[ad_1]

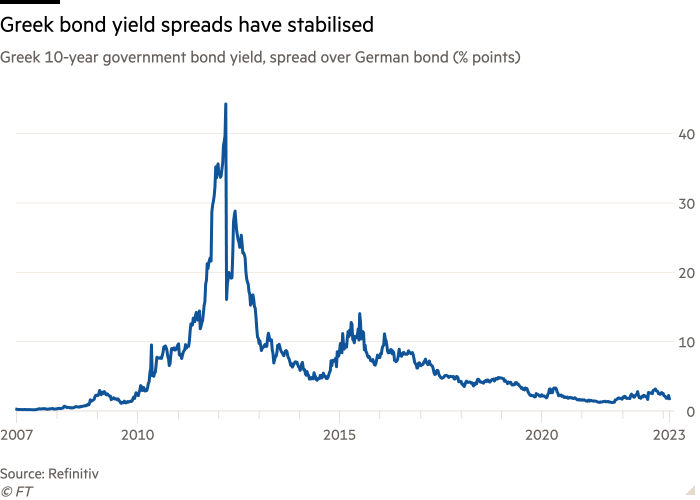

Greece is on the cusp of regaining its investment-grade credit standing after 12 years within the junk-bond wilderness, its central financial institution governor Yannis Stournaras has stated as he urged the nation’s subsequent authorities to take care of fiscal prudence.

Stournaras advised the Monetary Instances that he was “assured” that credit standing companies would improve Greek bonds inside months, ought to lawmakers sign their intent to take care of reforms and make the most of a “window of alternative” to considerably decrease the nation’s debt burden.

“We predict that 2023 is the 12 months will get the funding grade,” Stournaras stated.

His feedback come because the nation gears up for spring elections, with the incumbent centre-right New Democracy social gathering main within the polls. The social gathering has signalled that it’ll proceed to fastidiously handle the general public funds.

Stournaras stated the more than likely timing of the improve was “instantly after the election”, however that it may even come earlier than the vote takes place.

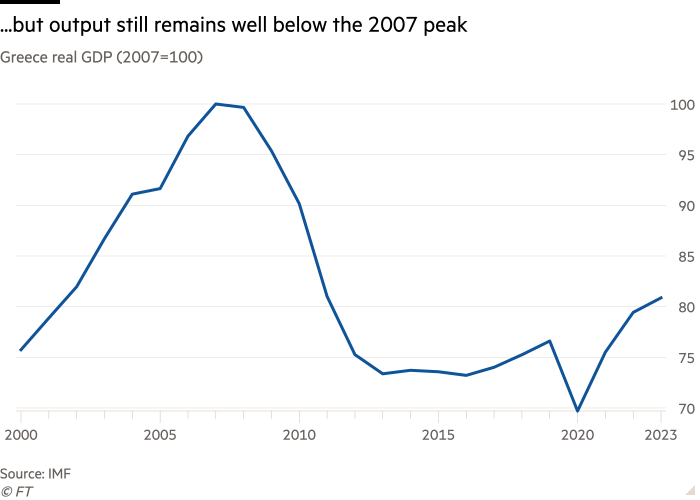

Greece misplaced its investment-grade standing in January 2011 after its financial disaster threatened to interrupt the eurozone aside. Its scores fell as little as CCC-, earlier than recovering to BB+ — one notch beneath funding grade — because the nation’s financial restoration gathered momentum.

The nation managed to shave greater than 24 share factors off its debt-to-GDP ratio final 12 months alone, with its economy increasing by simply over 5 per cent over the course of 2022.

“Just a few years in the past, few folks anticipated Greece to stay within the eurozone. Now, not solely does it stay, however it performs higher than the eurozone common,” the governor stated.

Stournaras, who has headed the central bank since 2014, warned that this “benign [economic] cycle” should not be squandered and known as on the federal government to make some desperately wanted investments within the nation’s battered infrastructure following a railway crash that has claimed the lives of a minimum of 57 folks.

“Greece has managed to appropriate macroeconomic imbalances and enhance value and wage competitiveness, however structural competitiveness stays low in comparison with different eurozone members,” he stated. “The nation’s infrastructure and the modernisation of the general public sector stay a difficulty.”

Regardless of the good points of latest years, Greece nonetheless holds the very best debt load within the eurozone at 170 per cent of its output.

Underneath the phrases of its bailout, official collectors took on a big chunk of Greece’s debt, whereas charging comparatively low rates of interest for the federal government to service it up till 2032.

“Now we have a window of alternative that shouldn’t be wasted,” Stournaras stated. “We have to carry down the debt-to-GDP ratio to such a stage that 9 years from now, so the curiosity funds, which at the moment are underneath grace interval, won’t create a brand new debt downside.”

Development would even be decrease this 12 months, with larger rates of interest anticipated to weigh on demand.

“A sustainable fiscal effort can be wanted,” the previous finance minister stated, including that it might not be simple for the federal government to go from a small main deficit to a place of fiscal surplus by 2024.

Excessive inflation would additionally dampen the financial outlook. Core value pressures — which exclude adjustments in meals and power prices, and are seen as a greater gauge of underlying inflation — hit a recent regional excessive of 5.6 per cent.

Nonetheless, Stournaras, who sits on the European Central Financial institution’s governing council, flagged that headline inflation readings have been a lot “higher”, or decrease, than rate-setters had anticipated in December because of a pointy fall in power costs.

He wouldn’t pre-commit to particular additional price rises in an surroundings the place headline inflation was declining. “That would result in a rise in market confusion relatively than restrict it.”

His feedback conflict with the more and more hawkish tone coming from lots of his fellow ECB rate-setters.

Its president, Christine Lagarde, has stated the central financial institution is “very, very possible” to boost its deposit price from 2.5 per cent to three per cent at its assembly on March 16, warning “inflation is a monster that we have to knock on the top”.

Further reporting by Martin Arnold in Frankfurt

[ad_2]

Source link