[ad_1]

Good morning. This text is an on-site model of our FirstFT e-newsletter. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Good morning.

At this time we begin with the information that Bridgewater Associates, the world’s largest hedge fund, is getting ready for probably the most important shake-up of the agency since its founder Ray Dalio ceded management.

And scroll down for our newest scoop on Adani Group, which has continued to dismiss brief vendor claims of fraud and share value manipulation to little impact.

Right here’s what to look at within the day forward:

-

International affairs: The G20 Foreign Ministers Meeting concludes in Delhi as we speak. Individually, Indian prime minister Narendra Modi will host his Italian counterpart Giorgia Meloni.

-

EU flash inflation figures: Client costs figures point out that European inflation is likely to persist forward of the publication of February euro space flash inflation knowledge as we speak.

-

Earnings: Outcomes are anticipated from firms together with Anheuser-Busch InBev, China Tower, London Inventory Alternate, Merck, Salvatore Ferragamo and Common Music Group.

Thanks for all of the suggestions on FirstFT’s new look. Preserve it coming: firstft@ft.com.

Be a part of us in Singapore on March 16 for our inaugural Wealth Administration Summit to debate how finest to scale up while navigating geopolitical tensions, regulatory shifts, and funding dangers. Register today.

At this time’s prime information

1. Bridgewater will minimize about 100 jobs whereas its Pure Alpha fund will cease accepting new cash as soon as it hits a sure measurement, one particular person accustomed to the plan stated. The cap on the fund will likely be set at a threshold that’s 20-30 per cent decrease than its peak measurement of $100bn. Learn what played a role in the decision.

2. Unique: India’s Adani Group has informed bondholders it has entry to a $3bn credit score line from backers together with at the least one sovereign wealth fund, because it tries to assuage concerns about its financial health within the wake of a harmful brief vendor report accusing it of fraud.

3. Swiss prosecutors have charged 4 bankers with serving to to cover tens of thousands and thousands of Swiss francs on behalf of Vladimir Putin, in one of many first ever courtroom circumstances within the west to straight contain belongings allegedly belonging to the Russian president. Read more on the four individuals.

-

Associated learn: Western allies are pushing the United Arab Emirates to halt exports of critical goods to Russia as they search to starve Putin’s army of elements to maintain its battle towards Ukraine.

4. Belgium’s cyber safety company has linked China-sponsored hackers to an assault on a distinguished Belgian politician, Samuel Cogolati, as European governments develop into more and more prepared to problem Beijing over alleged cyber offences. Keep reading.

5. Chinese language manufacturing unit exercise expanded at its quickest tempo in additional than a decade in February. The information is an early indication of the nation’s restoration following the top of strict Covid restrictions in December — however enthusiasm for China’s financial reopening is not universally shared.

The Large Learn

Can the world’s employees press residence their calls for for higher pay? That is the single biggest question facing central bankers across the globe as they struggle to curb the charges at which costs are rising.

We’re additionally studying and listening to . . .

-

Lab leak principle: Whether or not Covid got here from a lab or a seafood market is sort of irrelevant, writes Edward Luce. Humanity’s curiosity is to cease the following pandemic from occurring.

-

Mansion on the market: The Holme, set in 4 acres of London’s Regent’s Park, could develop into the UK capital’s most expensive house ever sold.

-

🎧 ‘Money stuffing’: On this episode of the Cash Clinic podcast, host Claer Barrett speaks to “money stuffer” Euphemia Senna concerning the pros and cons of budgeting this way (and the digital equal).

Chart of the day

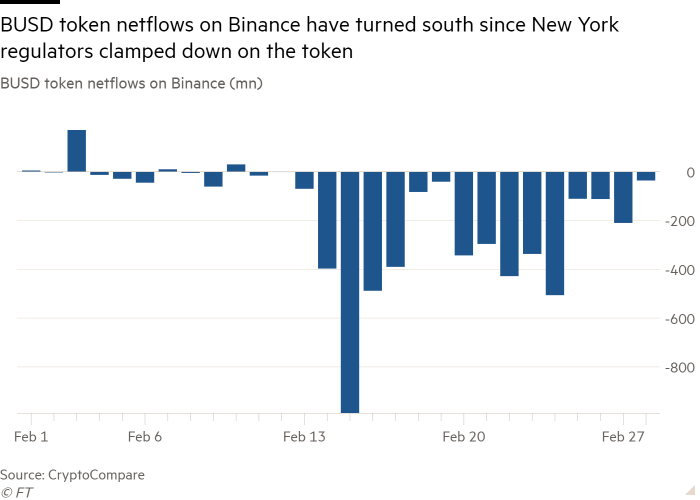

The world’s largest crypto change is underneath stress. Buyers have pulled more than $6bn out of a Binance-branded digital token generally known as BUSD prior to now month, in an indication {that a} latest US regulatory crackdown on digital belongings is making waves.

Take a break from the information

You’ve responded to an advert in search of crew for a harmful naval expedition. A flyer for the polar voyage promised months of darkness, low wages and a slim likelihood of protected return. From the very begin of the sport The Pale Past, it’s clear that you’ll be lucky even to survive.

Further contributions by Gordon Smith and Tee Zhuo

Thanks for studying and keep in mind you possibly can add FirstFT to myFT. You can even elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to firstft@ft.com

[ad_2]

Source link