[ad_1]

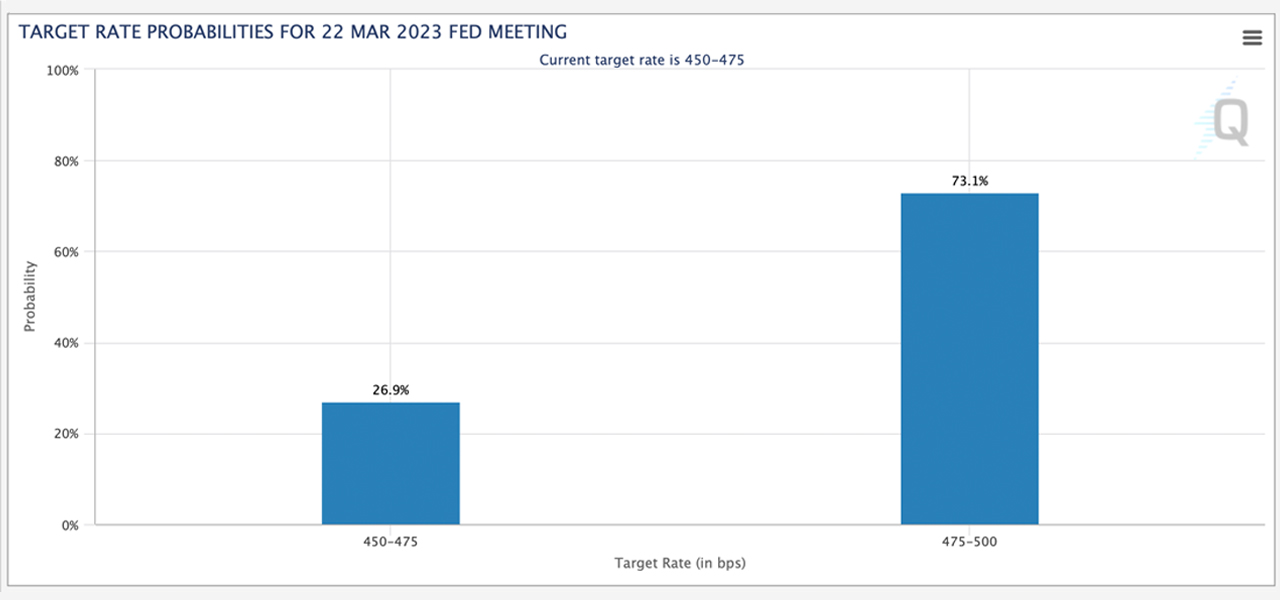

With the Federal Open Market Committee convening on Wednesday and the latest monetary troubles dealing with the U.S. banking system, White Home press secretary Karine Jean-Pierre stated President Joe Biden has “confidence” in Federal Reserve chair Jerome Powell. In the meantime, in accordance with the CME Group’s Fedwatch instrument, the goal price chance suggests the Fed will elevate the federal funds price by 25 foundation factors (bps) this week. There’s additionally a 26.9% probability the U.S. central financial institution gained’t elevate the speed this month.

Market Laser-Targeted on Upcoming Fed Assembly; Biden Administration Assured in Powell’s Management

It has been a tumultuous week within the U.S. banking trade as three main banks collapsed, and the Federal Reserve announced that it could totally bail out two of them. Moreover, the U.S. central financial institution created the Financial institution Time period Funding Program (BTFP) to help failed banks and their depositors. Furthermore, the Fed loaned the banks $164.8 billion to strengthen liquidity and collaborated on March 19 with 5 different main central banks to spice up U.S. greenback liquidity.

To make issues worse, a not too long ago printed paper signifies that roughly 186 U.S. banks are grappling with the identical issues as Silicon Valley Bank, and First Republic Financial institution’s inventory plummeted on March 20, shedding greater than 40% of its worth in a single day. Within the meantime, on March 22, the Federal Open Market Committee (FOMC) and Fed chair Jerome Powell will decide the destiny of the federal funds price.

Previous to the banking trade fallout, the U.S. central financial institution had been elevating the benchmark price quickly each month since this time final yr, following the numerous monetary expansion in response to the Covid-19 pandemic, which noticed the establishment retaining charges suppressed at zero. When inflation started to soar, Fed members, together with chair Powell, referred to it as “transitory” and predicted it wouldn’t final.

Nevertheless, the Fed’s swift financial tightening in response to inflation has brought about significant issues with long-duration Treasury notes. In the course of the White Home press briefing on Monday, press secretary Karine Jean-Pierre was requested about president Biden’s opinion of the Fed chair’s management and whether or not Powell is likely to be changed because the Fed’s head. “No, in no way. The president has confidence in Jerome Powell,” Jean-Pierre acknowledged.

Eight days prior, on March 13, president Biden had reassured Individuals that the U.S. banking system was safe. “Individuals can relaxation assured that our banking system is secure,” he said. “Your deposits are safe. Let me additionally guarantee you that we are going to not cease right here. We are going to do no matter is critical,” the U.S. president added.

Moreover, market strategists and economists are curious concerning the Fed’s plans for Wednesday, with some speculating that the central financial institution might be dovish. For instance, final week, Goldman Sachs chief economist Jan Hatzius revised the financial institution’s U.S. federal funds price forecast and acknowledged that he doesn’t anticipate a hike on Wednesday.

Different market analysts anticipate that the Fed will elevate the speed by 25 foundation factors (bps) this week. On the time of writing, the CME Group Fedwatch instrument signifies a 73.1% chance that the 25bps price improve will happen. The Fedwatch instrument additionally signifies that 26.9% of analysts predict no price hike this month.

What do you suppose the Fed’s choice might be this coming Wednesday? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link