[ad_1]

This text is an on-site model of our Disrupted Instances publication. Sign up here to get the publication despatched straight to your inbox thrice per week

At the moment’s high tales

For up-to-the-minute information updates, go to our live blog

Good night.

A shock jump in UK inflation to 10.4 per cent in February has fuelled considerations about the price of residing disaster and strengthened expectations that the Financial institution of England will increase rates of interest tomorrow.

The rise, from 10.1 per cent the earlier month, was pushed by an 18.2 per cent rise in meals and non-alcoholic drink costs, the very best tempo in additional than 45 years. Core inflation, which strips out meals and different unstable objects akin to vitality, additionally rose greater than anticipated, from 5.8 per cent to six.2 per cent.

Hovering meals costs are particularly dangerous information for poorer households as they make up a better proportion of their spending. The opposition Labour celebration accused the federal government of getting its priorities unsuitable, preferring a “£1bn bung” for the highest 1 per cent in its latest Funds, relatively than doing extra to alleviate pressures on these on the backside.

Meals costs have been pushed up by a spread of things. Britain’s farmers have been combating rising enter prices on every thing from gasoline to animal feed, whereas they’ve additionally lost income because of Brexit, as new UK help did not match earlier EU funds. February noticed an increase in salad vegetable prices and shortages at supermarkets due to provide chain issues in addition to antagonistic climate situations in Spain and Morocco. Farmers are additionally nonetheless affected by post-Brexit labour shortages.

Vitality costs, which had been the principle driver of the surge in inflation, are actually falling, however stay greater than within the US and the eurozone.

Like different central banks, the BoE is confronted with the duty of elevating charges to restrain inflation towards a backdrop of turbulence in the banking sector. Chancellor Jeremy Hunt informed parliament yesterday that the BoE ought to remain focused on the inflationary threat at the same time as he acknowledged that latest charge rises have been the “root explanation for the volatility we now have seen in latest months”.

Markets are actually predicting a rise of 0.25 share factors tomorrow, with some even pricing in an increase of 0.50 factors. Earlier than immediately’s knowledge, traders have been evenly break up between forecasting 1 / 4 level rise and no change.

Though the UK has the very best inflation within the G7, it’s not alone in struggling to show the tide. European Central Bank chief Christine Lagarde warned immediately of the danger of a “tit-for-tat dynamic” between corporations and employees as calls for for greater wages elevated worth pressures. Lagarde stated latest ECB charge rises have been solely beginning to take impact and wanted to proceed to “convey charges to sufficiently restrictive ranges” to damp demand.

Her feedback echo these of Bundesbank chief Joachim Nagel, who stated rate-setters must be “more stubborn” of their struggle towards inflation. Germany’s financial council individually warned that monetary market instability was making the task that much harder

Browse our global inflation tracker to see how your nation compares.

Must know: UK and Europe financial system

EU greenwashing guidelines that have been watered down after enterprise lobbying have been attacked by consumer groups. Industrialists stated the bloc’s makes an attempt to compete with US green subsidies have been inadequate. Brussels tried to resolve its spat with Germany over a proposed ban on autos with combustion engines by suggesting new fashions utilizing carbon-neutral e-fuels may very well be bought after 2035.

