[ad_1]

Good morning. This text is an on-site model of our FirstFT publication. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Now we have a scoop at present on Google’s plans to introduce generative artificial intelligence into its advertising business over the approaching months, within the newest transfer by tech giants to include the groundbreaking expertise into their merchandise.

In accordance with an inner presentation to advertisers seen by the Monetary Occasions, the Alphabet-owned firm intends to start utilizing the AI to create novel commercials primarily based on supplies produced by human entrepreneurs.

Google already makes use of AI in its promoting enterprise to create easy prompts that encourage customers to purchase merchandise. Nevertheless, the mixing of its newest generative AI — which additionally powers its Bard chatbot — means it will likely be in a position to produce way more subtle campaigns resembling these created by advertising companies.

In accordance with the presentation, advertisers can provide “inventive” content material resembling imagery, video and textual content regarding a specific marketing campaign. The AI will then “remix” this materials to generate adverts primarily based on the viewers it goals to achieve, in addition to different targets resembling gross sales targets.

Right here’s what I’m holding tabs on at present:

-

ECB: The European Central Financial institution publishes its financial coverage discussions from its assembly held final month.

-

UK: The CBI and PwC publish their quarterly survey of monetary companies, monitoring optimism, income and employment for the primary quarter.

-

Outcomes: WHSmith, Ipsos, Renault, AT&T, American Categorical and Philip Morris Worldwide report.

5 extra prime tales

1. EXCLUSIVE: Financial institution of America has raised considerations with Lloyd’s of London about excluding “state-backed” cyber assaults from normal insurance coverage insurance policies, underscoring unease amongst monetary establishments about modifications to a vital security web. Read the full story.

-

Extra banks: Morgan Stanley’s chief has warned that funding banking revenues may not recover until next year after the group reported a fall in income.

-

Opinion: Banks now look well positioned to outperform simply as some out there have deemed them to be uninvestable, writes Algebris Investments founder Davide Serra.

2. Pension funds have urged UK chancellor Jeremy Hunt to not drive them to spend money on riskier property resembling fast-growing, younger British corporations and infrastructure. Hunt has mentioned he wouldn’t be “instinctively snug” with ordering pension funds the place to take a position a few of their cash, but he has not ruled out such a move.

3. Virgin Media O2 has kicked off the sale of a minimum of half of its stake in Cornerstone, which manages the UK’s largest cell tower community and is more likely to be valued at as much as £3bn. Here’s how Virgin Media O2 could use the money from the sale.

4. Elon Musk indicated he was keen to sacrifice Tesla’s short-term income for market share so as to earn more money later when the corporate’s vehicles can function as absolutely autonomous “robotaxis”. The unconventional justification sent shares down 6 per cent in after-market trading yesterday.

5. The EU is planning emergency curbs on Ukrainian grain imports to 5 member states near the war-torn nation, bowing to strain from Poland and Hungary after they took unilateral motion to guard native farmers from a budget imports. Read more on Brussels’s unusual response to a challenge of its trade policy powers.

The Massive Learn

With India set to surpass China because the world’s most populous nation, its public digital infrastructure has turn out to be a core a part of Prime Minister Narendra Modi’s efforts to current India as a nascent financial superpower and various funding vacation spot to its neighbour. However the “India Stack”, its novel strategy to combine personal and public digital companies, has sparked worries over privacy and data protection.

We’re additionally studying . . .

Chart of the day

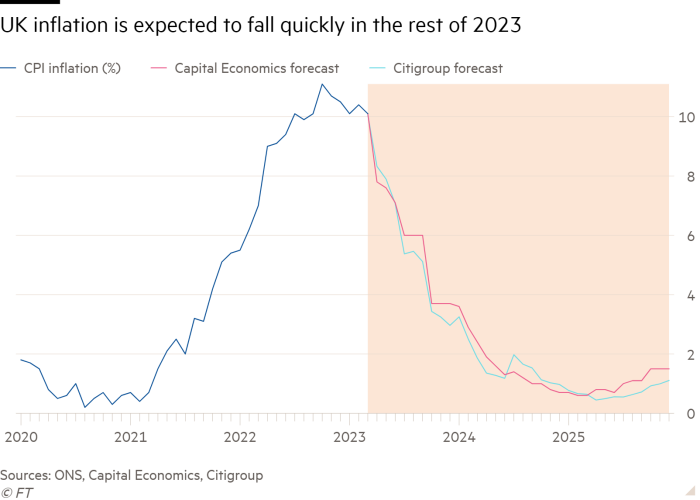

Knowledge launched yesterday confirmed UK inflation fell lower than anticipated and remained in double digits at 10.1 per cent final month, considerably increased than within the US and the eurozone. However the particulars and underlying traits additionally point out that Britain is not the outlier that initial comparisons suggest.

Take a break from the information

Double Vanilla is a vlogger on avenue model who asks strangers to element their seems — and asks them the worth. On a visit to Paris, she interviewed a vacationer carrying Tom Ford sun shades, a Dior purse, Chanel trainers and Van Cleef & Arpels jewelry and was in a position to reveal the not insignificant sum for her “walking-around-Paris-with-my-daughter” outfit.

“Individuals are at all times fascinated about seeing how a lot different folks spend on their garments,” Double Vanilla says.

Extra contributions by Gordon Smith and Emily Goldberg

Thanks for studying and bear in mind you may add FirstFT to myFT. You can too elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to firstft@ft.com

[ad_2]

Source link