[ad_1]

Earlier than they had been pushed out by Ukrainian troops, the Russian troopers scrawled “BOOM” in garish purple lipstick throughout the laboratory desk within the Nibulon grain terminal.

They ransacked places of work on the firm’s partially destroyed Kozatske facility, which lies on the west financial institution of the Dnipro river in southern Ukraine. They even destroyed the flower beds planted exterior.

“Earlier than the battle we constructed silos, roads, a fleet of ships, all with Ukrainian metal . . . Ukraine had one in every of its greatest harvests ever,” remembers Andriy Vadatursky, Nibulon’s chief govt and scion of the household that owns the Ukrainian grain firm.

“After the battle, all the pieces stopped,” he continues. “The Russians try to destroy ports, the vitality system . . . and naturally the stream of grain.”

No particular person can encapsulate the entire bloody story of Russia’s full-scale invasion of Ukraine. However Nibulon, one in every of Ukraine’s largest agro-industrial firms, comes shut.

As a pioneering firm that helped develop Ukrainian agriculture right into a world chief, it’s also an instance of how the Russian invasion has thwarted the nation’s financial potential and undermined its skill to maintain the battle and set up itself as a thriving democracy.

The 92,000-tonne Kozatske silo in Kakhovka — nonetheless shelled periodically by the Russian troops that retreated throughout the river final autumn — was one in every of 22 the place Nibulon as soon as collected thousands and thousands of tonnes of grain yearly. It then shipped the grain downriver in company-made metal barges to the port of Mykolayiv, and loaded the cargo into bulk carriers sure for world markets.

It was a logistics chain that helped remake post-Soviet Ukraine because the “breadbasket of the world” and turned Nibulon into one in every of its most profitable firms. It made the corporate’s founder, Oleksiy Vadatursky, an estimated $430mn fortune and gained him the “Hero of Ukraine” award, which pro-European president Viktor Yushchenko bestowed in 2007.

It additionally singled him out as a high-value Russian goal. Final summer time, Oleksiy, 74, and his spouse Raisa had been killed of their Mykolayiv house amid a volley of Russian missiles. On the time, President Volodymyr Zelenskyy described his dying as “an awesome loss for all of Ukraine”. No one else was killed within the assault on the town that evening, and senior officers intimated it had been a deliberate assassination.

“I bear in mind each minute of that day,” says Andriy, Oleksiy’s solely son, who out of the blue needed to assume management of the corporate. “My father and mom had been killed on July 31. I turned chief govt on August 4. On the fifth I held his funeral and had to ensure we had sufficient cash to pay workers their salaries.”

Russia’s invasion has spawned many casualties: an estimated 100,000 Ukrainian troopers killed or wounded, 30,000 civilians useless, 8mn refugees and one other 5mn displaced throughout the nation. However along with this human toll, the battle has devastated the Ukrainian financial system and its firms.

Final yr, the financial system shrank by 30 per cent and unemployment hit 35 per cent. Over three-quarters of firms stopped or scaled again manufacturing. Repeated Russian missile assaults on Ukraine’s electrical energy system hammered output simply because it was starting to recuperate.

The top of winter and higher energy provides have now stabilised enterprise sentiment, though at a low stage, based on the central financial institution. “We’ve handed the important level,” says Oleksandr Gryban, deputy financial system minister. “We’re changing into safer towards financial disruption.”

Even so, Ukrainian firms nonetheless face an uphill battle. Many are reducing manufacturing and workers. Rates of interest stand at 25 per cent, squeezing home lending. Non-performing loans within the banking sector stand at 38 per cent. They’ve risen quickest amongst giant firms and people with overseas foreign money loans, says Nataliia Shapoval, director of the Kyiv College of Economics Institute.

That’s as a result of Russia’s blockade of the Black Sea has choked off their essential export routes and an UN-sponsored deal, which has allowed 25mn tonnes of grain to go away sure ports, has solely supplied partial reduction. In 2019-2020, the sector exported 55mn tonnes of wheat, corn and barley.

Different giant agriculture firms have struggled. The battle pushed each grain exporter Kernel and poultry grower MHP to what credit score rankings firms contemplate the brink of default, although Kernel has since bounced again. As for Nibulon, which owes a complete of $570mn to 26 western and Ukrainian collectors, it stopped paying its worldwide lenders final autumn.

“Folks discuss rather a lot about army help and the way persons are struggling. However no one is speaking about firms,” says Vadatursky. “I’m frightened that within the larger image, enterprise is not going to survive. And enterprise is prime to each nation.”

Rise and fall

Oleksiy Vadatursky was an entrepreneur who absolutely understood how elementary enterprise is to a rustic’s sense of wellbeing.

Identified in Kyiv as “Previous Man River”, he grew up on a collective farm with a shock of white hair and a physique that appeared like packed concrete. In 1991, the yr of Ukraine’s independence, he additionally had a superb entrepreneurial imaginative and prescient.

