[ad_1]

5 weeks after the collapse of Silicon Valley Financial institution, there isn’t any consensus on whether or not the following monetary stress in North America and Europe has run its course or is a foretaste of worse to come back.

Equally urgent is the query of whether or not, towards the backdrop of nonetheless excessive inflation, central banks in superior economies will quickly row again from financial tightening and pivot in direction of easing.

These questions, that are of overwhelming significance for buyers, savers and mortgage debtors, are carefully associated. For if banks and different monetary establishments face liquidity crises when inflation is considerably above the central banks’ goal, normally of about 2 per cent, acute stress arises between their twin aims of worth stability and monetary stability. Within the case of the US Federal Reserve, the worth stability goal additionally conflicts with the aim of most employment.

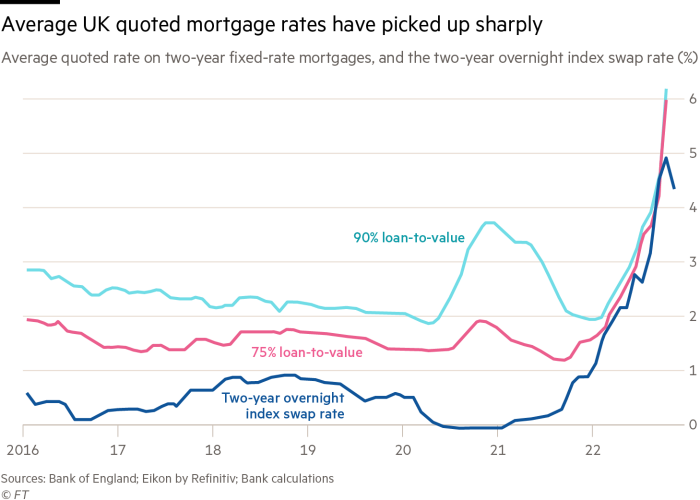

The alternatives made by central banks could have a far-reaching impression on our private funds. If inflation stays greater for longer, there will likely be additional ache for individuals who have invested in supposedly protected bonds for his or her retirement. If the central banks fail to engineer a comfortable touchdown for the economic system, buyers in danger belongings akin to equities will likely be on the rack. And for householders seeking to refinance their loans over the approaching months, any additional tightening by the Financial institution of England will feed into mortgage prices.

The bubble bursts

SVB, the sixteenth largest financial institution within the US, completely illustrates how the central banks’ inflation and monetary stability aims are probably in battle. It had been deluged with primarily uninsured deposits — deposits above the official $250,000 insurance coverage ceiling — that far exceeded lending alternatives in its tech trade stamping floor. So it invested the cash in medium and long-dated Treasury and company securities. It did so with out hedging towards rate of interest danger in what was the best bond market bubble in historical past.

The very sharp rise in coverage charges over the previous 12 months pricked the bubble, so miserable the worth of long-dated bonds. This is able to not have been an issue if depositors retained confidence within the financial institution in order that it might maintain the securities to maturity. But, in observe, wealthy however nervous uninsured depositors apprehensive that SVB was probably bancrupt if the securities have been marked to market.

A clumsy speech by chief government Greg Becker on March 9 rapidly unfold throughout the web, inflicting 1 / 4 of the financial institution’s deposit base to flee in lower than a day and pushing SVB into compelled gross sales of bonds at enormous losses. The collapse of confidence quickly prolonged to Signature Financial institution in New York, which was overextended in property and more and more concerned in crypto belongings. Some 90 per cent of its deposits were uninsured, in contrast with 88 per cent at SVB.

Worry unfold to Europe, the place failures of danger administration and a sequence of scandals at Credit Suisse induced deposits to ebb away. The Swiss authorities rapidly brokered a takeover by arch rival UBS, whereas within the UK the Financial institution of England secured a takeover of SVB’s troubled UK subsidiary by HSBC for £1.

These banks don’t seem to represent a homogeneous group. But, of their other ways, they reveal how the lengthy interval of super-low rates of interest because the nice monetary disaster of 2007-09 launched fragilities into the monetary system whereas creating asset bubbles. As Jon Danielsson and Charles Goodhart of the London College of Economics point out, the longer financial coverage stayed lax, the extra systemic danger elevated, together with a rising dependence on cash creation and low charges.

The last word consequence was to undermine monetary stability. Placing that proper would require a rise within the capital base of the banking system. But, as Danielsson and Goodhart point out, rising capital necessities when the economic system is doing poorly, as it’s now, is conducive to recession as a result of it reduces banks’ lending capability. So we’re again to the coverage tensions outlined earlier.

