[ad_1]

Good morning. This text is an on-site model of our FirstFT e-newsletter. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Our prime story at present is a scoop on Arm. The UK-based firm is seeking to raise prices for its chip designs in a bid to spice up revenues forward of a hotly anticipated preliminary public providing in New York this 12 months.

A number of trade executives and former workers mentioned Arm knowledgeable clients of plans to cease charging chipmakers royalties for utilizing its designs based mostly on a chip’s worth and as a substitute cost makers of units comparable to smartphones based mostly on the worth of the gadget.

This implies the SoftBank-owned group stands to earn a number of occasions extra for every design it sells, as the common smartphone is vastly costlier than a chip.

The transfer is without doubt one of the greatest enterprise technique shake-ups in a long time for Arm, which designs blueprints for semiconductors discovered in additional than 95 per cent of all smartphones. One former senior worker mentioned proprietor SoftBank was “testing the market worth of the monopoly that Arm has” by asking to be paid more cash “for broadly the identical factor”.

In different chip information, semiconductor firms together with Intel are fighting US clampdowns on so-called without end chemical substances which are utilized in myriad merchandise however are gradual to interrupt down within the surroundings.

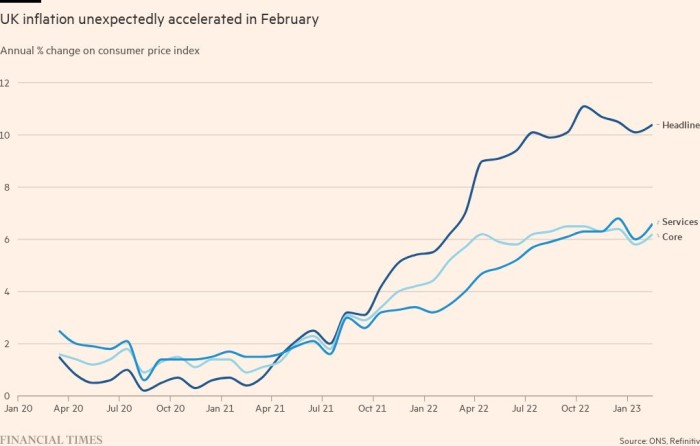

For at present, I’ll be intently watching the Financial institution of England’s resolution on rates of interest, which comes after the US Federal Reserve pressed forward with a quarter-point improve. The UK resolution is complicated not just by recent turmoil in banks but in addition by an surprising leap in inflation to 10.4 per cent in February (see the breakdown in our Chart under).

I’m additionally protecting tabs on:

-

Financial information: The EU has flash shopper confidence figures for this month and the US has weekly unemployment claims.

-

Outcomes: Accenture, Lloyd’s of London, Inchcape and Wickes report. See the full list in our Week Ahead newsletter.

-

EU assembly: The European Council begins a two-day assembly in Brussels to debate Russia’s invasion and the bloc’s assist for Ukraine.

What did you consider at present’s FirstFT? Tell us at firstft@ft.com. Thanks for studying.

5 extra prime tales

1. Business property is among the many greatest perceived dangers for US banks, becoming a member of deposit flight and bond portfolios. Hovering borrowing prices from rising rates of interest have strained the $5.6tn marketplace for business actual property loans. Now, the threat of a credit crunch has overtaken inflation as investors’ biggest worry.

2. The Financial institution of England warned US regulators concerning the dangers at Silicon Valley Financial institution nicely earlier than its collapse, central financial institution governor Andrew Bailey informed a British parliamentary committee. The letter revealed yesterday cited “concentration risk” and the “overlap of clients” between SVB’s lending and deposit books.

-

US banks: Treasury secretary Janet Yellen dominated out a broad enlargement of deposit insurance coverage to guard savers, fuelling a sell-off in shares of smaller US banks.

3. Indignant US bondholders and legal professionals are making ready to sue the Swiss authorities over its resolution to jot down down $17bn of Credit score Suisse further tier one bonds as a part of the financial institution’s shotgun marriage with UBS. One chief funding officer likened Switzerland to a “banana republic”.

4. French president Emmanuel Macron defended his unpopular plan to boost the retirement age however acknowledged public anger over the transfer, which he referred to as “a necessity for the nation”, in his first public remarks since his government forced the change through parliament.

5. Germany dangers working out of fuel subsequent winter, says its vitality watchdog. The Federal Community Company has warned that firms and households might want to reduce fuel use additional if the country is to avoid an energy crunch next winter.

The Huge Learn

The EU desires to make solar energy its single greatest supply of vitality by 2030. That might imply virtually tripling its solar energy technology capability over the subsequent seven years. The issue is greater than three-quarters of the EU’s photo voltaic panel imports in 2021 came from a single country: China.

We’re additionally studying . . .

Chart of the day

The unexpected jump in UK inflation to 10.4 per cent in February, coupled with turmoil within the world banking sector, leaves the Financial institution of England with an excellent harder resolution at present. The newest information has bolstered fears that value rises are more and more being pushed by home pressures fairly than exterior shocks.

Take a break from the information

In contrast to Logan Roy, Succession creator Jesse Armstrong is aware of when to name it a day. In its fourth season, the ultimate act of the peerless comedy, Succession reaches new highs, lows and a few shocking human feelings, writes critic Dan Einav. Read his review ahead of the season 4 premiere this week.

Extra contributions by Gordon Smith and Emily Goldberg

Thanks for studying and keep in mind you’ll be able to add FirstFT to myFT. You too can elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to firstft@ft.com

[ad_2]

Source link