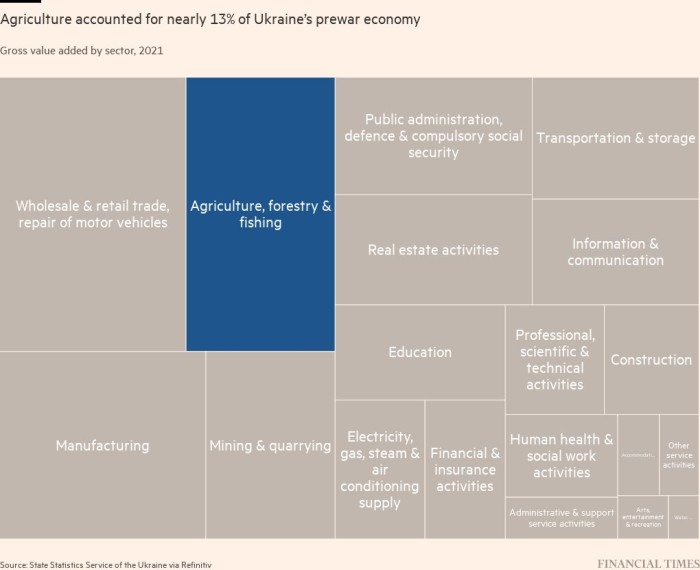

The IMF has struck a take care of Ukraine for a $15.6bn mortgage and a long-awaited financial lifeline. Our newest Big Read tells the story of the battle’s impact on Ukraine’s agricultural sector by the destiny of Nibulon, certainly one of its greatest grain producers.

Must know: International financial system

Chinese language president Xi Jinping backed Vladimir Putin over Ukraine however held again from confirming plans for an important pipeline to reroute Russia’s gas exports from Europe to Asia.

The IMF permitted a $3bn bailout for Sri Lanka to assist it restructure its money owed and tackle a “catastrophic” economic and social crisis. The nation’s progress is being intently watched by different troubled debtors that owe massive quantities to China, akin to Ghana and Pakistan.

Venezuela’s oil minister resigned amid a corruption probe into Petróleos de Venezuela, the state oil firm. Tareck El Aissami was a number one determine in former president Hugo Chávez’s “Bolivarian revolution”.

The Democratic Republic of Congo stated it was losing almost $1bn a year in minerals illegally smuggled into Rwanda together with gold, tin, tantalum and tungsten.

Must know: enterprise

Asian traders who had loaded up on Credit score Suisse AT1 debt have been stated to be “gobsmacked” on the $17bn bond wipeout when it was taken over by UBS. The EU vowed to take care of financial institution creditor hierarchies and respect bondholders’ rights, whereas the wipeout may hit further issuance of risky bank debt. Switzerland in the meantime has banned deferred bonuses for CS employees. Right here’s our new explainer on what the takeover means for UBS.

Within the US, treasury secretary Janet Yellen signalled that the federal government would supply further backing for deposits at smaller American banks if wanted. Financial institution shares rose in response. Need extra? Head to our particular “Banks in turmoil” part.

The pinnacle of JPMorgan Asset Administration warned that property may very well be the next sector under threat from rising borrowing costs. Industrial property values have began to fall in latest months as borrowing prices hit traders’ capability to transact.

Commodity merchants hit record profits in 2022 from excessive volatility in vitality markets after Russia’s invasion of Ukraine.

Chinese language tech group Tencent returned to progress as consumer spending started to tick up after pandemic restrictions ended. TikTok is caught up in a US-China authorized struggle over its powerful algorithm, stated to be one of the crucial superior makes use of of synthetic intelligence in client expertise.

Google launched its Bard chatbot, which gives solutions to text-based questions, in a bid to rival OpenAI’s well-liked ChatGPT.

Nestlé, the world’s largest meals firm, stated less than half of its mainstream food and drinks were considered “healthy”. The broadly used well being star ranking system measures ranges of saturated fat, sugar and salt in addition to “constructive vitamins” akin to fibre, fruit and greens.

The World of Work

Is it higher to make use of carrots or sticks to get individuals again into work? For the previous 25 years or so, loads of nations have gone huge on the latter, writes columnist Sarah O’Connor, however forcing the unemployed into low-paid work isn’t a good solution to today’s labour market problems, she argues.

What’s one of the best ways to get again into work after a number of years of retirement? Careers knowledgeable Jonathan Black and FT readers offer some advice.

Our new Working It podcast discusses the unintended penalties of mass lay-offs.

Some excellent news

Kindness is on the rise. Though this week’s World Happiness Report displays a turbulent interval of human historical past, it additionally exhibits a globe-spanning surge in benevolence, with “prosocial” acts about one-quarter extra frequent than earlier than the pandemic.

Thanks for studying Disrupted Instances. If this text has been forwarded to you, please enroll here to obtain future points. And please share your suggestions with us at disruptedtimes@ft.com. Thanks

[ad_2]

Source link