A part of the issue of such protracted lax coverage was that it bred complacency. Many banks that are actually combating rising rates of interest had assumed, like SVB, that rates of interest would stay low indefinitely and that central banks would at all times come to the rescue. The Federal Deposit Insurance coverage Company estimates that US banks’ unrealised losses on securities have been $620bn on the finish of 2022.

A extra direct consequence, noted by lecturers Raghuram Rajan and Viral Acharya, respectively former governor and deputy governor of the Reserve Financial institution of India, is that the central banks’ quantitative easing because the monetary disaster, whereby they purchased securities in bulk from the markets, drove an growth of banks’ stability sheets and stuffed them with flighty uninsured deposits.

Rajan and Acharya add that supervisors within the US didn’t topic all banks to the identical degree of scrutiny and stress testing that they utilized to the most important establishments. So these differential requirements might have induced a migration of dangerous business actual property loans from bigger, better-capitalised banks to weakly capitalised small and midsized banks. There are grounds for pondering that this can be much less of a difficulty within the UK, as we will see.

An extra vulnerability within the system pertains to the grotesque misallocation of capital arising not solely from the bubble-creating propensity of lax financial coverage however from ultra-low rates of interest holding unprofitable “zombie” corporations alive. The additional manufacturing capability that this stored in place exerted downward strain on costs.

At the moment’s tighter coverage, essentially the most draconian tightening in 4 many years within the superior economies with the notable exception of Japan, will wipe out a lot of the zombie inhabitants, thereby limiting provide and including to inflationary impetus. Notice that the overall variety of firm insolvencies registered within the UK in 2022 was the highest since 2009 and 57 per cent greater than 2021.

A system underneath pressure

In impact, the shift from quantitative easing to quantitative tightening and sharply elevated rates of interest has imposed a huge stress check on each the monetary system and the broader economic system. What makes the check particularly disturbing is the massive enhance in debt that was inspired by years of simple cash.

William White, former chief economist on the Financial institution for Worldwide Settlements and one of many few premier league economists to foresee the nice monetary disaster, says ultra easy money “inspired individuals to take out debt to do dumb issues”. The result’s that the mixed debt of households, corporations and governments in relation to gross home product has risen to ranges by no means earlier than seen in peacetime.

All this implies an enormous enhance within the scope for accidents within the monetary system. And whereas the upsets of the previous few weeks have raised severe questions concerning the effectiveness of financial institution regulation and supervision, there may be one respect through which the regulatory response to the nice monetary disaster has been extremely efficient. It has induced a lot conventional banking exercise emigrate to the non-bank monetary sector, together with hedge funds, cash market funds, pensions funds and different establishments which might be a lot much less clear than the regulated banking sector and thus able to springing nasty systemic surprises.

An illustration of this got here within the UK final September following the announcement by Liz Truss’s authorities of unfunded tax cuts in its “mini” Funds. It sparked a speedy and unprecedented enhance in long-dated gilt yields and a consequent fall in costs. This uncovered vulnerabilities in liability-driven funding funds through which many pension funds had invested so as to hedge rate of interest danger and inflation danger.

Such LDI funds invested in belongings, primarily gilts and derivatives, that generated money flows that have been timed to match the incidence of pension outgoings. A lot of the exercise was fuelled by borrowing.

UK defined-benefit pension funds, the place pensions are associated to last or profession common pay, have a near-uniform dedication to legal responsibility matching. This led to overconcentration on the lengthy finish of each the fixed-interest and index-linked gilt market, thereby exacerbating the extreme repricing in gilts after the announcement. There adopted a savage spiral of collateral calls and compelled gilt gross sales that destabilised a market on the core of the British monetary system, posing a devastating danger to monetary stability and the retirement financial savings of hundreds of thousands.

This was not totally unexpected by the regulators, who had run stress assessments to see whether or not the LDI funds might safe sufficient liquidity from their pension fund shoppers to fulfill margin calls in tough circumstances. However they didn’t permit for such an excessive swing in gilt yields.

Nervous that this might result in an unwarranted tightening of financing situations and a discount within the stream of credit score to households and companies, the BoE stepped in to the market with a short lived programme of gilt purchases. The aim was to present LDI funds time to construct their resilience and encourage stronger buffers to deal with future volatility within the gilts market.

The intervention was extremely profitable by way of stabilising the market. But, by increasing its stability sheet when it was dedicated to stability sheet shrinkage within the curiosity of normalising rates of interest and curbing inflation, the BoE planted seeds of doubt within the minds of some market individuals. Would monetary stability at all times trump the central financial institution’s dedication to ship on worth stability? And what additional dramatic repricing incidents might immediate harmful systemic shocks?

