[ad_1]

Good morning. This text is an on-site model of our FirstFT publication. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Greater than 90,000 Hongkongers who’ve utilized to maneuver to the UK are being blocked from accessing as much as £2.2bn of pension assets, as activists accuse the town’s authorities of “punishing” these deemed “unpatriotic” following a political crackdown.

“It’s a blanket ban on British Nationwide (Abroad) holders accessing the property that’s theirs,” mentioned Sam Goodman, director of coverage and advocacy at Hong Kong Watch, which launched the figures in the present day on the eve of a UK journey by monetary companies secretary Christopher Hui, the primary ministerial-level Hong Kong official to go to Britain since 2019.

The UK’s BN(O) programme provided thousands and thousands of Hong Kong residents a path to citizenship within the wake of a crackdown on pro-democracy protests in 2019. The transfer angered Chinese language authorities, and in response, the Hong Kong authorities in 2021 mentioned people couldn’t use emigration below the UK scheme as a sound cause for early withdrawal of pension funds, successfully stopping quick payouts.

Typically, former Hong Kong residents might reclaim their pension funds below the federal government’s Necessary Provident Fund retirement saving system in the event that they transfer overseas completely. A lot of banks, insurers and monetary establishments supply pension funds below the system, together with Manulife, Invesco, Constancy and HSBC.

Right here’s what else I’m watching in the present day:

-

Andrew Bailey: The Financial institution of England governor is because of communicate in Washington in regards to the shifting threat panorama on the sidelines of the IMF/World Financial institution spring conferences.

-

Financial information: The US has its shopper value index for final month. Economists forecast annual inflation to have fallen to five.2 per cent from 6 per cent in February.

-

Outcomes: French luxurious big LVMH studies first-quarter income.

Inside Politics is holding a stay panel dialogue on April 19. Be part of Stephen Bush and different FT journalists and consultants as they focus on subsequent yr’s UK common election. Sign up for the subscriber-only event here.

5 extra high tales

1. EXCLUSIVE: EY has scrapped plans to interrupt up its audit and consulting companies, a break up which might have represented the most important shake-up to the accounting business in additional than twenty years. Here’s how months of internal disagreement killed “Project Everest”.

2. EXCLUSIVE: Deutsche Financial institution is closing its remaining software program expertise centres in Russia, ending the German lender’s twenty years of heavy reliance on Russian IT experience within the wake of the nation’s invasion of Ukraine. Read the full story here.

3. The IMF has warned of a “exhausting touchdown” for the worldwide economic system if inflation continues to push rates of interest greater and mentioned decrease international power and meals costs might masks a darker actuality. Here’s what else you should know from the fund’s World Economic Outlook.

4. The UK inventory market is “not a really enticing place” for listed firms, the InterContinental Resorts chief has warned, within the newest signal of hassle for the London market. Keith Barr informed the Monetary Instances that a number of shareholders have requested if the group has plans to shift its primary listing from the City to the US.

5. European aviation faces €820bn in further prices to succeed in web zero emissions by 2050, in line with business estimates, with greater than half to be spent on cleaner fuels not created from fossil fuels. Read more on the sector’s decarbonisation challenges.

The Large Learn

Governments have promised to plant 633mn hectares of timber — an space bigger than the Amazon rainforest — to assist save the planet. Whereas the purpose is laudable, is it remotely believable? On this visible essay, the FT explores the idea of reforestation and its effects on the land and people.

We’re additionally studying. . .

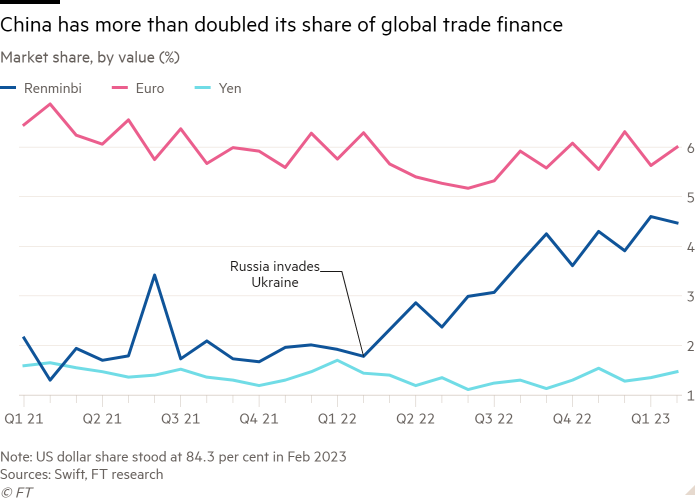

Chart of the day

The renminbi’s share of trade finance has more than doubled because the invasion of Ukraine, an FT evaluation has discovered — a surge that analysts say displays each better use of China’s foreign money to facilitate commerce with Russia and the rising price of greenback financing.

Take a break from the information

We’re seeing a gradual reimagining of the place, when and the way we work, writes Grace Lordan, affiliate professor on the London Faculty of Economics, and much of that shift is coming from employees.

Extra contributions by Emily Goldberg and Vita Dadoo Lomeli

Thanks for studying and keep in mind you’ll be able to add FirstFT to myFT. You may as well elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to firstft@ft.com

[ad_2]

Source link