[ad_1]

Greater than 340,000 Individuals will see a rise of their month-to-month pay cheque tomorrow after Walmart, the largest private-sector employer within the US, raised its minimal hourly wage to $14. The retailer’s transfer will in impact set a brand new ground for pay in lots of US states.

On the opposite aspect of the Atlantic, as many as half one million UK public sector employees have taken industrial motion over pay and Germany’s public sector unions are additionally calling strikes. In Hungary and Poland, wage development has reached double digits.

Even in Japan, the place many individuals haven’t had a pay rise for many years, huge employers are weighing a shake-up of seniority-based wage buildings that would lastly put cash in employees’ pockets.

Whether or not the world’s employees can press house their calls for for higher pay is the one greatest query going through central bankers around the globe this 12 months as they struggle to curb the charges at which costs are rising.

“Even after vitality and pandemic elements fade . . . wage inflation might be a major driver of value inflation over the following a number of years,” Philip Lane, chief economist on the European Central Financial institution, warned in November.

Central banks don’t but face the sort of “wage value spiral” that took maintain within the US within the Seventies. Then, staff gained inflation-busting pay rises for the very best a part of a decade, fuelling additional value rises till Paul Volcker’s arrival on the US Federal Reserve led to a change of financial regime. Volcker quashed inflation, however at the price of a deep recession.

“You don’t see [a wage-price spiral] but. However the entire level is . . . when you see it, you may have a major problem,” Jay Powell, the US Federal Reserve chair, informed reporters after the Fed’s newest rate of interest enhance, including: “That’s what we are able to’t enable to occur.”

The fear, although, is {that a} 12 months of rocketing costs could have triggered an enduring change within the expectations and behavior of employees, employers and shoppers. This might result in one thing higher described as “wage-price persistence” — the place a robust jobs market permits service sector employees to demand greater pay rises, and corporations to move on the prices to households bolstered by excessive employment charges and authorities help.

Even comparatively moderate-looking wage settlements might cease inflation falling again in direction of central banks’ 2 per cent targets — except they jack up rates of interest additional to doubtlessly recession-inducing ranges.

Demand, vitality and productiveness

The inflation issues going through the Fed and ECB are totally different, nevertheless. Within the US, inflation has been pushed mainly by a stimulus-fuelled surge in demand after the tip of lockdowns and the query for policymakers is whether or not greater wages might be justified by improved productiveness.

Within the eurozone and UK, the dominant challenge is the vitality value shock brought on by Russia’s invasion of Ukraine. Dramatically greater spending on vitality has made societies poorer total, and the query is how that value is shared between firms, employees and taxpayers. On this context, even when wages lag behind inflation, they may nonetheless be too excessive for firms to bear with out elevating costs additional.

On either side of the Atlantic, headline charges of inflation are set to gradual sharply over the following few months, as gasoline costs have eased and better borrowing prices are beginning to reasonable demand. However most employees have suffered a giant hit to their dwelling requirements up to now 12 months, as a result of pay settlements that will look beneficiant in regular instances are nonetheless effectively in need of inflation. Wage beneficial properties might be futile in the event that they merely perpetuate excessive inflation, however employees need their pay to meet up with costs.

They’re effectively positioned for that struggle. Regardless of excessive profile lay-offs within the tech sector, and a leaner 12 months forward for dealmaking bankers and attorneys, in lots of nations unemployment is close to document lows, labour shortages are widespread and employers are intent to retain employees even in a downturn.

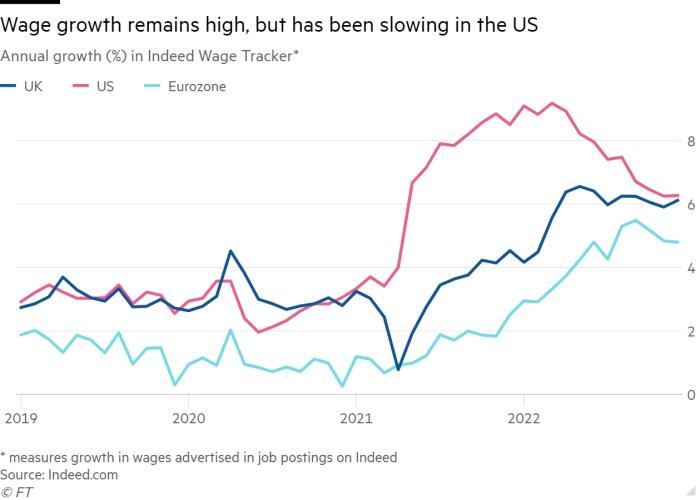

On this context, financial policymakers fear that even pay development of 4 or 5 per cent might be too sturdy for them to carry inflation sustainably again in direction of their 2 per cent targets — given the absence, up to now, of any vital pick-up in employees’ productiveness.

