[ad_1]

In accordance with knowledge from the Financial institution for Worldwide Settlements (BIS), revealed within the newest BIS Bulletin No. 69, researchers assessed that, on common, most customers misplaced cash on their investments over the previous seven years. Onchain knowledge, metrics from exchanges, and cryptocurrency software obtain statistics gathered by BIS researchers recommend that the majority median retail crypto buyers misplaced cash from August 2015 to the tip of 2022.

BIS Report Exhibits Majority of Retail Bitcoin Traders Misplaced Cash Over the Final Seven Years

After publishing recommendations from economists on the Financial institution for Worldwide Settlements (BIS) concerning three insurance policies for world regulators, BIS revealed a report that explores “crypto shocks and retail losses.” The report initially covers the Terra/Luna collapse and the FTX bankruptcy, throughout which the researchers noticed a major enhance in retail buying and selling exercise.

At the moment, BIS researchers famous that “massive and complicated buyers” have been promoting, whereas “smaller retail buyers” have been shopping for. Within the part titled “In Stormy Seas, ‘the Whales Eat the Krill,’” it’s detailed that “a hanging sample throughout each episodes was that buying and selling exercise on the three main crypto buying and selling platforms elevated markedly.”

BIS researchers be aware that “bigger buyers most likely cashed out on the expense of smaller holders.” The report provides that whales offered a good portion of bitcoin (BTC) within the days following the preliminary shocks from Terra/Luna and the FTX collapse. “Medium-sized holders, and much more so small holders (krill), elevated their holdings of bitcoin,” the BIS researchers clarify.

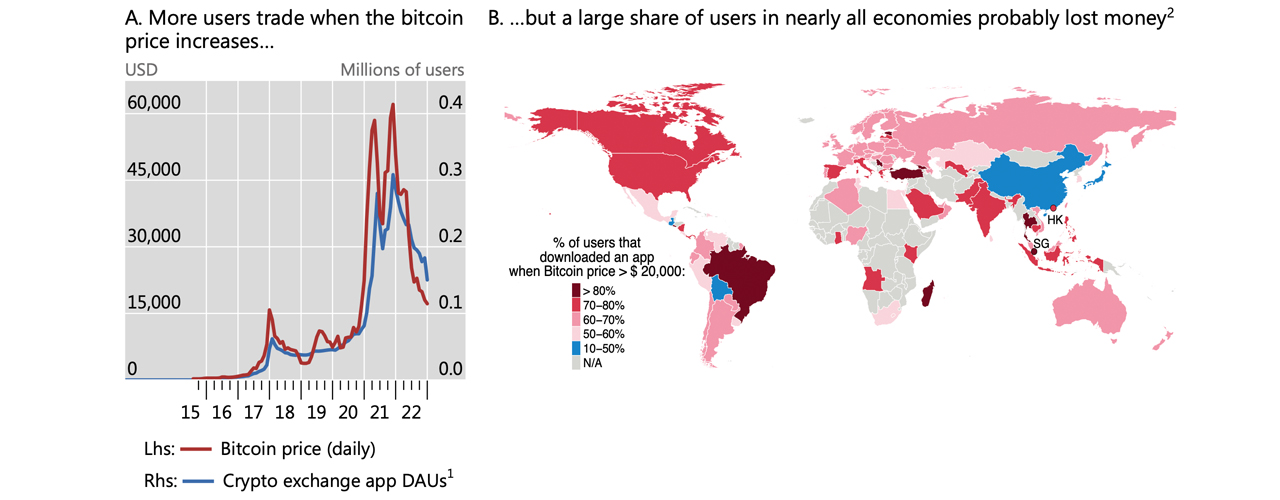

Within the second a part of the report, BIS calculated metrics from onchain knowledge, general software obtain statistics, and alternate knowledge to evaluate whether or not most median retail cryptocurrency buyers profited or misplaced cash during the last seven years. The info was collected from August 2015 to mid-December 2022, in a piece titled “Retail Traders Have Chased Costs, and Most Have Misplaced Cash.”

BIS performed a collection of simulations, resembling dollar-cost averaging $100 in BTC monthly, and concluded that over the seven-year interval, “a majority of buyers most likely misplaced cash on their bitcoin funding” in practically all economies within the researcher’s pattern. Regardless of the exercise stemming from the Terra/Luna fiasco, the FTX chapter, and the statistics indicating that median retail cryptocurrency buyers misplaced cash during the last seven years, BIS researchers insist that “crypto crashes have little impression on broader monetary circumstances.”

The retail losses and patterns nonetheless recommend to BIS researchers that there’s a want for “higher investor safety within the crypto area.” Whereas the evaluation reveals there was a “steep decline within the measurement of the crypto sector,” it has “not had repercussions for the broader monetary system to date.” Nonetheless, BIS researchers declare that if the crypto economic system have been extra “intertwined with the actual economic system,” crypto shocks would have far larger impacts.

What do you concentrate on the BIS report about crypto shocks and retail losses? Tell us your ideas within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link