[ad_1]

Peanuts have turn out to be China best-performing agricultural commodity as dry climate and Beijing’s insurance policies have eaten into provides, elevating merchants’ fears that demand from the world’s largest importer of the legume will push up worldwide costs.

China suffered a extreme drought in key rising areas final yr, whereas the federal government’s agricultural subsidy programme, which favours soyabeans, has led to a pointy drop within the nation’s peanut acreage.

Futures contracts traded on the Zhengzhou Commodity Trade have risen about 10 per cent this yr to only underneath Rmb11,000 ($1,582) a tonne. They’re hovering just under a report excessive touched late final month, making them the nation’s best-performing agricultural commodity thus far in 2023.

The rally in Chinese language peanut costs comes as the worldwide market stays tight, with drought having affected lots of the most important worldwide exporters final yr. Climate in Argentina, the main exporter, has been erratic throughout the previous few months, elevating merchants’ considerations about decrease yields and smaller kernels, whereas heavy rains in Brazil have hampered harvesting, resulting in analyst worries about high quality points, in line with Mintec, the commodity information and evaluation agency.

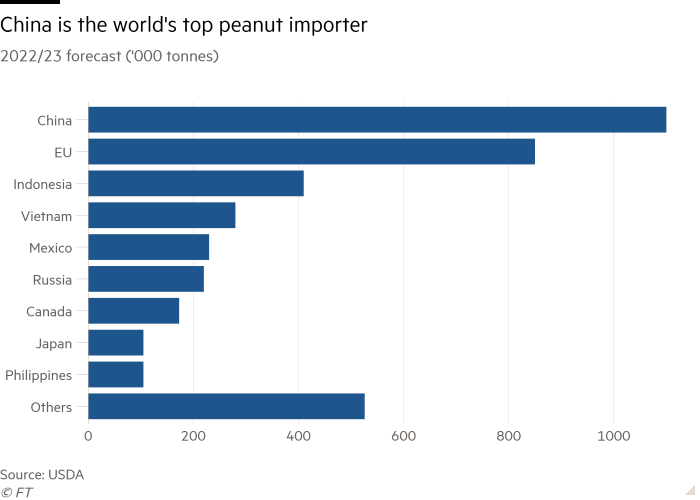

China is the world’s largest peanut producer, primarily crushing it for oil, however it is usually the main importer of the commodity. This yr it’s anticipated to import 1.1mn tonnes of the groundnut, greater than quadruple that of the EU, the second-largest market.

Since China reopened initially of the yr, it has actively purchased up provides, stated merchants and analysts. “They’re in all places attempting to purchase peanuts,” stated Martin Masopust, director at Netherlands-based dealer Bohemia Nut. “China is the market driver. In the event that they plant much less peanuts as a result of they lose acreage to soyabeans, then it’s going to have an effect on the world market.”

Masopust stated final yr’s drought had helped exacerbate home provide shortages and was driving Chinese language patrons to snap up provide throughout international markets starting from Senegal to Sudan.

Aidan Wright, senior nuts and dried fruit analyst at Mintec, stated: “Chinese language patrons have been securing peanut oil out of South America and shopping for up US farmer inventory for crushing.”

Analysts on the US Division of Agriculture had warned as early as November that “low costs, mixed with unfavourably dry planting circumstances in some areas, compelled some farmers to forgo planting usually greater margin peanuts for different crops”, however added that “excessive losses are probably restricted to a couple areas”.

Beijing has but to announce official manufacturing figures for 2022, however Chinese language media have begun sounding the alarm in current months, warning that authorities subsidies encouraging farmers to lift corn and soyabeans, a rival oilseed, had pushed farmers to desert peanut planting in pursuit of higher returns from different crops.

Final month, the state-run Financial Day by day reported that arable land used to domesticate peanuts in China shrank virtually 19 per cent in 2022, a report fall, concluding that enhancements “clearly stay to be made close to insurance policies meant to make sure simultaneous development in output capability for cereals, soyabeans and different oils”.

Chinese language information and information supplier Grain Information has reported that business estimates pointed to a fall of greater than 23 per cent in China’s peanut manufacturing final yr.

Darin Friedrichs, a commodities analyst at Shanghai-based Sitonia Consulting, stated China’s home peanut futures market, which launched simply two years in the past, was “simply getting tossed round by authorities subsidies”.

[ad_2]

Source link