Has wage development topped out?

The large unknown now’s whether or not jobs markets are already slowing sufficient to take the sting off wage development — or whether or not central banks will really feel the necessity to increase rates of interest additional and hold them excessive for longer, to be able to engineer job losses and monetary ache.

“Given tight labour markets, it’s clear that central banks need to see convincing indicators that the financial system is popping down and subsequently that unemployment will flip up,” says Invoice Diviney, economist at ABN Amro.

At current, each hawks and doves can level to proof that bolsters their case. Take US employment information; February’s payroll numbers might be introduced on Friday, however January noticed an surprising surge in hiring, with greater than half one million employees becoming a member of payrolls. In the identical month, annual development in common hourly earnings slowed from 4.8 to 4.4 per cent.

The mixture of blockbuster job creation and slowing wage development might vindicate those that imagine the Fed can engineer a delicate touchdown for the financial system, taming inflation with out the necessity to enhance charges to some extent that may trigger widespread lay-offs.

“If you wish to know what a full employment financial system appears like, it is a good begin. Sturdy however not over-strong nominal wage development, plentiful jobs, many individuals climbing the roles ladder, broad-based prosperity,” tweeted Arin Dube, a professor on the College of Massachusetts who has led analysis on minimal wages.

His argument is that wage beneficial properties mirror a real change within the construction of the US labour market as a result of pandemic lockdowns, and the hiring surge that adopted them, prompted employees to maneuver out of low-paying service jobs into extra productive sectors.

Others take a much less optimistic view on productiveness, nevertheless. Jason Furman, a fellow on the Peterson Institute for Worldwide Economics, says that after factoring in revisions to figures for earlier months, “the sample appears much less like a slowdown in wage development inside 2022 and extra like regular development that’s roughly in step with 3.5 per cent inflation”.

Newer information has made economists fear that even after elevating US rates of interest on the quickest fee in historical past over the previous 12 months, the Fed has not but finished sufficient to take the warmth out of the labour market.

One carefully watched indicator of value inflation — which strips out risky meals, vitality and housing prices and is subsequently strongly influenced by service sector wages — accelerated in January.

Furman says this exhibits that whereas the results of the pandemic on the costs of timber, microchips or delivery are over, “demand and self-fulfilling wage-price persistence are nonetheless with us. As could be very elevated inflation.”

The latest data from France and Spain additionally factors to persistent inflationary pressures within the eurozone. There, wage development was surprisingly muted in 2022 however is predicted to choose up this 12 months as unions renegotiate multiyear sectoral offers that cowl a giant share of the workforce in some nations.

Economists describe the deal struck in November by IG Metall, Germany’s greatest union, as a “Goldilocks” state of affairs balancing the dangers to development and inflation. It mixed pay rises over two years with one-off funds to assist with the rising value of vitality payments.

However German public sector unions are actually searching for a double digit wage rise and Dutch unions are agreeing pay awards of 5 or 6 per cent, effectively above historic norms. Spain’s central financial institution has flagged considerations over the rising use of indexation clauses in wage offers, pegging pay to inflation.

Erwan Gautier, an economist on the Banque de France, found that scores of industries had revisited their sectoral offers in the midst of 2022, generally twice or extra, to maintain up with the minimal wage, which in France adjusts mechanically when inflation is excessive. Many extra had been nonetheless enjoying catch-up, suggesting wage development would speed up in 2023.

Christine Lagarde, the ECB president, mentioned final week the central financial institution was “taking a look at wages and negotiated wages very very carefully”. Isabel Schnabel, a member of its govt board, has warned that possible wage development between 4 and 5 per cent within the years to return is “too excessive to be in step with our 2 per cent inflation goal” and will persist longer within the eurozone than within the US, as a result of extra widespread use of centralised wage bargaining processes.

