[ad_1]

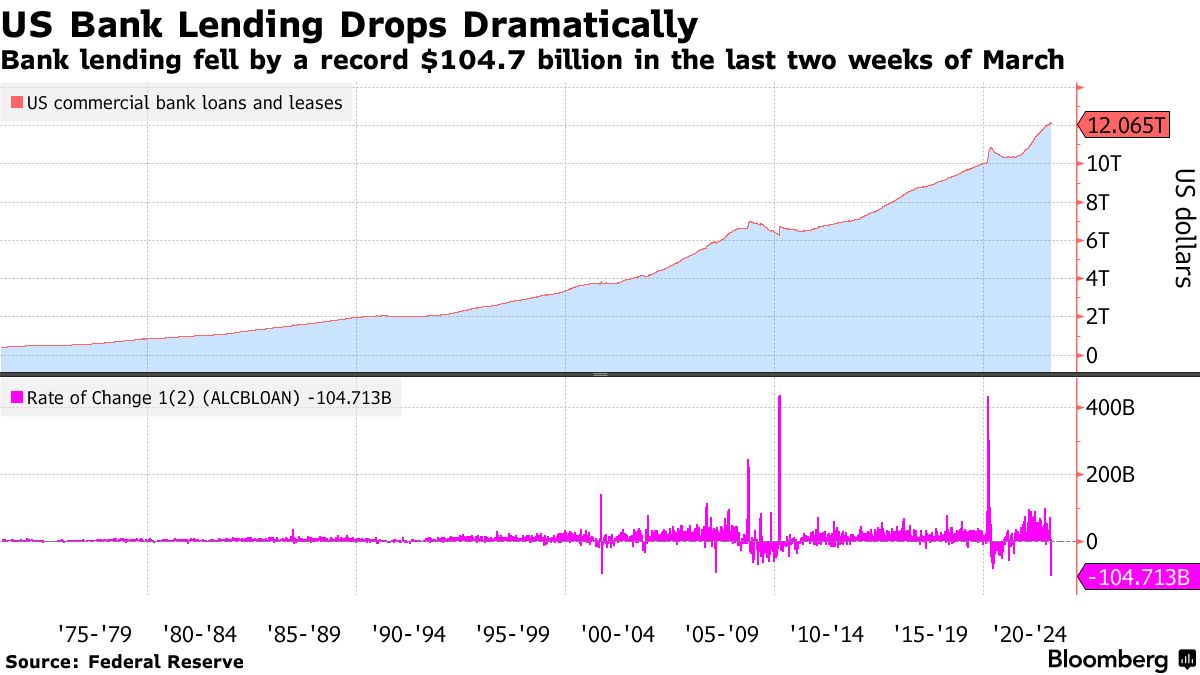

The banking business in the USA continues to be struggling after the collapse of three main banks. In response to statistics, financial institution lending within the U.S. has dropped by near $105 billion within the final two weeks of March, which is the biggest decline on document. Moreover, Elon Musk, a Tesla govt and proprietor of Twitter, not too long ago commented on trillions of {dollars} being withdrawn from banks into cash market funds, and he insists that the “pattern will speed up.”

Statistics Nonetheless Present Obtrusive Indicators of U.S. Financial institution Weaknesses; Musk Points Warning

There are nonetheless loads of indicators displaying that the U.S. banking system is feeling the aftermath of a number of high-profile financial institution collapses. Throughout the first week of March, Silvergate Bank, Silicon Valley Bank (SVB), and Signature Bank (SBNY) closed down operations. Each SVB and SBNY have been positioned beneath authorities management. The U.S. Federal Reserve, Treasury, and Federal Deposit Insurance coverage Company (FDIC) bailed out SBNY and SVB’s uninsured depositors and made all depositors entire.

Since then, the banking contagion has unfold throughout the USA and internationally, with monetary establishments like SVB UK and Credit Suisse faltering. In response to a latest report printed by Bloomberg, the final two weeks of March noticed the biggest contraction in lending on document after the collapses. The Federal Reserve’s information on the topic solely goes again to 1973, and within the final two weeks of March 2023, virtually $105 billion was erased.

Alexandre Tanzi from Bloomberg explains that loans consisted of business, industrial, and actual property loans. Moreover, final week noticed $64.7 billion in industrial financial institution deposits faraway from monetary establishments, which marked the tenth straight weekly decline in deposits. One other signal of hassle is the spike in Federal Dwelling Mortgage Financial institution (FHLB) bond issuance in March. Jack Farley, a journalist and macro researcher for Blockworks, shared a chart displaying FHLB bond issuance surging final month “to simply beneath 1 / 4 trillion {dollars}.” Farley added:

That is over six instances the post-GFC common for the month of March and it signifies banks’ scramble for money.

Furthermore, the favored Twitter account Wall Street Silver (WSS) shared a video of economist Peter St. Onge explaining {that a} important quantity of financial institution deposits are transferring to cash market accounts. WSS tweeted, “Trillions of {dollars} are draining out of the banks… into cash market funds. That weakens the banks. Worry that the banks are in danger is driving this pattern and thus making the banks even weaker.” The economist’s video assertion and WSS’s tweet sparked a response from Twitter’s proprietor, Elon Musk. The Tesla govt warned:

This pattern will speed up.

This isn’t the primary time Musk has cautioned the general public concerning the U.S. banking system, as he has criticized the U.S. Federal Reserve on a number of events. In November 2022, Musk warned that the U.S. would see a extreme recession and urged the Fed to slash the federal funds price. In December 2022, the proprietor of Twitter said {that a} recession would amplify if the Fed raised the rate of interest and the central financial institution elevated the speed. Musk additionally insisted in December that the Fed’s fast price hikes would go down in historical past as one of many “most damaging ever.” After the three main U.S. banks failed in March, Musk lambasted the Fed’s information latency and referred to as for a direct drop in rates of interest.

What do you suppose the long-term results of the latest financial institution collapses and reduce in lending shall be on the U.S. economic system? What do you consider Elon Musk’s warning? Share your ideas about this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Bloomberg Chart,

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link