[ad_1]

In response to a current examine by Intelligent, an actual property information firm, almost three out of 4 People fear there will likely be a recession this yr, and 69% of the analysis contributors say the U.S. is already in a recession. What’s worse, 55% of the examine’s respondents stated they’d lose all the things if a recession in america got here to fruition.

Survey Exhibits People Have a Gloomy Financial Outlook

After the Federal Reserve’s current rate hike and the inflation data from the U.S. Division of Labor that adopted, traders and analysts are unsure about what’s going to occur to the financial system in 2023. Nonetheless, many anticipate a recession. A current study by the actual property information agency Intelligent polled a bunch of 1,000 People and requested 21 questions concerning the U.S. financial system. Intelligent’s report reveals that one in 5 U.S. residents considers the financial system probably the most urgent problem at present, whereas 43% of these surveyed rank it throughout the prime three most urgent points.

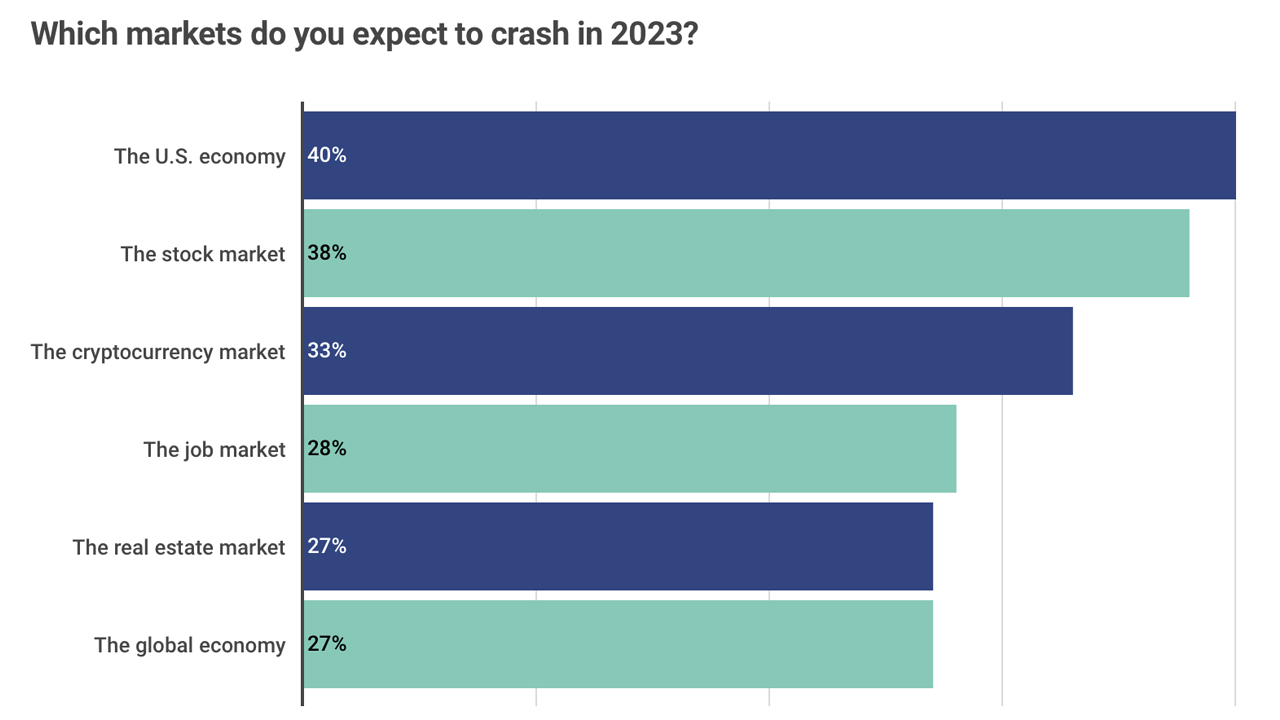

Intelligent’s examine reveals that two out of three People are apprehensive that the Ukraine-Russia battle and the Covid-19 pandemic will proceed to influence the financial system. The most typical market that respondents stated they anticipate to fall is the U.S. inventory market, with 38% believing this would be the case. Round 33% of the surveyed contributors imagine crypto markets will crash, 28% suspect will probably be job markets, and 27% assume the housing market will fall. The analysis additionally reveals that 22% of Intelligent’s survey contributors didn’t assume america had a single good financial yr within the final ten years.

