[ad_1]

Six days in the past, a couple of hours earlier than the blockchain infrastructure platform Paxos introduced it might not mint BUSD stablecoins, $2.86 billion price of BUSD had been redeemed. At present, Binance is essentially the most lively change buying and selling BUSD tokens, and the stablecoin nonetheless instructions roughly 10.7% of the crypto financial system’s $67.71 billion in world commerce quantity over the previous 24 hours.

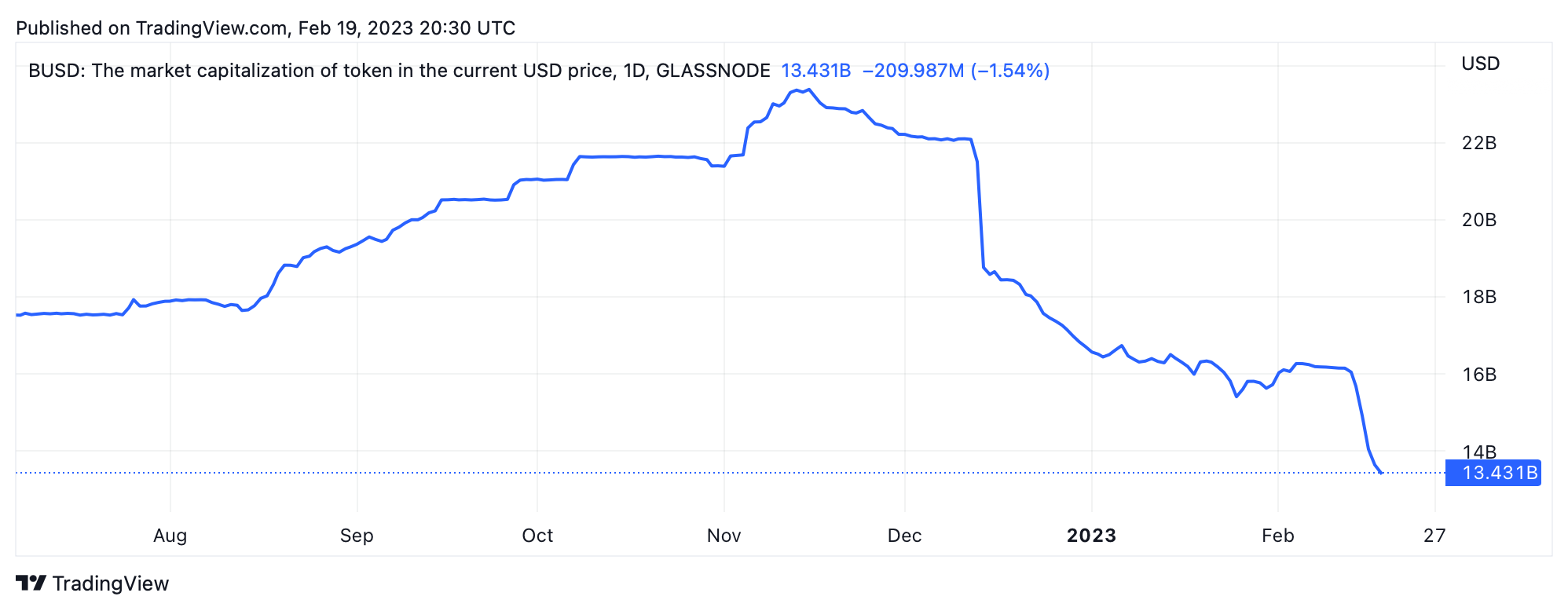

BUSD Provide Shrinks by 17.77% in 6 Days

Statistics present {that a} vital quantity of BUSD has been redeemed over the previous six days, with the availability dropping by 17.77% throughout that time-frame. Over the previous 30 days, the availability of BUSD has shrunk by 19.2%. On Feb. 13, 2023, Paxos, the corporate that points, manages, and redeems BUSD, announced that it might not mint new BUSD going ahead.

Redemptions kicked into excessive gear after Paxos made the announcement, with $290 million being redeemed within eight hours. On the time of the announcement, there was $16.1 billion BUSD in circulation. As of Feb. 19, 2023, there are roughly 13,238,824,118 BUSD in circulation, which means that the 17.77% of BUSD redeemed accounted for two.861 billion tokens being faraway from the market.

The blockchain intelligence agency Nansen has been monitoring the Paxos Treasury pockets, which sends thousands and thousands of BUSD to the burn tackle, successfully eradicating the stablecoins from circulation. In response to Nansen’s exchange portfolio tool, Binance at the moment holds 10.9 billion BUSD as of Feb. 19, 2023. Metrics present that BUSD nonetheless accounts for $7.24 billion of the day’s $67.71 billion in world commerce quantity, which represents 10.7% of the whole.

Binance dominates most of BUSD’s buying and selling quantity, with the stablecoin’s hottest buying and selling pair as we speak being tether (USDT). In response to statistics from cryptocompare.com, 5.52% of BUSD quantity on Sunday was additionally paired with the Turkish lira. Though BUSD had essentially the most redemptions previously 30 days, USDC noticed 2.9% of its provide eliminated throughout that interval.

Notably, Paxos’ different stablecoin, pax greenback (USDP), has seen its provide lower by 19.3%. A major quantity of pax gold (PAXG) has additionally been eliminated, as 11.3% of the circulating provide has been erased in 30 days. In distinction, tether (USDT) has seen its provide enhance by 5.8%, leading to a market capitalization of greater than $70 billion.

What do you suppose the longer term holds for BUSD in mild of those current developments and redemptions? Share your ideas within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link