The then 42-year-old sought to construct a farming-cum-logistics-cum-shipbuilding conglomerate based mostly out of a Soviet ship constructing plant in Mykolayiv. His central concept was to show the Dnipro into an agricultural logistics artery just like the Mississippi within the US.

Whereas Ukrainian oligarchs made billions within the post-Soviet years by state seize and graft, Vadatursky constructed up his empire with the help of loans from a spread of private and non-private monetary establishments each in Ukraine and overseas.

“There are various totally different gradations of odiousness in Ukrainian companies, however on the good excessive had been folks like previous man Vadatursky — a Soviet man, powerful as nails, however with a coronary heart of gold, who confirmed you might arrange a clear enterprise,” says Daniel Bilak, head of worldwide regulation agency Kinstellar’s observe in Kyiv.

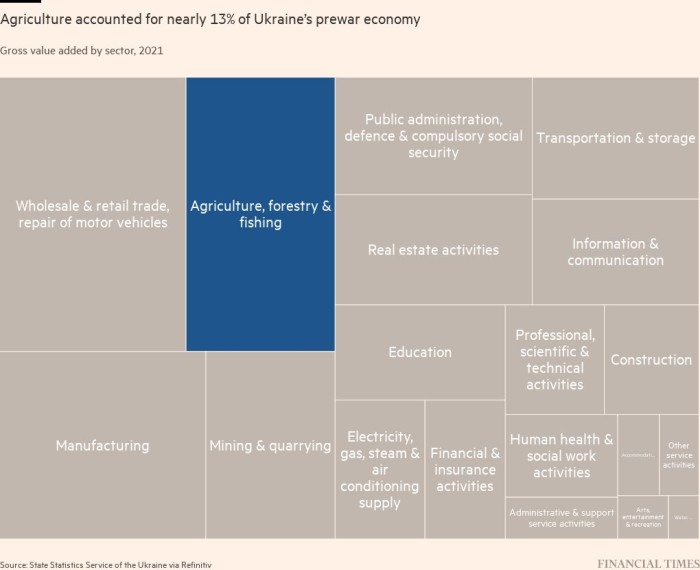

On the time, Ukraine was barely self-sufficient in meals. Within the early 2000s, its grain harvest even dropped as little as 20mn tonnes. By 2021, nonetheless, the nationwide harvest had tripled to virtually 60mn tonnes, and the sector employed 14 per cent of the inhabitants and accounted for a 3rd of nationwide financial output.

Oleksiy turned a rich tycoon, commanding a fleet of 82 vessels and over 76,000 hectares underneath cultivation. However his entrepreneurial imaginative and prescient additionally benefited the broader area, and his fame was additional burnished for preserving Nibulon in Ukraine, as an alternative of transferring it to decrease tax jurisdictions offshore, and for his giant investments within the space.

Nibulon additionally shipped grain for 4,500 personal farmers at farm-to-ship transport prices as little as $5 a tonne. And as a 3rd of Ukrainian grain exports moved by Mykolayiv, the port and Nibulon’s operations there boomed.

“He was the daddy to [Nibulon’s] 6,000 workers,” Andriy Vadatursky says.

Then the Russians invaded. Troops occupied close by Kherson, and shelled Mykolayiv each day for 9 months — together with the salvo of missiles that killed Oleksiy final July.

None of Mykolayiv’s former bustle was evident on a current go to. Boarded-up barges and tugboats had been moored on the quay. Seabirds whirled round buildings half-destroyed by missiles. And enemy troops occupying the Kinburn Spit throughout the estuary nonetheless often launched assaults, together with on a Nibulon boat in November.

“Lots of our massive firms have been destroyed and aren’t coming again but — the army dangers are too massive,” says Vitaliy Kim, governor of the Mykolayiv province, sitting in an improvised workplace after a Russian missile destroyed his former workplace in metropolis corridor. “The large drawback is jobs.”

Native firms have accomplished their greatest to adapt. Agrofusion, Europe’s third-biggest maker of tomato paste, has used cellular properties to deal with staff who misplaced their properties to the battle. Regardless of its shattered greenhouses, it restarted some operations final month, based on Kim.

Nibulon has in the meantime needed to reinvent its logistics chain, as have all of Ukraine’s grain firms. With no entry to the Black Sea and far of the Dnipro off limits, the invasion pushed up transport prices to over $150 a tonne, Vadatursky mentioned.

The corporate has since constructed a terminal at Izmail on the Danube that ships round 240,000 tonnes a month. That has helped scale back transport prices to round $125 a tonne. Even so, from a file 5.6mn tonnes in 2021, Nibulon’s exports dropped final yr by two-thirds to 1.8mn tonnes.

Mines and unexploded ordnance are one other drawback. Mykolayiv was virtually captured in March as Russian forces tried to push in direction of Odesa, and the roads out of city are flanked by trenches and run by artillery-pocked fields neglected by concrete pillboxes.