So far as the crypto ecosystem is worried, Intelligent’s researchers declare that 31% of the contributors view cryptocurrency negatively. That information consists of 57% of the ‘child boomer’ technology, which views crypto in a adverse method. Round 77% of the respondents imagine that the price of items and providers will proceed to rise, and 70% assume that inflationary costs may pressure them into debt. The information additionally reveals that 70% of People are struggling to pay for fundamentals, and 82% of liberal contributors assume the federal government ought to step in. An identical sentiment was shared by 78% of conservative ballot respondents.

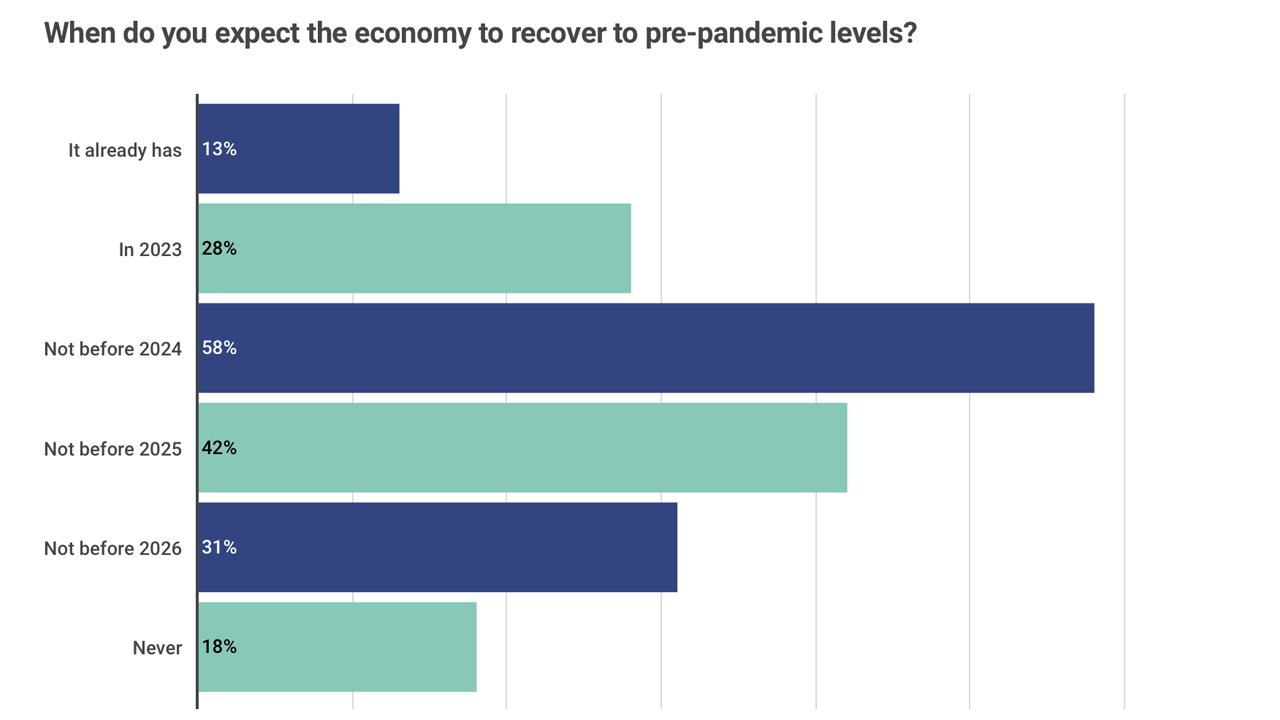

Total, 80% of People polled say they anticipate some market crashes this yr, and 40% imagine will probably be within the basic U.S. financial system. Intelligent’s examine additionally reveals that round 27% stated they imagine “the worldwide financial system will collapse.” Curiously, almost one in 5 polled stated they don’t imagine the financial system will ever get better, with about 28% of the newborn boomer technology agreeing with this sentiment. Moreover, round 82% of the polled respondents stated that whereas they don’t anticipate any reduction quickly, they do anticipate the U.S. financial system to bounce again.

You’ll be able to try Intelligent’s U.S. financial system report and ballot in its entirety here.

What do you consider Intelligent’s current survey and the notion a lot of the polled People have concerning the U.S. financial system? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link