[ad_1]

This text is an on-site model of our Disrupted Instances publication. Sign up here to get the publication despatched straight to your inbox 3 times per week

Right now’s high tales

-

The UN mentioned a 1.5C rise in global temperature was “extra possible than not” within the near-term, with the chance better than beforehand thought. It additionally concluded that the dearth of political dedication was a key barrier to progress in what was a “quickly closing window”.

-

Chinese language president Xi Jinping met Russian counterpart Vladimir Putin in his first state visit to Moscow for four years.

-

Police and troopers in South Africa had been deployed to quell a threatened “national shutdown” by the unconventional opposition Financial Freedom Fighters who’re demanding the removing of president Cyril Ramaphosa.

For up-to-the-minute information updates, go to our live blog

Good night.

“Banking is an enormous, sophisticated and delicate confidence trick. Usually it really works high-quality. However as quickly as individuals fear that it might collapse, it typically does, typically spectacularly.”

That was the view of Frankfurt bureau chief Martin Arnold after Credit Suisse was taken over by larger rival UBS on the weekend. The $3.25bn deal was finalised yesterday after Swiss regulators rushed to safeguard the nation’s banking sector and stop the disaster spreading throughout international markets.

Ever because the present turmoil started with the collapse of lenders within the US (see Enterprise part beneath), traders have nervous about which different banks could possibly be weak. Credit score Suisse was already in deep trouble after a sequence of scandals and management shake-ups and the shotgun wedding with UBS follows a $54bn failed lifeline from the Swiss central bank final week.

Though the deal cements UBS’s place because the world’s largest wealth supervisor, with invested property of $5tn, CS bondholders are in uproar and considering authorized motion after $17bn of the financial institution’s debt was worn out. Bondholders with further tier 1 (AT1) bonds — a type of debt launched after the worldwide monetary disaster to make banks enhance their capital ranges — will obtain nothing, whereas shareholders will get some SFr3bn ($3.2bn). EU authorities have also expressed concern. CS workers will nevertheless still collect their bonuses.

As Arnold factors out, Europe’s establishments, though in a stronger place than within the earlier disaster, are not immune to the current turmoil. Lenders are additionally more likely to develop into extra cautious, decreasing the move of credit score, rising the chance of a recession and elevating stress in already weak areas akin to business property — none of which is nice for banks, he notes.

European Central Financial institution chief Christine Lagarde right now welcomed the Credit Suisse takeover and mentioned the ECB was “prepared to reply as crucial” to protect worth and monetary stability. She burdened that the eurozone banking system was “resilient, with robust capital and liquidity positions”.

Though the financial institution failures in Europe and the US have completely different circumstances, one factor they’ve in widespread is the impact of sharp rises in international rates of interest, with the present tumult doubtlessly appearing as a brake on central banks’ plans, beginning with selections from the Federal Reserve on Wednesday and the Bank of England on Thursday.

The opposite main growth of the weekend was a co-ordinated plan from the Fed and 5 different central banks to improve access to US dollars “to ease strains in international funding markets”.

The large query nevertheless stays: are banks on the sting of a 2008-style meltdown?

FT deputy editor Patrick Jenkins, writing earlier than the CS deal, mentioned that even when the probabilities of one other full-blown financial meltdown had been low, our potential to take care of it is perhaps much less.

“Again in 2008, policymakers had been capable of slash rates of interest, launch quantitative easing and flood the banks with rescue capital and liquidity,” he writes. “With authorities stability sheets right now much more stretched, and rates of interest needing to rise to fight inflation, the weaponry at their disposal is dangerously diminished.”

Have to know: UK and Europe economic system

The DUP, Northern Eire’s greatest unionist occasion, will vote in opposition to Rishi Sunak’s deal on the province’s post-Brexit trading arrangements, dealing a blow to the prime minister and the probabilities of any imminent return of its power-sharing authorities.

One a part of the UK’s rail disputes has ended, after RMT union members accepted a pay offer from infrastructure proprietor Community Rail. The union remains to be in dispute with a gaggle of prepare working corporations, whereas drivers stay in talks with prepare corporations in their very own dispute over pay.

A think-tank chaired by former chancellor George Osborne advisable council tax, stamp obligation and enterprise charges in England needs to be changed with a devolved land-value tax as a part of a radical overhaul of local government funding.

A Financial institution of England plan to revamp financial institution capital guidelines risked a 25 per cent cut in lending to small businesses, in response to a brand new report.

Have to know: International economic system

Our newest Large Learn appears at how Singapore and Hong Kong, two of Asia’s greatest monetary centres, are vying to rival offshore places such because the Cayman Islands and shift the global centre of gravity for hedge funds and the world’s richest households.

India’s high-growth economic system — forecast by the IMF to increase 6.1 per cent this yr — is failing to create enough jobs, particularly for younger individuals, leaving many with out work or toiling in labour that doesn’t match their expertise.

Corporations are replanting tens of millions of hectares of bushes and producing income by means of carbon credit score gross sales as Brazil gears as much as reforest the Amazon.