At an agricultural plant in Snihurivka, a small city some 40km from Mykolayiv that after stood on the frontline, tools hangers and grain silos have been shot to items, the tarmac is charred by gunfire, a dormitory village has been all however deserted, and uneasy Ukrainian troops stand guard.

“Over a 3rd of buildings are fully destroyed, 95 per cent are broken, there isn’t a electrical energy and there’s no water. We dwell off support,” says Alexander, a city spokesperson. “Few folks have come again, and anyone dwelling here’s a bit mad.”

He gestured at skinny strips of roped-off land which were demined so repairmen can repair the overhead electrical cables.

“They are saying each month of battle requires a yr of demining. So meaning it’ll take 9 years to demine right here,” Alexander says. “Will folks come again? Perhaps by no means.”

Financial life help

With as a lot as 1 / 4 of Ukraine’s 40mn hectares of arable land in want of demining, eradicating unexploded munitions could be the most harmful activity going through agricultural firms comparable to Nibulon. However Vadatursky’s most urgent want is money — he calls it “oxygen” — to tide the corporate over the battle.

The Nibulon chief govt desires a negotiated debt standstill that may give the corporate monetary respiration house. However an try and agree a debt rescheduling settlement with worldwide collectors has stalled. Some Ukrainian banks have even began to grab the corporate’s property.

To get finance flowing once more, Vadatursky desires Ukraine’s western allies to supply ensures masking battle dangers so that personal and multilateral growth banks can lend to Ukrainian firms.

Deputy financial system minister Gryban says a high precedence for Kyiv is persuading Ukraine’s G7 allies to create a belief fund to cowl reinsurance prices for personal lenders. Thus far, although, just a few tens of thousands and thousands of euros have been made accessible to cowl battle dangers in Ukraine, supplied by the World Financial institution’s Multilateral Funding Assure Company.

As for direct funding, the World Financial institution’s personal lending arm, the IFC, has earmarked $2bn to assist Ukrainian companies, however there was no authorities compensation for enterprise losses. In the meantime personal capital stays leery of investing right into a battle zone. Corruption, significantly within the judicial system, additionally stays a giant deterrent to new funding.

These nonetheless keen to take a position are looking for what Vadatursky calls “felony” knockdown costs. “Ukrainian property are very low cost, so in fact, there may be curiosity to purchase,” he says. “The query is whether or not it’s an excellent time to promote.”

Tomas Fiala, chief govt and founding father of Dragon Capital, a Kyiv-based funding financial institution and asset administration firm, concurs.

“Non-public fairness companies and different overseas traders are definitely trying and utilizing this time to lift funds,” he says. “However though persons are very sympathetic, 95 per cent of that cash gained’t be invested right here till the battle is over.”

One hope is {that a} profitable Ukrainian army offensive this spring will deliver the top of the battle nearer by pushing out the Russian invaders, maybe through a southern assault which severs the territory connecting the Russian mainland to Crimea. That would assist finish Russian management of the Dnipro and permit firms comparable to Nibulon to make use of the river as a logistics artery once more.

One other massive benefit can be if the UN-brokered grain initiative, which has enabled 25mn tonnes of grain to be exported from a few of Ukraine’s Black Sea ports, is ultimately expanded to incorporate the port of Mykolayiv and Nibulon’s amenities there. The settlement was prolonged on March 18, however no new ports had been added.

Nibulon’s future “relies upon very a lot on the grain hall”, says Gilles Mettetal, former director of agribusiness on the European Financial institution for Reconstruction of Improvement and now a member of Nibulon’s worldwide advisory board. “Nibulon can self-finance itself if it achieves a sure stage of exports.”

Succeeding Previous Man River

As if this uncertainty was not sufficient, Vadatursky should additionally cope with the company legacy of his celebrated father, all of the whereas reassuring nervous workers. It’s a troublesome balancing act.

Forty per cent of the corporate’s prewar workers can not work as a result of they joined the military, dwell in Russian-occupied territories or have moved away. However Vadatursky says he nonetheless seeks to “pay folks their salaries, to not hearth them, and save the workforce”. Round 80 per cent of Ukrainian firms say the identical, based on central financial institution surveys.

On the identical time, although, Vadatursky wants to maneuver the corporate on from the administration model of his father, which tended in direction of the patriarchal.

He has appointed a world advisory board, and divided the businesses’ essential features — agriculture, logistics, grain buying and selling and shipbuilding — into separate revenue centres. These are the varieties of recent, clear company practices that Ukraine must undertake throughout the board whether it is to draw overseas funding and combine into European markets after the battle.

First, although, Vadatursky must cope with his collectors. With a debt cost vacation and money in hand, he says, Nibulon might finance subsequent yr’s crop, unbiased farmers would skirt chapter, meals would develop, Ukraine would wish much less western support, and customers internationally would get cheaper meals.

“With out cash, you can’t do something,” he says. “It’s my primary precedence.”

Cartography by Cleve Jones

[ad_2]

Source link