[ad_1]

Thousands and thousands of U.S. {dollars}’ value of cryptocurrency has been despatched to centralized exchanges (CEXs), most notably Binance, from wallets offering funds in assist of Russia’s warfare effort in Ukraine, transaction knowledge suggests. In accordance with Ukrainian analysts, the cash was transferred to the crypto buying and selling platforms in an effort to be laundered.

Over 90% of Professional-Russian Crypto Transfers Recognized in a Research Despatched to Largest Alternate

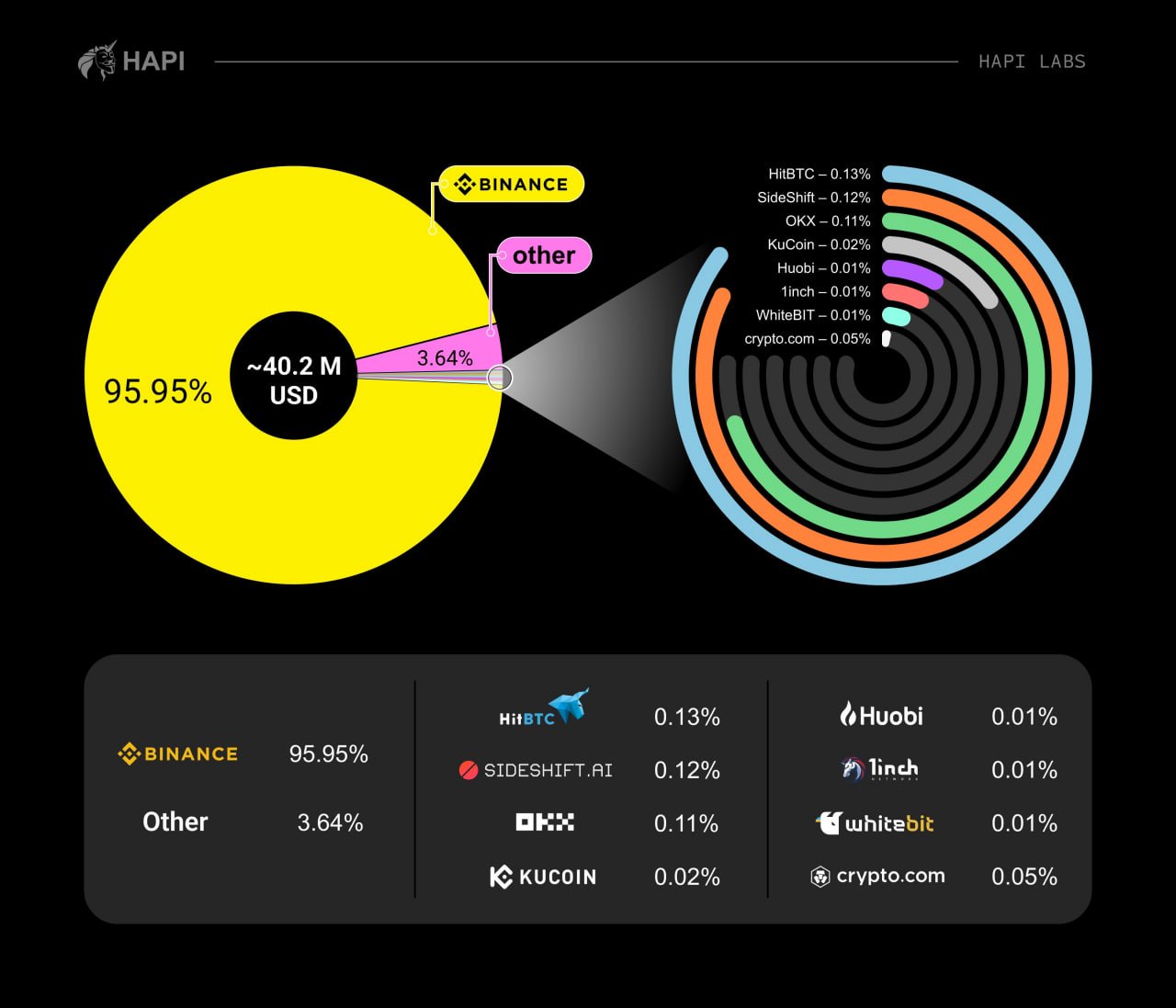

Greater than $40 million was despatched final 12 months from wallets that have been used to sponsor the Russian invasion of Ukraine to cryptocurrency exchanges, in line with an evaluation of such transactions performed by Hapi Labs. The principle function of those transfers was to launder the cash, the Ukrainian startup claims in a post on Twitter printed Tuesday.

Whereas numerous quantities went to quite a lot of crypto platforms, practically 96% of the digital money reached Binance, the world’s largest cryptocurrency trade. Researchers on the firm, which supplies blockchain monitoring instruments and knowledge evaluation software program, consider this is a sign of failures within the anti-money laundering (AML) procedures.

On the similar time, quantities transferred in the wrong way — from exchanges to wallets used to assist the Russian warfare on Ukraine — are rather more modest, the decentralized safety protocol builders identified.