One issue might restrict wage pressures within the eurozone, nevertheless. In a lot of the bloc’s main economies, higher job alternatives have drawn extra individuals into the workforce, with financial exercise above its pre-pandemic fee in France, Germany and Spain.

UK charges: greater for longer

That is in sharp distinction with the scenario within the UK, whose workforce has shrunk by greater than 300,000 since Covid hit. The Financial institution of England sees little prospect of this altering, except immigration rises, as a result of it’s has been brought on by people who find themselves too sick to work or have chosen to depart the workforce. Even when this legacy of the pandemic fades over time, employers will more and more run into the constraints imposed by an ageing inhabitants.

Employers bidding for more and more scarce employees is a key purpose why rates of interest might stay greater for longer within the UK than elsewhere — and why Andrew Bailey, the BoE governor, has warned of consequences for inflation and financial coverage if the federal government agrees to pay public sector employees extra with out elevating taxes to fund it.

“I’m very unsure notably about price-setting and wage-setting on this nation,” he mentioned in proof to MPs on 9 February.

In all nations, although, there’s a rising pressure between central banks’ concern over inflation and governments’ want to defend voters’ dwelling requirements and keep away from social battle.

In Europe, many governments have tried to resolve this by boosting pay for these on the backside. Statutory minimal wages rose by 12 per cent on common throughout the EU in 2022, double the speed of the earlier 12 months. This was partly because of a catch-up in jap and central European states, however the wage ground additionally rose by 22 per cent in Germany, 12 per cent within the Netherlands and round 5 to eight per cent elsewhere within the core of the bloc.

Each France and Germany have additionally provided tax breaks that incentivise firms to make up for below-inflation wage rises with huge one-off bonuses. These can have a extra transient impact, however nonetheless bolster shopper spending and so enhance firms’ pricing energy.

And whereas the Fed frets that the US labour market could also be operating too scorching, the Biden administration is celebrating an financial setting that has helped marginalised teams and low-wage employees climb the roles ladder.

“Our nation is again to work. We’ve seen historic employment beneficial properties up to now two years,” the Treasury secretary Janet Yellen mentioned final month, noting that unemployment was now close to document lows for Black and Hispanic Individuals and other people with disabilities.

Taming inflation: whose job is it?

Some argue {that a} shortage of employees is driving a much-needed correction within the stability of energy between capital and labour, and that pay ought to rise to guard dwelling requirements. However this might solely occur if firms absorbed the shock via decrease earnings — one thing that has not often occurred earlier than.

At current — besides within the vitality sector, the place earnings have soared — each employees and employers are feeling the squeeze. As Torsten Bell, on the UK’s Decision Basis, places it: “The dimensions of the ache is so huge there’s greater than sufficient of it to result in each earnings and wages falling.”

This pressure might make life robust for central banks in the event that they press on with rate of interest rises to cease wage pressures lingering earlier than they’re able to see the total impact of the tightening they’ve already delivered.

“Governments going through fixed social demand for indexation . . . could more and more resent a financial coverage tightening, and so do companies squeezed between rising labour and funding prices,” says Gilles Moëc, chief economist at Axa Group.

Elevating rates of interest stays the usual prescription for coping with these pressures — choking off financial development till employees develop into too afraid of dropping their jobs to carry out for greater wages and corporations too petrified of dropping prospects to boost costs any additional.

Olivier Blanchard, former chief economist on the IMF, has argued that that is “a extremely inefficient approach” to take care of inflation, which he describes as the results of a “distributional battle, between corporations, employees and taxpayers”.

The OECD is in favour of governments utilizing minimal wages to assist the poorest handle rising costs, however has additionally urged higher use of collective bargaining mechanisms. It argues these may help keep away from a wage-price spiral, as a result of they assist to share the prices of inflation pretty between employees at totally different earnings ranges, and in addition enable for trade-offs between wages and different advantages that employees worth, reminiscent of extra versatile working hours.

However in observe, Blanchard notes, it’s virtually all the time central banks which might be left to resolve the battle. “One can dream of a negotiation between employees, corporations and the state, during which the end result is achieved with out triggering inflation and requiring a painful slowdown . . . Sadly, this requires extra belief than might be hoped for and simply doesn’t occur.”

[ad_2]

Source link