage charges by 1 / 4 share level subsequent month.

A number of members of the ECB council have stated they count on one other charge rise at its subsequent assembly on Might 4, however most are ready for knowledge on financial institution lending and inflation earlier than deciding whether or not to decelerate to 1 / 4 level transfer.

Some council members fear the banking sector turmoil of the previous month, following the collapse of Silicon Valley Financial institution and compelled rescue of Credit score Suisse, will trigger lending to dry up and scale back the necessity for extra charge will increase.

However Wunsch stated Belgian financial institution executives he met final week informed him that they had no plans to chop the provision of credit score in response to the tumult.

“It’s not like I really like mountain climbing,” stated Wunsch, who labored on the Belgian central financial institution for eight years earlier than taking cost in 2019 and had change into one of many extra hawkish ECB council members, usually pushing for increased charges.

“What we attempt to do is all the time to go for a mushy touchdown and no one goes to err on the facet of destroying the economic system for the sake of destroying the economic system,” he stated. “However I’ve completely no indication that what we’re doing is an excessive amount of.”

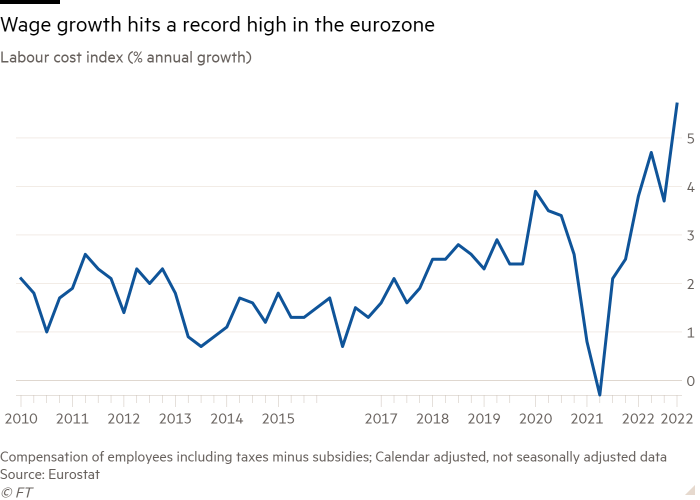

Hourly labour prices within the 20-country single foreign money zone rose by a document 5.7 per cent within the fourth quarter from a yr earlier, exceeding the tempo of wage rises within the US. In Belgium, one of many few European nations to nonetheless formally hyperlink pay to inflation through indexation clauses, many employees got a ten per cent pay rise initially of the yr.

Wunsch stated there have been already clear indicators of “second-round results” within the bloc, as employees demand increased wages to offset a better price of dwelling and that pushes costs up much more.

“I’m not a fetishist,” he stated. “I’m not going to hike charges even in a recession simply because we now have 2.3 per cent or 2.1 per cent inflation within the two-year forecast. However I’m not seeing inflation numbers stepping into the best path but.”

The ECB set out a brand new three-part information to its future coverage selections final month, saying future charge strikes can be determined by a mixture of its inflation forecast, previous modifications in underlying worth pressures and the way a lot impression its insurance policies are having.

Wunsch stated wage progress was a key a part of this on account of its impression on the inflation forecast. “If we see wage agreements remaining round 5 per cent progress for longer than that is going to be within the forecast after which inflation just isn’t going to return to 2 per cent on a structural foundation,” he stated.

Wunsch known as on governments to begin decreasing their finances deficits, even earlier than they withdraw the widespread power and gasoline subsidies.

“We’re flirting with a weak type of fiscal dominance,” he stated. “The bottom case is we will hike, however there are dangers that one thing will occur, a political disaster in a rustic, the place we will likely be confronted with fiscal trade-offs.”

ECB president Christine Lagarde has taken delight in her skill to steer most of its 26 council members — together with the 20 heads of every nationwide central financial institution — to assist fastidiously constructed compromises on charge strikes. Because the ECB will get nearer to the height charge, bringing everybody collectively will get more durable, Wunsch stated.

He “very a lot appreciates” Lagarde’s strategy, however added: “The place there’s room for dialogue is that if there’s an excessive amount of consensus. I feel it removes related data from the market.” Hiding divisions between rate-setters risked shocking the market, as has occurred a number of instances already, he added.

[ad_2]

Source link