[ad_1]

Chancellor Jeremy Hunt’s efforts to revitalise the UK economic system haven’t been enough to lift it from the foot of the worldwide league desk this 12 months, in line with forecasts revealed by the IMF on Monday.

In its twice-yearly World Financial Outlook, the fund predicted that the UK economic system would shrink by 0.3 per cent in 2023, even after a big improve to the forecast of a contraction of 0.6 per cent in January.

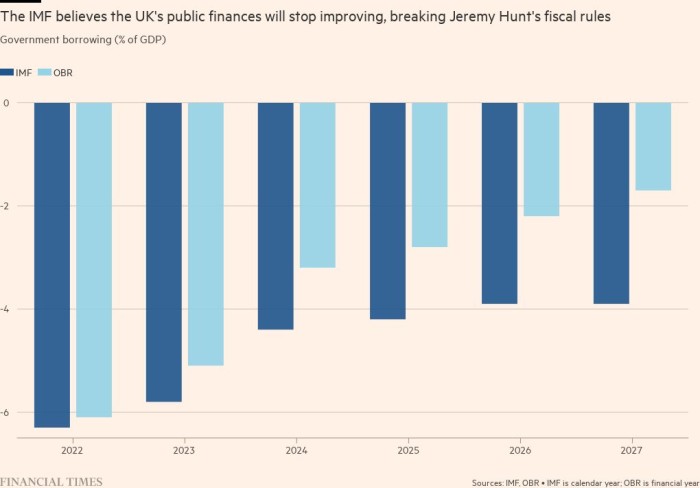

With a worse outlook than Hunt anticipated even into the medium time period, the IMF forecasts confirmed that the UK was set to overlook his two foremost fiscal rules — to have each a falling public debt burden and borrowing under 3 per cent of gross home product by 2028.

Amongst all different massive superior nations, solely Germany was anticipated to shrink, with output in Europe’s largest economic system forecast to slide by 0.1 per cent this 12 months.

Some smaller European economies have been predicted to do worse than the UK this 12 months as a result of they suffered extra from the surge in wholesale gasoline costs final 12 months.

They included Sweden, the Czech Republic and Estonia however the IMF anticipated all three to broaden this 12 months, since their foremost issues hit on the finish of 2022.

Evaluating the fourth quarter of 2023 with a 12 months earlier, together with solely efficiency inside 2023, the UK economic system was anticipated to shrink 0.4 per cent, worse than every other superior economic system other than Denmark.

Russia’s development forecast of 0.7 per cent in 2023 was stronger than that of Britain, however in contrast to in January, the IMF didn’t single out the UK for criticism. Pierre-Olivier Gourinchas, the fund’s chief economist, grouped it along with the eurozone as an space of the world the place “the slowdown is concentrated”.

Hunt will attend the IMF and World Financial institution spring conferences in Washington DC this week, the place he’s set to reiterate his view that “the declinists are fallacious and the optimists are proper” in regards to the UK’s financial prospects.

The fund’s forecasts don’t help this view. In a nod to the latest banking turmoil, IMF analysts famous that the disaster that adopted then chancellor Kwasi Kwarteng’s “mini” Budget final 12 months have been an instance of the “vital vulnerabilities [that] exist each amongst banks and non banks” around the globe.

Hunt will meet different finance ministers and central financial institution governors at a time when he hopes the UK can be out of the highlight.

On the fund’s final gathering in October 2022, Kwarteng needed to answer questions from peers in regards to the risks of contagion from the disaster sparked by his announcement of £45bn of unfunded tax cuts.

Hunt will obtain some reassurance from the IMF information. After predicting a contraction of 0.3 per cent this 12 months, it expects development of 1 per cent in 2024, rising to 1.5 per cent by 2028.

This forecast was considerably weaker, nevertheless, than these drawn up by the Workplace for Price range Duty, the fiscal watchdog, which underpinned final month’s Price range.

The IMF’s extra sober outlook was additionally mirrored in its predictions for the general public funds, which confirmed a deficit of three.7 per cent of GDP by 2028 in contrast with the OBR’s forecast that it will fall to 1.7 per cent of GDP.

That might push borrowing above Hunt’s dedication to maintain it under 3 per cent of GDP.

Larger borrowing within the IMF’s forecasts would additionally cease the general public debt burden from falling. As a substitute of public sector internet debt as a share of GDP falling by 2027-28, the IMF expects the online debt burden — measured barely in a different way — to stabilise above 100 per cent of GDP.

[ad_2]

Source link