[ad_1]

Regardless of a 9.95% improve final week and the all-time excessive issue, bitcoin’s hashrate has averaged round 305 exahash per second (EH/s) over the previous 30 days. In response to present knowledge, the hashrate has been round 308 EH/s over the previous 2,016 blocks. The subsequent issue change, set to happen on March 10, is estimated to extend once more, as block occasions have been sooner than the 10-minute common, coming in at 8 minutes and 30 seconds to 9 minutes and 41 seconds per block.

Bitcoin’s Community Problem Projected to Rise; Hash Value Stays Above Hash Worth

Bitcoin’s computational energy has remained excessive regardless of a 9.95% issue improve on Feb. 24, 2023, at block peak 778,176. Statistics present that on Sunday, March 5, the issue is estimated to extend by more than 3% throughout the subsequent issue retarget on March 10. Whereas the issue is a staggering 43.05 trillion hashes and the fee to mine is larger than the present spot worth, the 300 EH/s vary or larger has been the norm for the reason that final retarget.

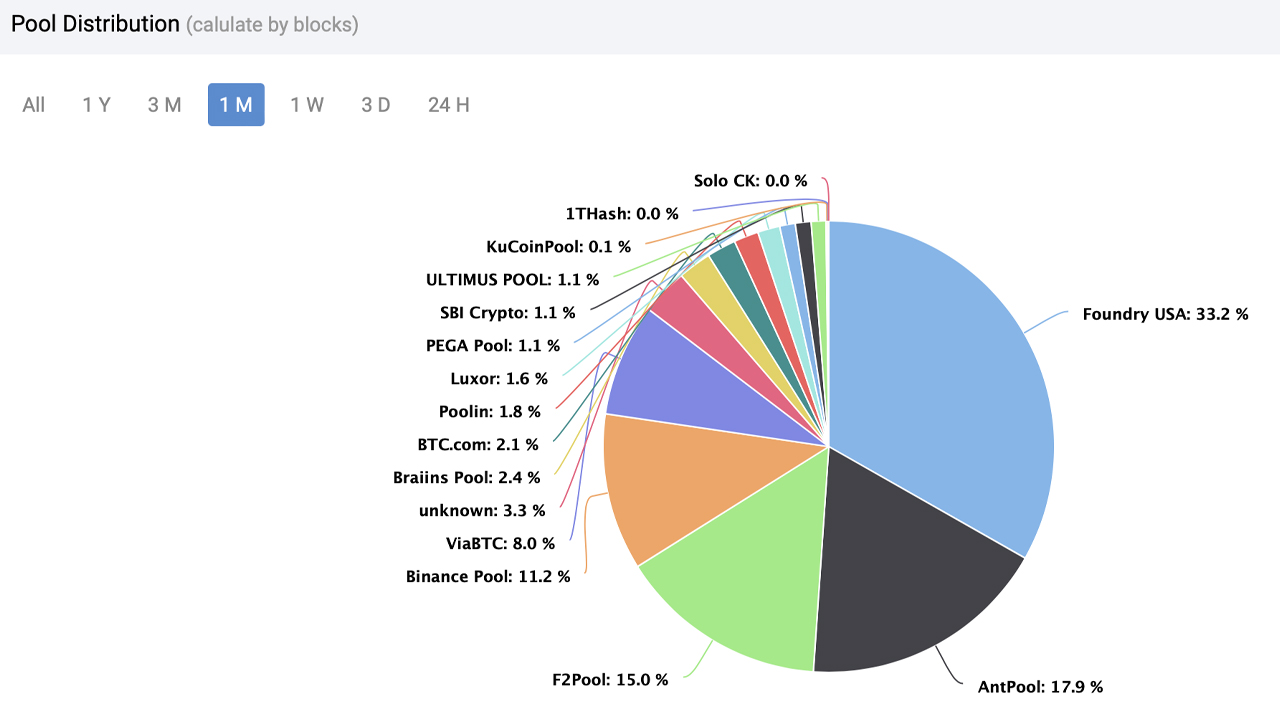

At present, greater than 60,000 blocks are left to mine till the subsequent halving, and over the previous 30 days, 4,557 blocks have been mined, with Foundry USA discovering 1,514 of them. Foundry instructions 34.44% of the worldwide hashrate, or 113.45 EH/s over the previous 24 hours. Out of the 151 blocks mined, Foundry found 52, and three-day statistics present the pool has acquired 163 blocks.

Thirty-day, three-day, and 24-hour statistics point out that Antpool is the second-largest mining pool throughout these intervals. Out of the 4,557 blocks mined since Feb. 5, 2023, Antpool found 815 blocks, accounting for 17.88% of the worldwide hashrate in a month’s time. Foundry and Antpool have been adopted by F2Pool (14.99%), Binance Pool (11.24%), and Viabtc (8.03%).

Bitcoin miners have been coping with decrease BTC spot costs as the value has dropped greater than 8% over the previous two weeks. Miners have been incomes extra charges (the fee to ship transactions) from the Ordinal inscription development as charges jumped to three.5% of a block reward worth on Feb. 16. Bitcoin network fees dropped to 1.5% of a block reward 4 days later.

Knowledge reveals that community charges equate to 2.1% of a block reward on the time of writing. Regardless of the challenges, many bitcoin mining swimming pools have remained robust and contributed to a rise within the international hashrate. Nevertheless, the upper value of manufacturing in comparison with the present spot market worth and the continuous improve in issue might dissuade some mining operations from collaborating.

What do you suppose the longer term holds for bitcoin miners, given the anticipated improve in issue and the present market uncertainty? Share your ideas about this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss induced or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link