[ad_1]

Central banks present continued demand for gold in 2023, as per a current report from the World Gold Council (WGC), which famous that the world’s central banks collected 31 tons of the valuable steel in January. Turkey was the biggest gold purchaser, including 23 tons to its central financial institution’s stash, whereas the Folks’s Financial institution of China additionally bought 15 tons of gold.

Central Financial institution Gold Purchases Stay Regular Regardless of Potential Challenges in 2023

On the time of writing, a troy ounce of positive .999 gold is $1,857.50 per unit, up 1.12% over the previous day. Gold prices have been down since Jan. 31, 2023, when the value per ounce reached $1,950 per unit in opposition to the U.S. greenback. On March 2, the World Gold Council (WGC) revealed a report titled “No Dry January for Central Financial institution Gold Shopping for,” which discusses how Jan. 2023 data present that the world’s central banks have maintained the demand registered on the finish of 2022.

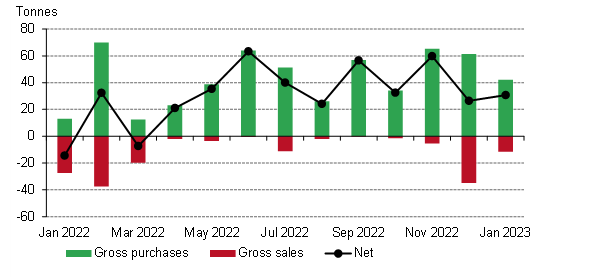

Based on Krishan Gopaul, the writer of the report, many purchases got here from Turkey, China, and Kazakhstan. “In January, central banks collectively added a internet 31 tonnes (t) to international gold reserves (+16% m-o-m),” Gopaul wrote. “This was additionally comfortably throughout the 20-60t vary of reported purchases which has been in place during the last 10 consecutive months of internet shopping for.”

Central financial institution purchases and gross sales accounted for 44 tons in Jan. 2023, with one central financial institution offsetting its stash by promoting 12 tons. The most important gold purchaser was the Central Financial institution of Türkiye (Turkey), which acquired roughly 23 tons throughout the month. Based on the nation’s data, Turkey now holds 565 tons of gold.

China got here in second, with the Folks’s Financial institution of China buying 15 tons throughout the identical time-frame, as Gopaul detailed. “The Nationwide Financial institution of Kazakhstan elevated its gold reserves by a modest 4 tons in January, taking its gold reserves to 356 tons,” the WGC writer explains. The report notes that the info is predicated on Worldwide Financial Fund (IMF) data, and among the information could also be revised throughout the subsequent WGC month-to-month report.

Along with Turkey, China, and Kazakhstan, the WGC writer particulars that the European Central Financial institution (ECB) acquired two tons as a result of Croatia joined the eurozone, and the nation was required to switch its reserve belongings to the ECB. The vendor of the 12-ton sale of gold in January 2023 was the Central Financial institution of Uzbekistan, and the nation now holds roughly 384 tons.

The WGC report concludes that the group has little doubt that central banks worldwide will proceed to buy gold throughout the remainder of 2023. Nevertheless, the WGC writer stresses that the gold shopping for this yr could not match the records set in 2022. “Additionally it is affordable to imagine that central financial institution demand in 2023 could wrestle to succeed in the extent it did final yr,” the report notes.

What do you assume the long run holds for central financial institution gold demand? Will it proceed to rise or will it lower within the coming months and years? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, World Gold Council, Tradingview

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link