Inflation earlier than all?

The obvious scope for sharp repricing pertains to market expectations about inflation. Within the brief time period, inflation is ready to fall as world worth pressures fall again and provide chain disruption is easing, particularly now China continues to reopen after Covid-19 lockdowns. The BoE Financial Coverage Committee’s central projection is for client worth inflation to fall from 9.7 per cent within the first quarter of 2023 to simply underneath 4 per cent within the fourth quarter.

The help provided by the Fed and different central banks to ailing monetary establishments leaves room for just a little extra coverage tightening and the sturdy risk that this can pave the way in which for disinflation and recession. The purpose was underlined this week by the IMF, which warned that “the probabilities of a tough touchdown” for the worldwide economic system had risen sharply if excessive inflation persists.

But, along with the query mark over central banks’ readiness to prioritise preventing inflation over monetary stability, there are longer-run issues about unfavorable provide shocks that might maintain upward strain on inflation past present market expectations, based on White. For a begin, Covid-19 and geopolitical friction are forcing corporations to restructure provide traces, rising resilience however lowering effectivity. The availability of staff has been hit by deaths and lengthy Covid.

White expects the manufacturing of fossil fuels and metals to undergo from lately low ranges of funding, particularly given the lengthy lags in bringing new manufacturing on stream. He additionally argues that markets underestimate the inflationary impression of local weather change and, most significantly, the worldwide provide of staff is in sharp decline, pushing up wage prices in every single place.

The place does the UK stand in all this? The resilience of the banking sector has been enormously strengthened because the monetary disaster of 2007-08, with the loan-to-deposit ratios of huge UK banks falling from 120 per cent in 2008 to 75 per cent within the fourth quarter of 2022. Way more of the UK banks’ bond portfolios are marked to market for regulatory and accounting functions than within the US.

The power of sterling because the departure of the Truss authorities means the UK’s longstanding exterior stability sheet danger — its dependence on what former BoE governor Mark Carney referred to as “the kindness of strangers” — has diminished considerably. But enormous uncertainties stay as rates of interest look set to take one final upward step.

Dangers for debtors and buyers

For mortgage debtors, the image is combined. The BoE’s Monetary Coverage Committee estimates that half the UK’s 4mn owner-occupier mortgages will likely be uncovered to charge rises in 2023. However, in its latest report in March, the BoE’s FPC says its worries concerning the affordability of mortgage funds have lessened due to falling power costs and the higher outlook for employment.

The persevering with excessive degree of inflation is lowering the actual worth of mortgage debt. And, if monetary stability issues trigger the BoE to stretch out the interval over which it brings inflation again to its 2 per cent goal, the actual burden of debt will likely be additional eroded.

For buyers, the likelihood — I’d say likelihood — that inflationary pressures are actually larger than they’ve been for many years raises a crimson flag, a minimum of over the medium and long run, for fixed-rate bonds. And, for personal buyers, index-linked bonds supply no safety until held to maturity.

That could be a enormous assumption given the unknown timing of mortality and the potential of payments for care in previous age that will require investments to be liquidated. Notice that the return on index-linked gilts in 2022 was minus 38 per cent, based on consultants LCP. When fixed-rate bond yields rise and costs fall, index-linked yields are pulled up by the identical highly effective tide.

After all, in asset allocation there may be no absolute imperatives. It’s value recounting the expertise within the Seventies of George Ross Goobey, founding father of the so-called “cult of the fairness” within the days when most pension funds invested solely in gilts.

Whereas working the Imperial Tobacco pension fund after the battle he famously bought all of the fund’s fixed-interest securities and invested solely in equities — with excellent outcomes. But, in 1974, he put an enormous guess on “Conflict Mortgage” when it was yielding 17 per cent and made a killing. If the worth is true, even fixed-interest IOUs is usually a cut price in a interval of rip-roaring inflation.

A last query raised by the banking stresses of current weeks is whether or not it’s ever value investing in banks. In a recent FT Cash article, Terry Smith, chief government of Fundsmith and a former top-rated financial institution analyst, says not. He by no means invests in something that requires leverage (or borrowing) to make an satisfactory return, as is true of banks. The returns in banking are poor, anyway. And, even when a financial institution is properly run, it may be destroyed by a systemic panic.

Smith provides that expertise is supplanting conventional banking. And, he asks rhetorically, have you ever seen that your native financial institution department has grow to be a PizzaExpress, through which position, by the way in which, it makes extra money?

A salutary envoi to the story of the most recent spate of financial institution failures.

[ad_2]

Source link