[ad_1]

Good morning. This text is an on-site model of our FirstFT publication. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Good morning, and welcome to the brand new FirstFT.

Immediately we now have a scoop on Jaguar Land Rover proprietor Tata Motors, which has demanded greater than £500mn in support from the UK authorities to decide on Somerset over Spain for its new battery plant.

And what position did BBC political comedy Sure Minister need to play in breaking the impasse over Northern Eire? Scroll down for our behind-the-scenes learn on secret talks that led to the Windsor deal.

Right here’s what to maintain tabs on right this moment:

-

Financial information: S&P International publishes manufacturing buying managers’ indices for Canada, France, Germany, Italy, the eurozone, the US and the UK. Germany additionally has January unemployment figures and its February shopper value index.

-

Outcomes: Salesforce has fourth-quarter outcomes as activist investors circle. Atos, Juventus, Kuehne+Nagel, Persimmon and Reckitt Benckiser additionally report. See the full list in our Week Ahead newsletter.

-

Macron in Africa: French president Emmanuel Macron begins a visit to win over nations on a continent that’s increasingly resistant to one-time colonial powers taking part in a job in its affairs.

What do you consider our new look right this moment? Tell us at firstft@ft.com.

Immediately’s prime information

1. EXCLUSIVE: Jaguar Land Rover’s proprietor is demanding greater than £500mn for a battery manufacturing facility to be inbuilt England over Spain and has given UK ministers “weeks” to pledge monetary help. Here’s why Tata Motors’ ultimatum could be pivotal for the future of Britain’s car industry.

2. Wall Road’s largest firms warn that backlash towards sustainable funding is now a cloth threat. A dozen fund managers together with BlackRock, Blackstone and KKR wrote of their annual experiences that pressures equivalent to “divergent views” or “competing demands” on ESG investing could hurt financial performance.

3. Goldman Sachs chief David Solomon admitted errors in an ill-fated foray into shopper banking and raised the potential of promoting components of the enterprise at an investor day that didn’t raise the cloud over the US financial institution. Read the full story on the “strategic alternatives” Solomon is exploring.

4. US chipmakers should agree to not increase capability in China for a decade if they’re to obtain cash from a $39bn federal fund designed to construct a modern US semiconductor business, in response to new commerce department rules.

5. EXCLUSIVE: Belgium’s cyber safety company has linked China to a cyber assault on MP Samuel Cogolati, who wrote in January 2021 of “crimes towards humanity” towards Uyghur Muslims. European governments have turn out to be extra keen to problem Beijing over alleged cyber offences. Read the full story.

The Large Learn

Central banks don’t face a wage-price spiral but, however the fear is {that a} yr of rocketing costs could have triggered a long-lasting change within the expectations and behavior of staff, employers and customers. This might result in one thing better described as “wage-price persistence”.

We’re additionally studying . . .

Chart of the day

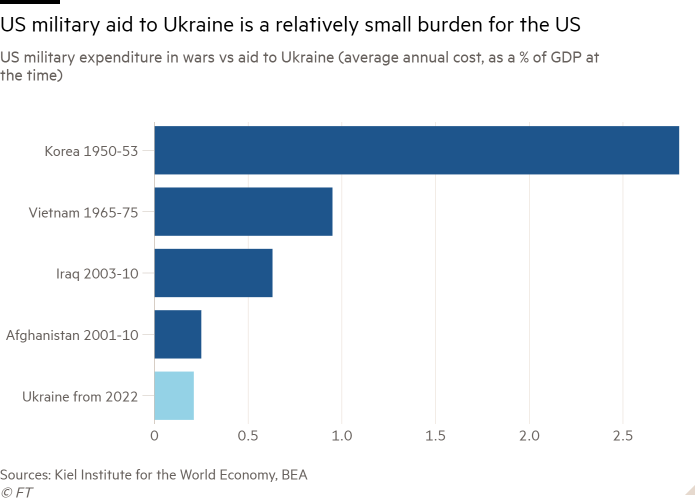

Vladimir Putin might fairly conclude that he has time on his facet and Ukraine is not going to get the sources it must final within the longer run, writes Martin Wolf. The west has to prove he is wrong, and sooner rather than later.

Take a break from the information

Are you uninterested in all of your garments? Do you are feeling rudderless in the case of describing what your “model” is? Stylist Anna Berkeley provides recommendation on how to get out of a style rut. For extra, sign up to our Fashion Matters newsletter.

Extra contributions by Emily Goldberg and Gordon Smith

Thanks for studying and keep in mind you’ll be able to add FirstFT to myFT. You can even elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to firstft@ft.com

[ad_2]

Source link