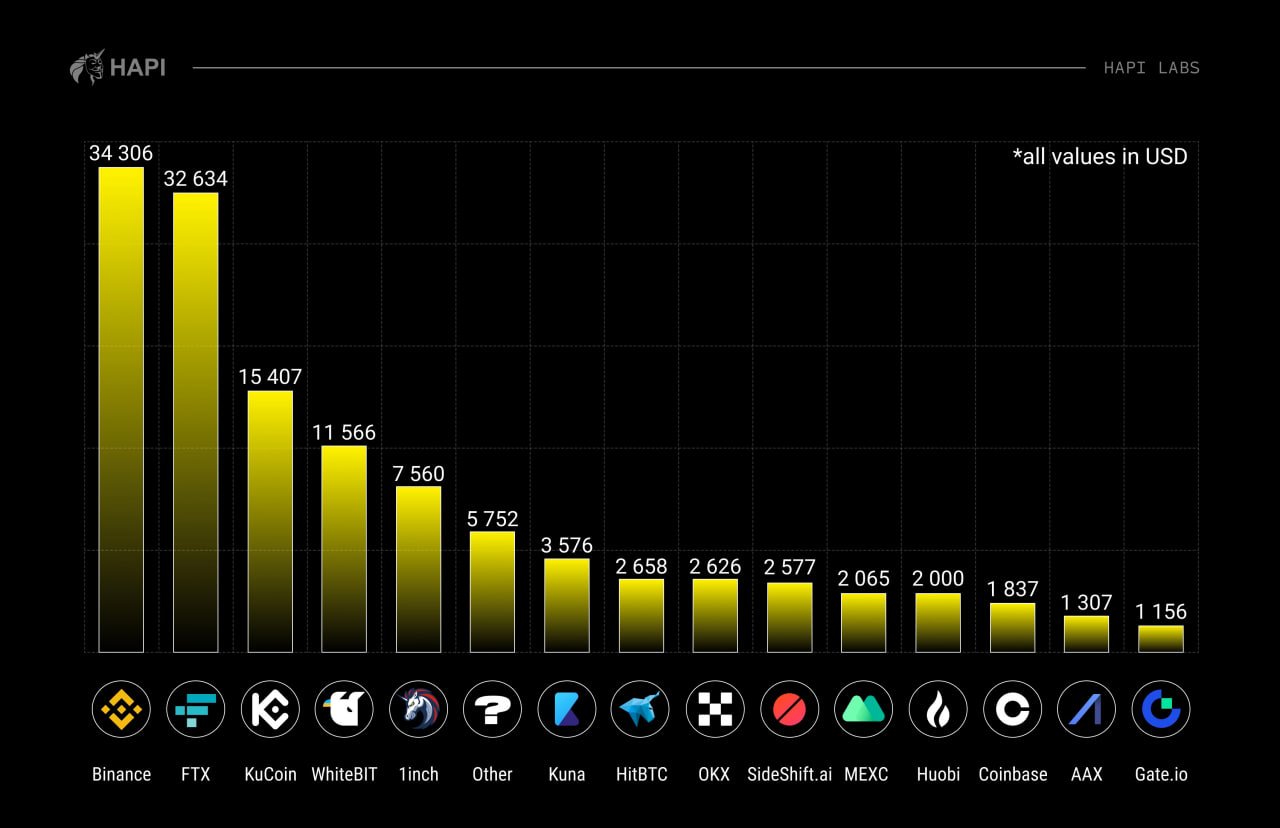

“Binance remains to be among the many leaders, however as we will see, it’s not the one one. Say whats up to the bankrupt @FTX_Official and others!” they remarked in one other tweet. Two different main centralized exchanges, Kucoin and the European, Ukraine-rooted Whitebit, are additionally within the high 5, together with the decentralized aggregator 1inch.

Hapi Labs tracked donations for weapons and ammunition supposed for the Russian military and numerous personal army firms, together with teams related to the 2 Russia-backed self-proclaimed republics within the Donetsk and Luhansk areas, Mark Letsyuk, the corporate’s head of analytics and analysis, instructed the crypto information outlet Forklog.

Typically, exchanges don’t block wallets concerned within the financing of the Russian army aggression for greater than six months, regardless of requests by regulation enforcement authorities, the Ukrainian blockchain forensics consultants identified.

“Centralized exchanges ought to block such wallets as quickly as doable after notification. However most frequently they’re both not blocked in any respect, or they’re blocked very late, when soiled funds have already handed by means of them and the account is empty,” Letsyuk added, commenting on the findings.

He additionally famous that Whitebit is essentially the most fast to reply to alerts from regulation enforcement businesses and cybersecurity firms whereas cooperating with Hapi Labs and Ukrainian particular companies to trace and block transactions linked to the Russian marketing campaign.

Binance Blames Unregulated and Sanctioned Exchanges

Representatives of Binance referred to a latest article by Chagri Poyraz, head of its international sanctions staff, who highlights that the platform makes use of analytical instruments from Elliptic, Chainalysis, and TRM Labs to observe transactions. He additionally explains that it’s not quite simple to dam incoming transactions which could be investigated solely after they’re made.

These funds could be tracked, however it is rather tough to freeze or block, he elaborated. Poyraz additionally emphasised that unregulated or sanctioned exchanges don’t carry out know-your-customer (KYC) checks or adjust to present AML guidelines. And most of them are based mostly in Russia whereas some are working from China or India.

Binance additionally reminded that through the first eight months of the battle in Ukraine, greater than $4 million in cryptocurrency was raised in assist of pro-Russian organizations, most of that are already positioned underneath sanctions. In accordance with a report by Elliptic launched in February 2023, such entities have raised round $4.8 million for the Russian army and related militias.

The 2 quoted figures are a lot smaller than the one produced by Hapi Labs, which can point out that not the entire funds that handed by means of the wallets the corporate studied characterize war-related donations. Each side within the battle have been raising crypto and in line with Elliptic, over $212 million has been despatched to Ukraine.

Do you suppose crypto exchanges have the means to limit transactions associated to funding the warfare in Ukraine? Share your ideas on the topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link