[ad_1]

This text is an on-site model of Martin Sandbu’s Free Lunch e-newsletter. Join here to get the e-newsletter despatched straight to your inbox each Thursday

Ah, the recollections a great financial institution run can deliver again. I used to be in Brussels earlier this week, and loved reminiscing with veterans of the worldwide monetary disaster and the eurozone debt disaster over FT entrance pages plastered in downward-pointing charts and photos of apprehensive merchants. For a second, it felt like 2008 (or 2009, or 2010) yet again.

Hopefully, the fallout from the Silicon Valley Financial institution collapse is not going to come anyplace close to that, though as Credit score Suisse’s troubles present, nervousness has already crossed the Atlantic. At the least one distinction from 15 years in the past is that we gained numerous understanding from how these crises unfolded. However, the SVB story tells me that we didn’t totally be taught the teachings from final time. In reality, we’re nonetheless not in settlement on what these classes are.

For some — together with, it appears, the US authorities — the lesson was that no one ought to ever lose any cash they deposit in a financial institution, even when the “any individual” is a complicated midsize enterprise and the quantity is way above the deposit insurance coverage restrict. For me, the lesson was that we should have a monetary system the place non-public banks can by no means blackmail governments into bailing them out, lest panicked depositors deliver the entire economic system down.

As Matthew Klein so memorably puts it, banks are “speculative funding funds grafted on prime of important infrastructure. This construction is designed to extract subsidies from the remainder of society by threatening civilians with crises if the banks’ bets are ever allowed to fail. [The SVB bailout] is a reminder that these threats often work.” The coverage problem has at all times been to finish this state of affairs.

I’m with former US regulator Sheila Bair, who slams her successors for ruling the SVB scenario a danger to the complete US monetary system: “Is that system actually so fragile that it could’t take up some small haircut on these banks’ uninsured deposits?”

However even in the event you agree with retroactively guaranteeing SVB’s uninsured depositors, you should admit it displays a coverage failure. If all financial institution deposits ought to at all times have the federal government’s backing in full, then why didn’t we abolish outright the deposit insurance coverage restrict of $250,000, which is now presumably solely notional? (It’s €100,000 in Europe, which suggests the query there’s much more urgent.)

Be aware, by the best way, that nobody has questioned the knowledge of the a part of the US financial institution decision system that has labored as it’s purported to: unsecured bondholders within the failed banks will likely be written down — depositors, even uninsured ones, come first. Again within the eurozone disaster days, such “depositor choice” was seen as anathema, and consequently, quite a lot of Irish taxpayers are nonetheless shouldering the burden that the eurozone made Dublin take off the backs of Irish banks’ bond traders.

The true query SVB throws up is one which has obtained far too little consideration within the debate for the reason that disaster broke. Do we’d like our monetary system to supply an instrument the place anybody can retailer any sum of money with absolute security (in nominal phrases)? That’s what guaranteeing deposits in full quantities to.

There are explanation why such ensures have been stored restricted — though the bounds have been elevated in crises. It provides banks an incentive to be prudent in the event that they know they won’t be bailed out. It offers incentives to financial institution prospects too. As Bair factors out: “The uninsured depositors of SVB will not be a needy group.” It’s apparent why people and households want a protected place to obtain their salaries, handle their spending and maintain an quantity of liquid financial savings. However their want is met by the present insurance coverage schemes. The query is whether or not it’s needed to supply medium-sized companies that have to hold hundreds of thousands in money buffers with the identical security.

Even for these of us who’re sceptical of the SVB bailout, it isn’t apparent how such companies ought to go about managing their liquidity wants. The present mannequin requires corporations both to take a forensic take a look at their financial institution’s stability sheet — basically treating a deposit because the unsecured mortgage it truly is — or to unfold their money buffers throughout dozens of banks in order to remain beneath the restrict in every single place. Neither is especially sensible. And lots of companies’ publicity to financial institution deposits might be oblique: the Washington Publish’s blow-by-blow account cites the case of a payroll processor that used SVB for serving to its shopper corporations pay about 1mn staff.

As soon as we begin interested by this, it turns into laborious to see how a banking system designed alongside present traces might ever deal with this downside. That’s the reason I believe the primary criticisms SVB has triggered — of administration failure and regulatory failure — are reputable however considerably inappropriate.

SVB had quite a lot of bonds on its stability sheet of the kind which can be ultra-safe (US authorities and company debt), however not if it’s important to promote earlier than maturity, through which case the worth you get relies on present rates of interest. For the reason that Federal Reserve has raised rates of interest drastically up to now yr, promoting its bonds would have worn out SVB’s fairness cushion. Not hedging towards this danger was the administration failure. The regulatory failure was in letting this go beneath the radar, in spite of everything, however the greatest banks a number of years in the past have been spared the stress exams required by the hard-won Dodd-Frank guidelines imposed after the worldwide monetary disaster.

Each accusations have benefit however miss the larger level. In any case, Treasuries and US company bonds are essentially the most liquid property you possibly can spend money on, and as assured as something ever will get to pay out its promised worth in full. If even that is problematic from the standpoint of banks’ capacity to supply protected houses for giant depositors, what about their supposed perform of channelling financial savings to issues resembling mortgages and enterprise loans, that are a lot riskier and far more durable to liquidate? SVB’s critics say they need to have purchased hedging devices that eradicated the rate of interest danger in case of getting to promote their property earlier than maturity. However that’s basically saying that banks ought to chorus from their different conventional perform of maturity transformation — pooling instantly redeemable deposits towards investments locked up for the long run.

