[ad_1]

After dropping under $26,000 per unit, the worth of bitcoin, the main digital asset by market capitalization, continues to be up 9.6% since final week. Nonetheless, its worth has decreased by 6.5% within the final 24 hours. Out of the 7,316 firms, crypto property, valuable metals, and exchange-traded funds value greater than $82 trillion in worth, bitcoin is the twelfth largest asset worldwide by valuation.

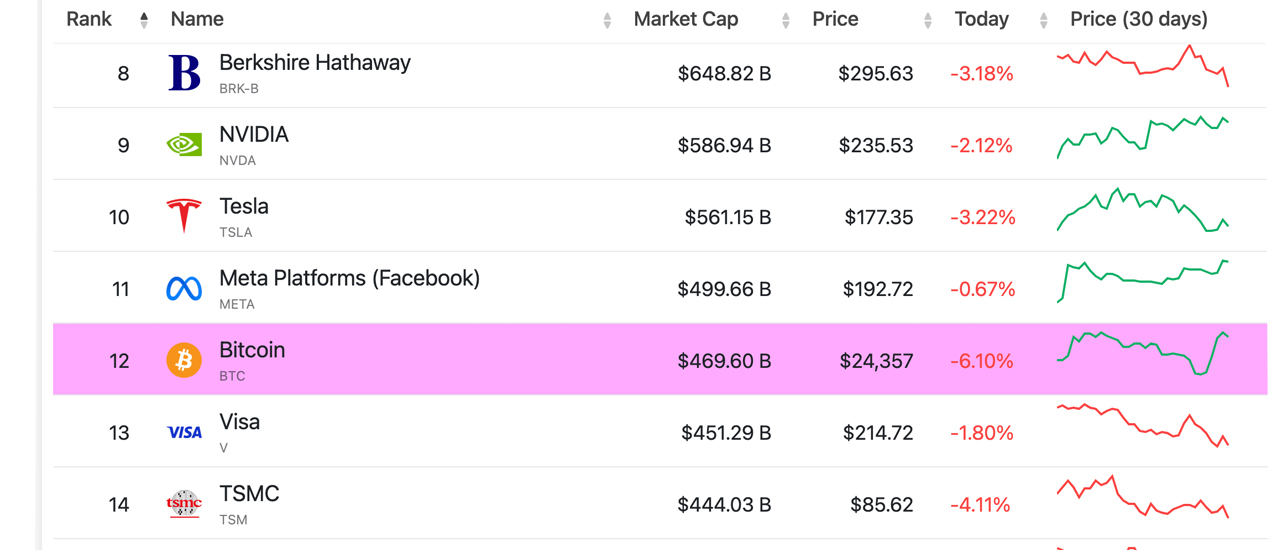

Bitcoin’s Market Capitalization In comparison with Different High Belongings: Main Crypto Climbs Above Visa, However Lags Behind Meta

Crypto property, particularly bitcoin (BTC), have elevated in worth this week following the collapse of three main U.S. banks. Over the previous 24 hours, bitcoin (BTC) has dropped 6.5% in opposition to the U.S. greenback. Nonetheless, weekly metrics point out that BTC is up 9.6% week over week. Most of BTC’s improve occurred on March 14, when it jumped above the $26K zone to exactly $26,533 at round 9 a.m. (ET) on Tuesday. As of two:35 p.m. on March 15, bitcoin is exchanging arms for $24,357 per unit.

Regardless of the lower in worth in opposition to the U.S. greenback, bitcoin has develop into the twelfth largest valuation on the planet, surpassing the market capitalization of funds large Visa. On Wednesday afternoon, BTC had a market valuation of $469.60 billion, which is $18.31 billion greater than Visa’s. Nonetheless, the crypto asset’s market valuation continues to be under that of Meta (previously Fb), which is at the moment at $499.66 billion. For bitcoin to develop into the eleventh largest asset by valuation on the planet, its market capitalization wants to extend by $30.06 billion, surpassing that of Meta.

At the moment, the highest ten property by market valuation embody gold, Apple, Microsoft, Saudi Aramco, silver, Alphabet (Google), Amazon, Berkshire Hathaway, Nvidia, and Tesla. Gold, the chief of the group, has a market capitalization of round $12.81 trillion. Whereas BTC represents 42.7% of the crypto financial system’s $1.1 trillion in worth, it solely accounts for 3.67% of gold’s general market valuation. Bitcoin’s market valuation would want to extend by roughly $12.34 trillion to surpass gold’s market capitalization. Nonetheless, bitcoin’s market valuation is at the moment nearer to silver, which is valued at $1.245 trillion as of Wednesday afternoon.

Due to this fact, as of as we speak, bitcoin’s market capitalization is roughly 37.7% of silver’s market valuation. To surpass silver’s market capitalization, bitcoin’s market valuation would want to extend by roughly $775.4 billion. In October 2021, BTC’s market capitalization ran up in opposition to silver’s general valuation, however at the moment, silver’s capitalization was $1.31 trillion. Relating to contending with tech large Apple’s web value, BTC’s market valuation accounts for 19.69% of Apple’s. For bitcoin to exceed the California tech large’s web value, it might want to extend its market valuation by one other $1.917 trillion.

What do you consider bitcoin’s seven day market efficiency and the crypto asset changing into the twelfth largest asset by market cap worldwide? Share your ideas about this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link