[ad_1]

Mexico’s peso has touched its strongest stage in additional than 5 years because the nation’s comparatively excessive rates of interest, tight fiscal coverage and funding alternatives accruing from its proximity to the US make it a favorite for foreign money buyers.

The peso is the highest performing main foreign money this 12 months, in response to Bloomberg, and has greater than recovered from its pandemic weak spot. It has risen 8.5 per cent this 12 months to commerce above 18 to the greenback.

That compares with the South African rand weakening 7.1 per cent and the Brazilian actual gaining 2.4 per cent in the identical interval.

Furthermore, the peso has more and more grow to be the automobile for rising market buyers who need to borrow in a foreign money with a low rate of interest, just like the greenback, to purchase belongings providing greater charges of return, referred to as the carry commerce.

The traits which have propelled Mexico’s foreign money are more likely to have some endurance, analysts mentioned.

“Within the medium time period we see a powerful peso,” mentioned Gabriel Casillas, head of Latin America Economics at Barclays. “Inside Latin America, Mexico appears excellent in virtually each approach.”

Mexico’s foreign money is benefiting from a confluence of home and worldwide components. The nation, which shares a 2,000-mile border with the US, is ready to be a primary beneficiary of corporations specializing in their provide chains nearer key markets and away from China in a phenomenon referred to as “nearshoring”.

Mexico is a part of the USMCA free trade agreement with the US and Canada and was included in current inexperienced subsidies underneath Washington’s Inflation Discount Act. These have helped it appeal to funding in its historically robust auto sector, which has decrease wages than its northern neighbour.

BMW mentioned final month it will spend €800mn to develop electrical automobile manufacturing in Mexico whereas Tesla introduced final week it will construct a brand new manufacturing unit in northern Mexico that officers mentioned would begin off as a $5bn funding, one of many nation’s largest in recent times. The information helped push up the peso even additional towards the greenback.

Overseas direct funding in Mexico hit $35.3bn final 12 months, the best stage since 2015, in response to financial system ministry information. Transport manufacturing accounted for 12 per cent of that.

One other supply of overseas revenue has been resilient remittances from Mexican migrants within the US.

The transfers from overseas now make up 4 per cent of the nation’s gross home product. Even after rising to report ranges final 12 months, in January remittances had been 12.5 per cent greater than the identical month a 12 months earlier, in response to Financial institution of Mexico figures.

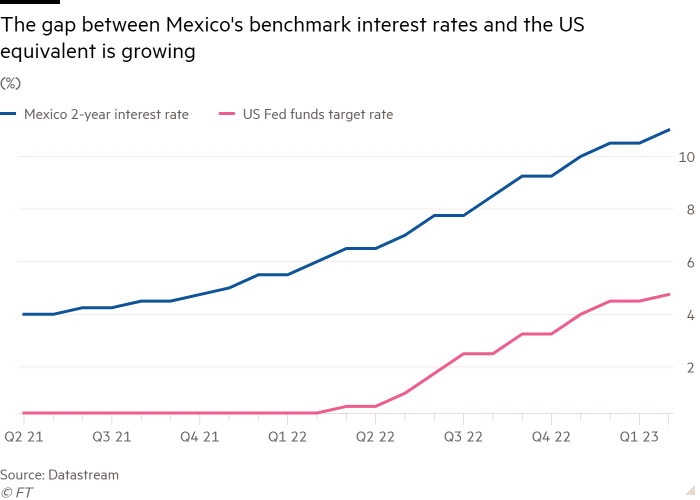

Mexico’s central financial institution, which has had a brand new governor Victoria Rodríguez Ceja since final 12 months, has additionally proved to be extra hawkish than many anticipated. The financial institution’s five-member board started elevating rates of interest in June 2021, 9 months earlier than the US Federal Reserve, and has elevated its benchmark charge at 14 consecutive conferences from 4 per cent to 11 per cent.

The unfold over the Fed’s fed funds goal charge has grown from 3.75 per cent to six.25 per cent, including to the peso’s attractiveness.

The market is betting on additional hikes since inflation began rising once more in December after peaking in September and dropping within the following two months.

Mexican president Andrés Manuel López Obrador’s fiscal austerity has additionally helped prop up the peso. The populist chief, who flies business and prides himself on being a person of the folks, has slashed authorities spending and run small deficits.

In the course of the pandemic, he resisted intense stress to implement massive assist packages for companies and people.

His stance has received him favour with foreign money buyers relative to different leaders in Latin America, like Gustavo Petro in Colombia and Brazil’s new president, Luiz Inácio Lula da Silva.

“We now have plenty of new presidents . . . and it is not clear whether or not they’re going to be fiscally accountable,” Casillas mentioned.

The information isn’t all constructive. Regardless of investor confidence within the peso and wholesome ranges of overseas funding, Mexico’s financial development has fallen in need of potential for many years, economists mentioned.

Since López Obrador took workplace in 2018 the financial system has barely grown and lagged behind regional friends in recovering from the pandemic. This 12 months analysts count on development of simply 1.2 per cent, in response to a central financial institution ballot.

Banco Base analyst Gabriela Siller mentioned it was not a coincidence that the peso was now again near ranges seen in 2018, simply earlier than López Obrador received the presidency. Early fears that he would attempt to finish the central financial institution’s autonomy or keep in energy past the strict six-year time period restrict had dissipated, she mentioned.

Nevertheless, structural issues stay, reminiscent of the delicate rule of regulation, with little expectation of enchancment within the medium time period. Strikes by López Obrador to weaken autonomous our bodies and alter the principles within the electrical energy market have additionally raised investor issues.

These long-term challenges will proceed to carry again funding, JPMorgan economist Gabriel Lozano mentioned in a current word.

“Had a long-term technique to spice up funding been in place, we expect Mexico may have been prepared to spice up nearshoring earlier,” he mentioned.

[ad_2]

Source link