[ad_1]

We’re all interventionists now. Within the US, not way back the bastion of free market pondering, concern of China, worries over the safety of provide chains, aspirations for re-industrialisation and hopes of a inexperienced transformation are combining to reshape commerce and industrial insurance policies. The EU shares US worries over China, principally by way of the technological menace. However additionally it is involved by the “America First” character of US policymaking, notably the $369bn Inflation Reduction Act. This rising perception within the skill of governments to reshape their economies for the higher might have been inevitable, given financial disappointments and geopolitical tensions. However what does it indicate?

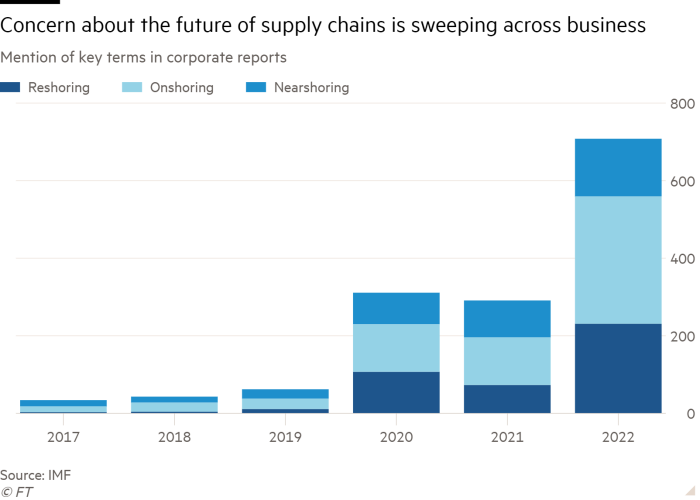

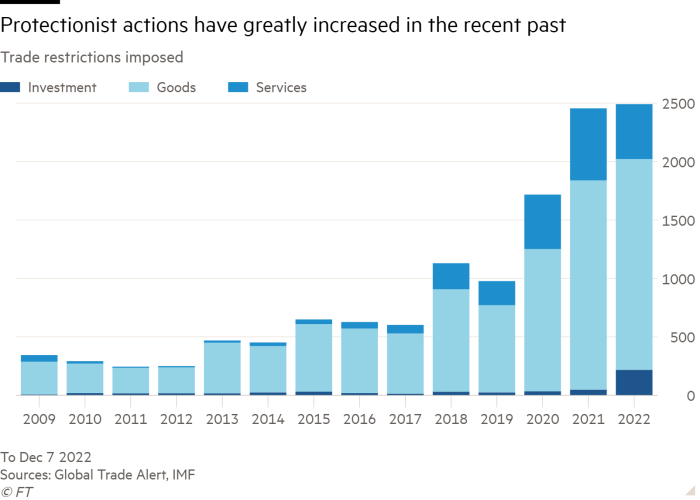

A giant query is what these shifts in direction of financial nationalism and interventionism will do to the world economic system. As issues stand at this time, deep disintegration seems unlikely, although it’s, alas, conceivable. It could even be very pricey, as Geoeconomic Fragmentation and the Future of Multilateralism, a current dialogue word from the IMF, factors out. Furthermore, the deeper the disintegration the larger such prices will probably be. Technological decoupling can be the costliest of all, particularly for rising and low-income international locations. Past this are the inevitable geopolitical prices. As James Bacchus, former head of the World Trade Organization appellate body, has rightly noted, containing these prices in at this time’s world poses big challenges.

A narrower query is how effectively the brand new interventionism will work in its personal phrases. Will the US federal authorities, which is essentially the most lively and potent participant, get hold of the outcomes it needs from the insurance policies it’s now dedicated to make use of? There are good causes for doubt. Profitable intervention is tough.

It isn’t that theoretical arguments for intervention are missing. Quite the opposite, ever since Alexander Hamilton, arguments for toddler business safety (and different such interventions) have been well-known. The core argument is that markets on their very own will fail to take advantage of accessible alternatives. Harvard’s Ricardo Hausmann has not too long ago restated these arguments. To such toddler business arguments we will add these for safeguarding financial, technological or navy safety.

But in apply it’s fairly troublesome to make such interventionism work. Too usually, for instance, it’s assumed that the successes of Japan, South Korea and extra not too long ago China are attributable to far-sighted authorities interventionism. That is exaggerated: the primary engine was market competitors. Furthermore, authorities intervention turns into harder the nearer an economic system is to the technological frontier: innovation is often more durable than copying. Not least, there’s a political economic system of intervention, with losers choosing governments quite than governments choosing winners. The extra open to lobbying a state is, the larger the possibilities of such seize. That is significantly relevant to the US.

Helpfully, in 2021, the Peterson Institute for Worldwide Economics printed a briefing entitled Scoring 50 Years of US Industrial Policy. It particulars some grotesquely costly insurance policies of commercial safety, noting that “US customers and taxpayers are presently paying greater than $900,000 a 12 months for each job saved by Trump’s metal tariffs, prolonged by Biden”. Generally, alas, bipartisanship will be silly.

What did work? As anticipated, the star has been Darpa, maybe essentially the most profitable innovation programme in world historical past. One other success was Operation Warp Velocity, the vaccination programme of the Trump administration — a triumph many Republicans have wished to disown. One other was the North Carolina Analysis Triangle Park. Encouragement of overseas vehicle meeting labored fairly effectively, as did tax credit for photo voltaic panels.

But what’s hanging is how usually such programmes didn’t make industries aggressive, save jobs at cheap price or advance the technological frontier. This was notably true for commerce measures and firm-specific subsidies. The massive successes had been in combining private and non-private outlays on analysis and improvement, as one would possibly anticipate. Given this, one should ponder whether at this time’s subsidy programmes will work.

In opposition to this, there are reputable safety causes for selling manufacturing of pc chips, regardless of the prices. Once more, within the absence of higher insurance policies, subsidies for the inexperienced transition ought to push the economic system in the appropriate path. Furthermore, subsidies have the benefit of being clear, whereas safety is a hidden tax on customers transferred to producers. Tariffs additionally bias manufacturing in direction of the house market, whereas subsidies are impartial between home and overseas markets. But subsidies usually are not impartial throughout international locations: these with the deepest pockets will win. Furthermore, subsidies, particularly subsidies restricted to home producers, will trigger friction, together with with allies. The result will probably be a subsidy battle. This will decrease emissions of high-income international locations. Nevertheless it won’t clear up world local weather change, which is determined by profitable co-operation in direction of a worldwide transformation.

The brand new interventionism has many causes and lots of objectives. In principle, it’d result in higher outcomes, particularly the place the case for presidency intervention is robust, as with local weather change or nationwide safety. However there are additionally massive potential dangers, not least that many of those programmes will develop into an enormous waste of cash, as so many interventionist programmes have been prior to now. Furthermore, these interventions will worsen the commerce wars now below method. Fragmentation could be very simple to begin. However it is going to be exhausting to regulate and even more durable to reverse.

[ad_2]

Source link