[ad_1]

Banks fail. After they do, those that stand to lose scream for a state rescue. If the threatened prices are sufficiently big, they are going to succeed. That is how, disaster by disaster, we have now created a banking sector that’s in idea non-public, however in apply a ward of the state. The latter in flip makes an attempt to curb the need of shareholders and administration to take advantage of the security nets they take pleasure in. The result’s a system that’s important to the functioning of the market economic system however doesn’t function in accordance with its guidelines. This can be a mess.

Cash is the stuff one will need to have if one is to purchase the issues one wants. That is true for households and companies, which must pay suppliers and staff. That’s the reason financial institution failures are calamities. However banks aren’t designed to be safe. Whereas their deposit liabilities are purported to be completely protected and liquid, their belongings are topic to maturity, credit score, rate of interest and liquidity dangers. They’re honest climate establishments. In unhealthy instances, they fail, as depositors run for the door.

Over time, state establishments have responded to the lack of banks to supply the protected cash their depositors anticipate. Within the nineteenth century central banks turned lenders of final resort, although supposedly at a penalty charge. Within the early twentieth, governments assured smaller deposits. Then, within the monetary disaster of 2007-09, they in impact put their total steadiness sheets behind the banks. The banking system as a complete turned, unambiguously, part of the state. In return, capital necessities have been raised, liquidity guidelines have been tightened and stress assessments have been launched. All then can be nicely. Or not.

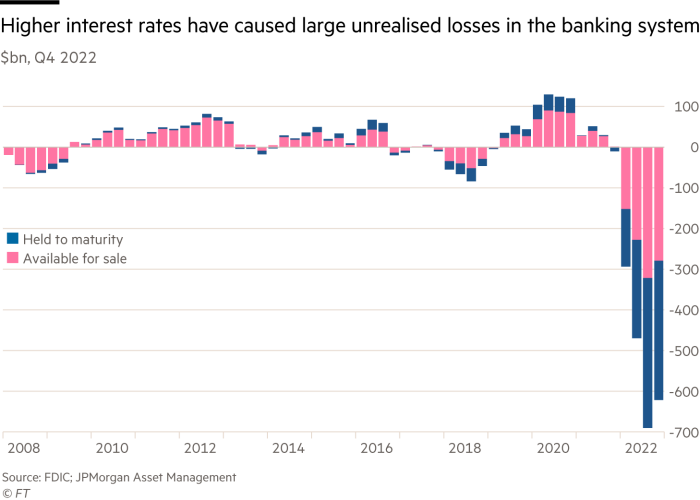

The failure of Silicon Valley Financial institution reveals there are holes within the US regulatory dike. That’s no accident. It’s what lobbyists known as for: do away with onerous laws, they cried, and we’ll ship miracles of development. Within the case of this financial institution, what stands out is its reliance on uninsured deposits and its guess on supposedly protected long-duration bonds. On the finish of 2022, it had $151.6bn in uninsured domestic deposits towards about $20bn in insured deposits. It additionally had substantial unrealised losses on its bond portfolio, as rates of interest rose. Put these two issues collectively and a run turned seemingly: rats will all the time abandon sinking monetary ships.

Those that fail to flee in time will scream for a bailout. It might be amusing that these shrieking for a rescue this time have been the libertarians of Silicon Valley. However few individuals are capitalists when threatened by dropping cash they considered protected and no one is healthier than a capitalist at explaining how important their wealth is to the well being of the economic system. Uninsured depositors have duly been rescued at SVB and elsewhere. This removes one more supply of personal sector self-discipline on banks.

But SVB was solely the Sixteenth-largest financial institution within the US. That is, in spite of everything, why it had been neglected of the regulatory web utilized to essentially the most systemically vital banks. It was conveniently non-significant in life, however turned systemically vital in demise. The Federal Reserve has also offered to lend at par value to banks that need liquidity. These are destructive “haircuts” — name them “hair-grafts” — to banks who want emergency loans. Past this, President Joe Biden has asserted that “we’ll do no matter is required”. True, this time shareholders and bondholders aren’t being bailed out. Furthermore, losses will supposedly be borne by the banking business as a complete. But the losses are once more partially socialised. Does anyone doubt that socialisation will turn out to be deeper if the disaster additionally does?

Naturally, folks surprise what this new shock means. Some analysts consider that the Fed will no longer tighten monetary policy this month. What is evident is that there’s a lot uncertainty, which might justify delay of additional tightening. However reducing inflation stays important: the US shopper worth index rose 6 per cent yr on yr in February.

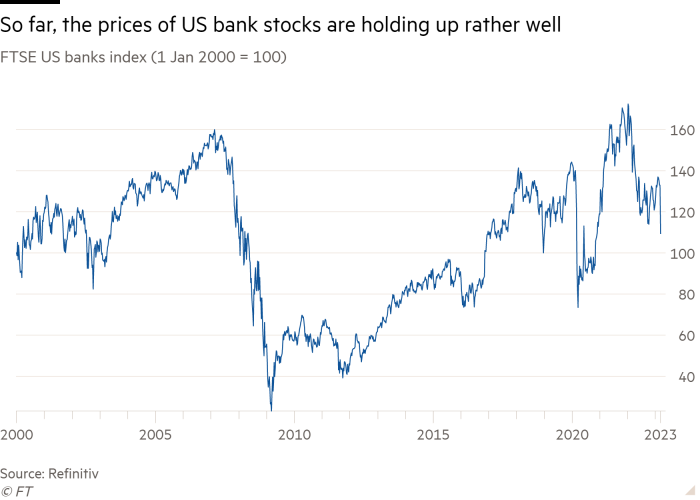

At current, nevertheless, the massive concern is just not what will occur to the economic system, however what will occur to finance. One level is that it’s a good factor if worry has reignited within the monetary system. The anxiousness created by small shocks makes massive crises considerably much less seemingly. There are further classes: banks stay as susceptible to runs as ever and, prefer it or not, uninsured depositors won’t be worn out in a failure. Confidence that deposits are protected is simply too necessary, economically and politically.

So, how is that this new proof of the extent to which the state backs the banks, even in comparatively regular instances, to be mirrored in coverage? One easy reply is that regulation of systemically vital banks have to be prolonged all through the system. One other is that deposits have to be put above all different debt in an insolvency, to mirror their social and financial significance. Yet one more is that steadiness sheets ought to all the time mirror market realities. Lastly, capital necessities needs to be adjusted accordingly. If banks’ capital falls too low, at market valuations, it must be elevated, promptly.

The basic lesson we have now to relearn is that even in a modest disaster deposits can’t be sacrificed, and guidelines on haircuts for provision of liquidity will exit of the window. Banks are wards of the state partly as a result of they’re on the coronary heart of the credit score system, however much more as a result of their deposit liabilities are so politically necessary. The wedding of dangerous and sometimes illiquid belongings with liabilities that should be protected and liquid inside undercapitalised, profit-seeking and bonus-paying establishments regulated by politically subservient and sometimes incompetent public sectors is a calamity ready to occur.

Banking wants radical change. Subsequent week I’ll focus on the right way to ship this.

[ad_2]

Source link