Have to know: enterprise

The banking disaster on the opposite facet of the Atlantic continues too. The bid deadline for failed Silicon Valley Financial institution has been prolonged as buyers hold back; shares in First Republic plunged once more right now after its credit standing was lower for the second time within the house of per week; and New York Neighborhood Financial institution agreed to purchase many of the operations of collapsed Signature Bank. The failures of Signature and Silicon Valley Financial institution have thrown the highlight on smaller and regional lenders, shaking the publish 2008-view that the most important systemic risks lay with losses on the Wall Avenue giants.

Hollywood is bracing for a strike as screenwriters and film studios start contract negotiations which are anticipated to be probably the most contentious since 2007, when the movie and tv trade floor to a halt for 100 days. The Writers Guild of America is concentrating on compensation practices which have taken root within the streaming period — together with how royalties are paid.

Large Pharma desires the US authorities to extend chip industry tax breaks to the biotech sector. President Joe Biden introduced a nationwide biotechnology and biomanufacturing technique in September to strengthen provide chains, create American jobs and thrust back competitors, significantly from China.

Poul Weihrauch, the top of client group Mars, hit out at “nonsense” attacks on corporate ESG (environmental, social, and governance) commitments: “We don’t imagine that function and revenue are enemies.”

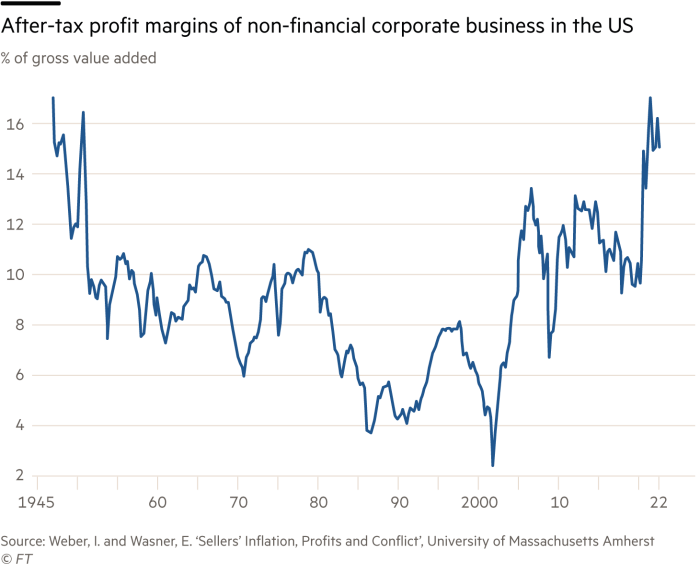

One among our charts of the week: Revenue margins of US corporations have reached ranges not seen because the aftermath of the second world war.

The World of Work

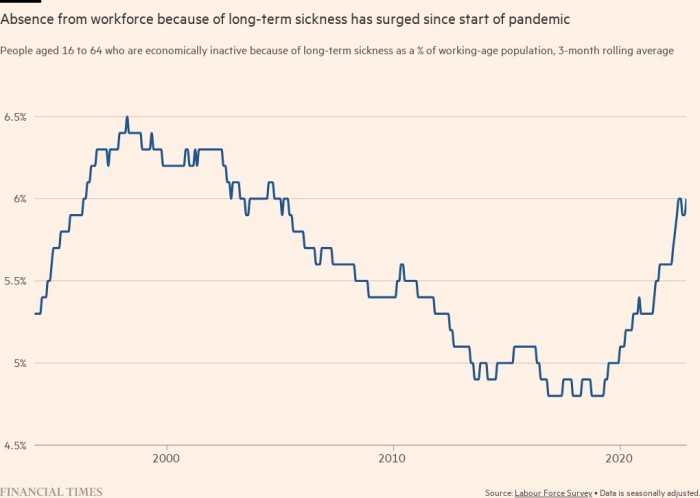

About 6 per cent of the UK’s working age inhabitants is at the moment “inactive” — not searching for or accessible for work — because of long-term illness, the highest rate in almost 18 years.

Client editor Claer Barrett welcomes new UK plans to enhance childcare however says the federal government’s “gross neglect and chronic underfunding” of the early years sector means it’s going to take years earlier than ladies actually profit from the modifications.

Columnist Jemima Kelly skewers the brand new office buzzword: “mattering”. The idea just isn’t about honouring working hours, or ensuring workers are reaching a correct work-life stability, however somewhat cultivating the assumption that you’re essential to others in your office.

Columnist Simon Kuper argues the larger paid ought to work longer than their lower paid counterparts that suffer depressing circumstances and a shorter lifespan.

Some excellent news

Profitable cataract surgical procedures on king penguins in a Singaporean wildlife park mark a milestone in veterinary medicine. “Whereas intraocular lens implants are widespread for people and a few home mammals, it’s possible the primary time they’ve been efficiently used on penguins,” the park says.

Thanks for studying Disrupted Instances. If this article has been forwarded to you, please join here to obtain future points. And please share your suggestions with us at disruptedtimes@ft.com. Thanks

[ad_2]

Source link