In the end, then, the SVB disaster ought to make us ask: what’s the level of banks? If offering protected storage of cash for enterprise depositors requires them to carry riskless property with no efficient period, they might as properly merely maintain central financial institution reserves. Or — what quantities to the identical factor — be promised access to cash from the Fed towards the complete worth of presidency bonds, which is what the central financial institution’s newest emergency programme presents. However these are very roundabout methods to safe financial stability, which we now appear to say require utterly protected enterprise deposits in arbitrary quantities. If we’d like these deposits to be backed by central financial institution reserves or one thing very very like them, what’s gained by interposing non-public banks out to make earnings on the intermediation?

Which is why, in Brussels this week, I requested Paschal Donohoe, the president of the eurogroup of finance ministers, and Paolo Gentiloni, the EU commissioner for the economic system, whether or not they and the assembled ministers had drawn the hyperlink between the SVB disaster and the undertaking for a digital euro, which was additionally on their agenda. As a result of a central financial institution digital foreign money would offer exactly what appears to be lacking right this moment: a way by which companies might hold money utterly protected, with none want for banks.

If a CBDC is issued by the European Central Financial institution, which might be determined this yr, any enterprise with liquidity buffers higher than the deposit insurance coverage restrict ought to see the curiosity in holding these buffers in digital euros. Right here is a solution to those that dismissively ask what the use case is for a CBDC: it might remove the kind of systemic danger recognized by US regulators through which peculiar enterprise depositors doubt the security of their deposits. However it might solely accomplish that if customers are allowed to carry greater than the very low limits the ECB is at current considering.

From Donohoe’s and Gentiloni’s answers, it’s clear that ministers haven’t drawn this hyperlink. I reasonably suspect that they should give it some thought quickly.

Different readables

-

My colleague Richard Milne takes a deep dive into the commercial journey that’s Northvolt, the Swedish battery manufacturing start-up.

-

Can Europe’s start-up sector innovate its method out of a plastic bag? A new Sifted report provides some solutions on how we’d get to a post-plastic future.

Numbers information

-

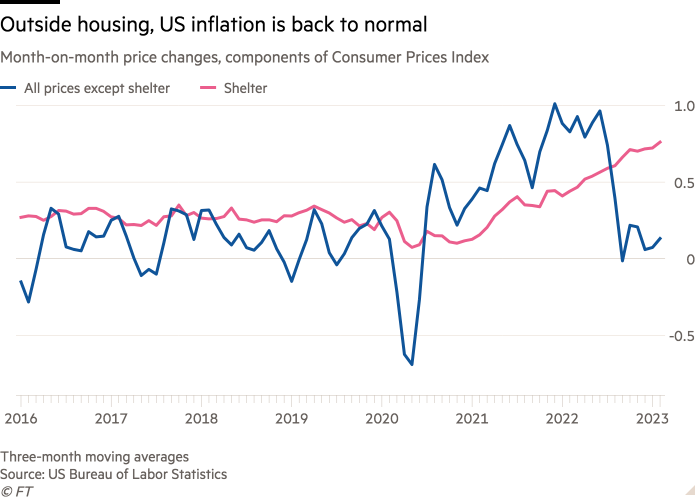

The newest US inflation numbers — with stubbornly excessive month-on-month client worth will increase — have been taken as bad news for the Federal Reserve. I disagree. There is just one sector the place inflation is misbehaving, and that’s shelter — exterior of housing, inflation has been again to regular since final summer season.

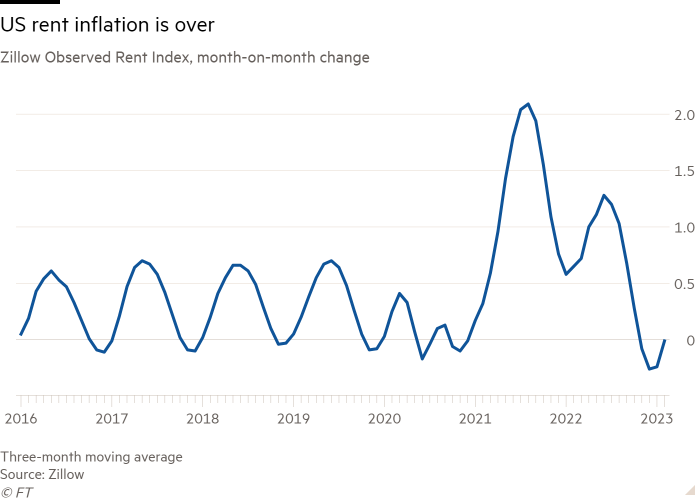

However for shelter costs, then, we’d declare the inflation hazard over. And we all know that the CPI measure of housing prices is backward-looking — it displays modifications which have already occurred. This implies present actions in shelter costs will present up within the CPI measure over the following yr. So this element ought to fall too. Should you take a look at a non-public hire index such because the Zillow Observed Rent Index, you discover that rental costs have hardly moved since September.

[ad_2]

Source link