[ad_1]

Good morning. This text is an on-site model of our FirstFT publication. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

EY’s UK arm is following its US enterprise in telling companions to prepare for cost cuts and staff departures after the collapse of the agency’s long-running try to separate its world enterprise in two.

In a recording of a name shared with the Monetary Occasions, Anna Anthony, UK managing associate for monetary companies, mentioned yesterday: “We’ve inefficiencies in our enterprise, which we will begin to tackle now so we’re already engaged on lowering our prices.”

Anthony mentioned the inefficiencies have been one of many “classes realized” by EY throughout the failed try to separate its audit and consulting companies and that the cost-cutting can be a part of the UK agency’s plan for its new monetary 12 months, which begins in July.

She didn’t give particulars of what the cuts would entail.

Anthony additionally confirmed that the prices racked up on the deal, codenamed Venture Everest, had reached $600mn on the world degree, together with $300mn of inside prices for work carried out by EY’s personal workers.

For extra on the Massive 4 agency’s ill-fated break-up plan, I’d suggest:

-

Energy vacuum danger: After the failure of Venture Everest, the way forward for world chief Carmine Di Sibio and different senior executives hangs in the balance.

-

US retrenchment: EY’s US arm says it is going to embark on a $500mn cost-saving programme over the following 12 months as a part of a “simplification agenda”.

Right here’s what else I’ll be searching for as we speak:

Is a Labour victory over the Conservatives inevitable? Be a part of award-winning FT columnist Stephen Bush and colleagues on April 19 as they deal with your questions within the run-up to the UK’s 2024 election. Register here for free.

5 extra high tales

1. EXCLUSIVE: SoftBank has moved to promote nearly all of its remaining shares in Alibaba, finally chopping the Japanese group’s stake to only 3.8 per cent. It has bought about $7.2bn price of shares within the Chinese language firm this 12 months by means of pay as you go ahead contracts, the FT’s analysis of regulatory filings has revealed.

2. The Financial institution of England is engaged on reform of Britain’s financial institution deposit insurance coverage assure scheme, the central financial institution’s governor Andrew Bailey mentioned yesterday. His remarks in response to financial institution failures on each side of the Atlantic raise the prospect of increased protection for UK customers.

3. Marex is contemplating a New York itemizing because it seems to be to revive plans for an preliminary public providing, within the newest blow to the London inventory market. The commodity dealer cancelled a list within the UK in 2021 with a targeted valuation of between $650mn and $800mn.

4. JPMorgan Chase was conscious by 2006 that Jeffrey Epstein had been accused of paying money to have “underage ladies and younger ladies” delivered to his house — seven years earlier than the financial institution dropped him as a consumer, legal filings in New York yesterday alleged.

5. Royal Financial institution of Canada was the fossil gas business’s high financier final 12 months, changing JPMorgan after extending $42.1bn in funding. Here’s why Canadian banks have become the industry’s “lender of last resort”.

The Massive Learn

Not like with the bankruptcies of firms and people, there isn’t any legislation governing bancrupt international locations — solely a chaotic, advert hoc course of that includes a hodgepodge of contractual clauses and tacit conventions, tortuous negotiations and navigating geopolitical expediency. This fragile patchwork might unravel utterly as a result of emergence of a new, disruptive, opaque and powerful force in sovereign debt: China.

We’re additionally studying . . .

-

2008 redux?: Fears of excessive rates of interest resulting in defaults on industrial property loans and solvency points are greatly exaggerated, writes Megan Greene.

-

Defending Oxbridge: Britons mustn’t put down those that handle to get into elite establishments that contribute much to the UK, writes Jemima Kelly.

-

Macron on Taiwan: The French president’s remarks that Europe ought to distance itself from tensions over the island have created an impression of disarray over the EU’s China policy.

Chart of the day

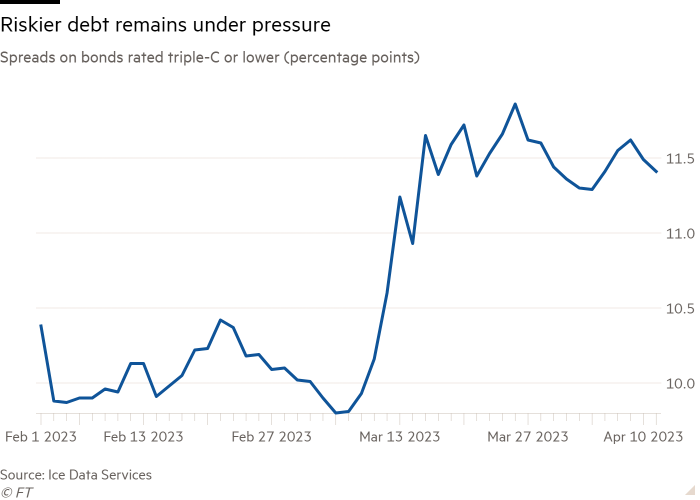

Buyers are shying away from the riskiest US corporate debt as fears of an impending recession gas a rising divide between the highest- and lowest-rated firms within the $1.4tn high-yield bond market.

Take a break from the information

New Zealand’s Stratford-Okahukura railway has lengthy since been deserted by common prepare companies. Now often called the Forgotten World Line, you may drive your personal “rail cart” (which can be a golf buggy transformed to run on rails) throughout 82km of a rugged panorama and distant hamlets . . . and previous an unforgettable pub.

Further contributions by Gordon Smith and Emily Goldberg

Thanks for studying and bear in mind you may add FirstFT to myFT. You may also elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to firstft@ft.com

[ad_2]

Source link