[ad_1]

China is about to tighten its grip on world cobalt provide, as the value of the important thing metallic for electrical automobile batteries hits a 32-month low off the again of a surge in manufacturing.

Over the following two years, China’s share of cobalt manufacturing is predicted to succeed in half of worldwide output, up from 44 per cent at current, in keeping with a report by Darton Commodities, a UK-based cobalt dealer.

The rise comes regardless of western efforts to realize management over provide chains for important minerals reminiscent of cobalt, lithium and nickel, that are important for making electric car batteries.

Chinese language refining exercise reached 140,000 tonnes in 2022, greater than double its degree of 5 years in the past, as volumes processed in the remainder of the world stagnated on the 40,000 tonnes mark, handing Asia’s largest financial system a 77 per cent world share of refining capability.

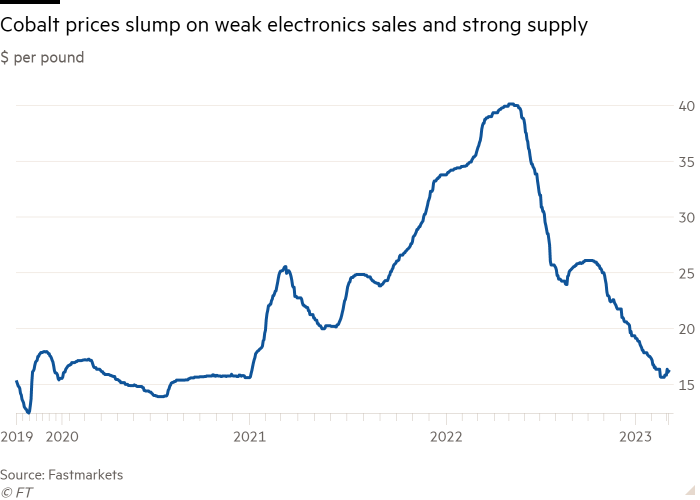

China’s rising function in cobalt provide comes as a 12-month rally for the metallic has spun into reverse, with costs dropping 60 per cent to $16 a pound, from their peak above $40 a pound in Might.

“Quite a lot of issues converged on the identical time to push the market down: the relief of logistics points, weak shopper digital gross sales and a expertise shift in the direction of decrease or no cobalt EV batteries,” stated Caspar Rawles, chief information officer at Benchmark Mineral Intelligence, a pricing company.

World cobalt output elevated 23 per cent or by 35,000 tonnes in 2022 over the earlier yr, in keeping with Darton. That was pushed by Swiss commodities group Glencore ramping up manufacturing at Mutanda, the world’s largest cobalt mine within the Democratic Republic of Congo, in addition to Indonesia rising as a serious producer.

The availability surge was greater than double the demand improve, resulting in the value collapse. Demand was hit by delicate gross sales of transportable electronics globally, draconian Covid-19 lockdowns in China, and a shift within the Chinese language electrical car market in the direction of lower-range batteries that don’t use cobalt.

One dealer stated there was a “double whammy” as Chinese language cobalt refineries and customers destocked because of weaker shopper demand, however the market was now asking “when does China come again” by way of demand.

Decrease cobalt costs present some reduction to automakers apprehensive about the price of uncooked supplies for electrical batteries, however increase massive challenges for getting tasks outdoors of China off the bottom.

Within the US, Washington’s considerations over China’s dominance of the cobalt provide chain have led to substantial incentives for cobalt manufacturing domestically or in nations deemed pleasant to America. Nonetheless, these incentives, codified within the Inflation Discount Act, will take years to yield any outcomes.

Automakers have been pushing to develop battery chemistries that use much less cobalt due to considerations over baby labour within the DRC, which generates three-quarters of worldwide provide.

Cobalt is a byproduct from copper or nickel mines, costs of which have remained comparatively robust, which means provide will not be readily diminished even when cobalt costs drop.

Nonetheless, trade sources stated small-scale casual mining, which contributes between 15 and 30 per cent of DRC output, has already in the reduction of, with some artisanal producers shifting to copper as an alternative.

Steven Kalmin, Glencore’s chief monetary officer, stated final month throughout an analysts name that “we’ll look to be dynamic round managing cobalt manufacturing and gross sales” to handle decrease costs.

Cobalt costs might fall additional if Tenke Fungurume, the world’s second-largest cobalt mine owned by China’s CMOC, is allowed to renew exports from the DRC after a tax dispute led to an export ban final July. It has saved producing regardless of the ban, stockpiling 10,000 to 12,000 tonnes of fabric, equal to six per cent of final yr’s demand, in keeping with market estimates.

The projected improve in China’s share of worldwide cobalt mining is essentially as a result of begin up at CMOC’s Kisanfu copper-cobalt mine within the DRC this yr.

[ad_2]

Source link