[ad_1]

Little greater than every week in the past, buyers thought it was a finished deal that the Financial institution of England would press forward with one more improve in rates of interest when its financial coverage committee meets this week.

By the tip of final week, pricing in monetary markets instructed that the probabilities of a policy transfer on Thursday could be no higher than even.

Successive scares within the monetary sector didn’t deter the European Central Financial institution from elevating rates of interest by 50 foundation factors final week, sticking to the script it had set earlier within the 12 months.

However even earlier than the collapse of Silicon Valley Bank — not to mention the weekend’s frantic negotiations to forge a rescue deal for Credit Suisse — the case for an extra rise within the UK’s benchmark rate of interest, which has climbed from 0.1 per cent to 4 per cent in simply 14 months, was much less clear-cut.

“For central banks that imagine they’ve much more tightening to do, for now it’s enterprise as normal,” stated Philip Shaw, economist at Investec. “Those who aren’t certain may put charges on maintain. That’s the class into which we put the Financial institution of England.”

When the MPC final met in early February, it deserted its earlier steering that additional fee will increase had been wanted, saying as a substitute that it might act solely on proof of “persistent inflationary pressures”.

Andrew Bailey, the BoE governor, warned buyers earlier this month to not assume that UK rates of interest would rise additional, because the UK’s inflation dynamics didn’t essentially match these of the US and EU.

“At this stage, I’d warning towards suggesting both that we’re finished with rising financial institution fee, or that we are going to inevitably must do extra,” he stated on March 1.

Knowledge launched since then has proven that the economic system was extra resilient than anticipated in January, with GDP development of 0.3 per cent pointing to a shorter, shallower downturn than feared.

This may very well be seen as vindication of the arguments put ahead by Catherine Mann, probably the most hawkish member of the MPC, who argued in February {that a} 12 months of coverage tightening had not but had as a lot of an impact as anticipated, and that extra was wanted “sooner quite than later”.

Kallum Pickering, economist at Berenberg, stated that “wanting one thing going drastically incorrect”, this pointed to an extra 0.25 share level fee rise on Thursday, as “with much less fear about recession, policymakers will most likely really feel extra assured to lean a bit tougher on home inflation pressures”.

Andrew Goodwin, on the consultancy Oxford Economics, took an analogous view, saying that whereas the state of affairs was “extremely unstable”, he anticipated the MPC to vote via one final quarter-point improve.

“A majority of MPC members will wish to increase rates of interest by 25 foundation factors to ensure they aren’t going simple on inflation too quickly,” stated Paul Dales on the consultancy Capital Economics.

The MPC may also must take account of measures introduced by chancellor Jeremy Hunt in final week’s Budget, together with additional assist for family vitality payments, assist with childcare prices and a £9bn tax break to spice up enterprise funding.

Though these may ultimately strengthen the availability facet of the economic system, within the brief time period they’re extra prone to result in stronger demand, which the BoE would wish to offset to maintain inflation on course.

Nonetheless, different information may strengthen the arguments made by the extra dovish members of the MPC — comparable to Swati Dhingra, who thinks that exterior worth pressures are already easing and that there’s little proof of wages spiralling upwards at a tempo that may preserve inflation too excessive.

Inflation fell to 10.1 per cent in January, consistent with the BoE’s forecasts, however a pointy drop in service sector inflation may very well be extra important as a result of it is a higher reflection of underlying pressures.

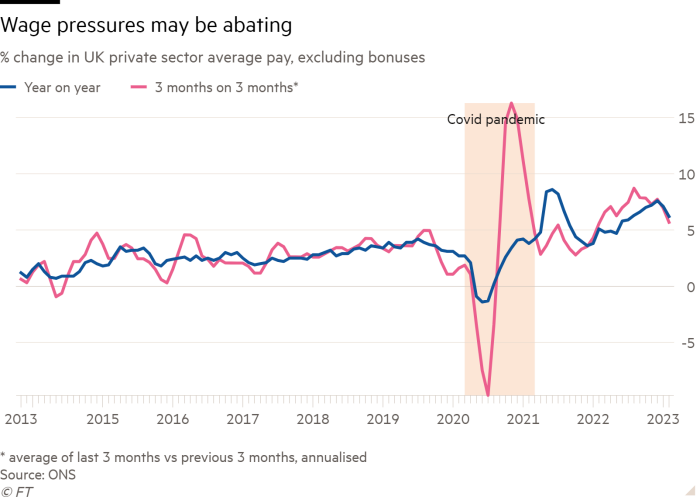

The backdrop within the labour market additionally appears to be like extra benign. Though there are nonetheless greater than 1mn vacant jobs, non-public sector wage development is lastly slowing and the workforce is beginning to develop once more.

The MPC will see yet one more key set of information — February’s inflation print is out on Wednesday — earlier than taking its choice. It’ll even have a clearer view of the extent of issues within the world banking sector, and can know whether or not the US Federal Reserve sees these as enough motive to gradual or pause its personal fee elevating cycle.

“By far the most important concern . . . can be inflation versus monetary stability,” stated Thomas Pugh, economist at RSM, who thinks that the flare-up of dangers will lead the MPC to “press pause earlier”.

The BoE’s personal message on Sunday, after Swiss authorities engineered the takeover of Credit score Suisse, was that the UK banking system was “effectively capitalised and funded and stays protected and sound”.

However even when the issues seen thus far are contained, and don’t grow to be broader systemic points, they present that rising rates of interest are actually having a tangible impact on each the monetary sector and the true economic system, with tighter monetary circumstances now prone to do a few of central banks’ work for them.

“The state of affairs remains to be very a lot in flux,” Dales stated. “The truth that issues within the banking system . . . may be traced again to the rises in world rates of interest means it’s pure for the MPC to grow to be extra cautious about additional tightening the screws.”

[ad_2]

Source link